2022 was a miserable one for investors, right? For most that’s probably true but most definitely not for Ken Griffin. The billionaire not only beat the market by a huge margin and outpaced his fellow billionaire colleagues, he did so at record-breaking levels. Per LCH investment data, Griffin’s hedge fund Citadel raked in profits of $16 billion – the most ever seen on Wall Street – whilst delivering for investors returns of 38% from its main hedge fund.

Considering that performance, for investors looking to get an edge in the market, it makes sense to keep a tab on Griffin’s purchases.

We’ve gotten that job started and have tracked down two stocks Griffin was busy buying last year. But he’s not the only one showing confidence in these names. According to the TipRanks database, both are also rated as Strong Buys by the analyst consensus. Let’s see why the experts think they make good investment choices right now.

Palo Alto Networks, Inc. (PANW)

It goes without saying, cybersecurity is an essential need in the modern world, so it is hardly surprising to learn Griffin has been showing a strong interest in one of the segment’s big names.

Palo Alto Networks is a leader in cyber security solutions. These range from its flagship next-generation firewalls to zero trust network protection, security analytics, and automation, amongst other products. The company also offers professional, educational, and consulting services with three separate platforms – Network Security, Cloud Security, and Security Operations – forming the basis of its operations.

Despite the challenging macro, Palo Alto put in a strong showing in its most recent quarterly update for the fiscal first quarter of 2023 (October quarter).

The company beat Street expectations on both the top and bottom lines. Revenue saw a 24.8% year-over-year increase to reach $1.56 billion, trumping the Street’s forecast by $10 million, as billings climbed by 27% from F1Q22 to $1.7 billion. PANW reported adj. EPS of $0.83, handsomely beating analyst expectations of $0.69.

It’s the kind of performance that will no doubt please Griffin. During Q3, Citadel bought 1,103,104 PANW shares, increasing the fund’s stake in the company by 166%. It currently holds 1,767,784 shares, valued at $264 million at the current share price.

Meanwhile, Morgan Stanley’s Hamza Fodderwala has been laying out the bull case even in the face of global economic uncertainty. Calling the stock a Top Pick, representing an “exceptional opportunity,” the analyst wrote: “While there are valid concerns regarding the relative defensibility of security budgets in a slower macro, we think Palo Alto Networks is best positioned to deliver durable topline growth as the market materially underappreciates the company’s broader platform evolution and ability to drive vendor consolidation for more efficient and effective security.”

“Given the ability to consolidate security budgets within a large installed base, growing recurring revenue and improving operating margin, we believe PANW remains a durable 20%+ FCF compounder even in a slowing macro,” Fodderwala summed up.

Acknowledging the company’s potential growth, Fodderwala rates PANW shares an Overweight (i.e. Buy), and his $220 price target suggests an upside of 47% for the year ahead. (To watch Fodderwala’s track record, click here)

Most on the Street agree with that bullish stance. Based on 26 Buys vs. 3 Holds, the stock receives a Strong Buy consensus rating. At $210.19, the average target makes room for 12-month gains of ~41%. (See PANW stock forecast)

Bill.com Holdings, Inc. (BILL)

In spite of the ongoing digital transformation, Bill.com claims that 90% of surveyed U.S. businesses remain dependent on paper checks and other manual procedures. Bill.com’s modus operandi is to change all that. The company offers cloud-based software that streamlines, digitizes, and automates back-office financial activities. Primarily focused on small and mid-sized businesses, the clientele comes from a wide variety of sectors, charity organizations, and both startups and well-known brands.

Bill.com’s offerings are in growing demand, with the company showing some serious top-line growth as was evident in the latest quarterly update – for the first fiscal quarter of 2023 (September quarter). Revenue increased by 97.5% year-over-year to $229.9 million, beating the Street’s call by $18.98 million. Adj. EPS of $0.14 also handily beat the $0.06 consensus estimate. The guidance was strong as well, with the company calling for FQ2 revenue between $241.5 – $244.5 million, above the Street’s forecast for $233.50 million.

However, that seemed to matter little to investors who seemed to focus on the negatives such as a loss from operations of $87.7 million, vs. the loss of $74.2 million in the same period last year. And with tech stocks generally out of favor in 2022, the stock shed 56% over the course of the year.

Griffin, though, has been loading up. During Q3, Citadel upped its BILL holdings by 18%, with the purchase of 270,115 shares. Griffin’s fund now owns 1,828,905 shares worth ~$201 million at the current share price.

Of further note, in November the company announced that it had closed the acquisition of Finmark, a provider of financial planning software.

This is a good move, according to Canaccord 5-star analyst Joseph Vafi who writes: “The acquisition of Finmark should help boost the Bill value proposition in the all-important accounting channel. The moat BILL has built is a key differentiator and the Finmark deal is more evidence of this building moat, in our view. Importantly, we think the cross-sell opportunity is still in its infancy. We believe that SMBs are hard to penetrate but perhaps easier to cross-sell, and Bill is an example here. The cross-sell setup here bodes well for next year’s outlook.”

All told, Vafi rates BILL shares a Buy, while his $250 price target makes room for one-year returns of a hefty 127%. (To watch Vafi’s track record, click here)

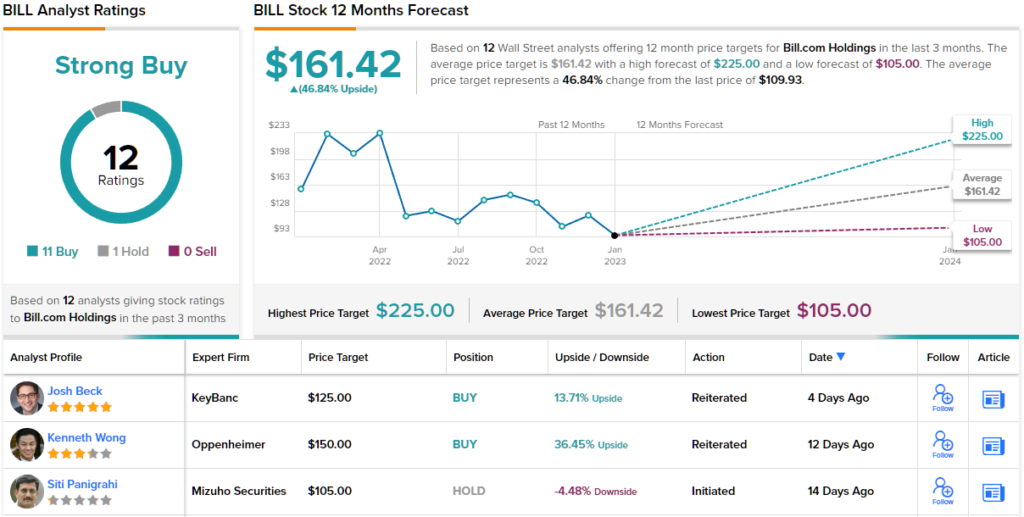

Similarly, Wall Street is bullish when it comes to the software stock. With 11 Buy recommendations and 1 Hold assigned in the last three months, the message is clear: BILL is a ‘Strong Buy’. To top it all off, its $161.42 average price target indicates ~47% upside potential (See BILL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.