For investors seeking the strongest possible returns, there has always been a clear path. It involves risk, but the rewards are real. We’re talking, of course, about the outsized gains available in penny stocks, the low-priced equities that can slide under the radar.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Historically, these are shares that sold for less than an old English shilling – just pennies. Later, they were defined as stocks selling for less than a one dollar per share; today, they’re the shares priced at less than $5. No matter how the price has changed over the decades, the risk/reward profile has remained consistent. Because the shares are priced so low, even a very small change in the absolute value – just a few cents – can quickly turn into a high-percentage gain or loss.

When it’s a gain, there are few investment instruments that can match the potential return of a penny stock. That’s the fundamental fact about them that keeps them popular – as long as you’re willing to shoulder the risk.

Taking all of this into consideration, we set out to find compelling penny stocks that combine a low cost of entry with the Street’s backing. Using TipRanks’ database, we pinpointed two that fit the bill. Not only are the tickers currently going for less than $5 apiece, but each has also received enough bullish support from analysts to earn a “Strong Buy” consensus rating. If that wasn’t enough, plenty of upside potential is at play here.

Marrone Bio (MBII)

First up is a California-based biotech company in the pest control niche. Marrone Bio uses a proprietary tech platform to develop naturally occurring microorganisms – found in soil, flower, and insect samples – into safe and effective past management solutions. To date, the company has screened more than 18,000 microbes and another 350 plant extracts to create a line of biopesticides for both conventional and certified organic agriculture.

In its last financial report, released in November for 3Q21, Marrone showed solid gains in revenue and gross income. At the top line, the company reported $9.9 million in total revenue, up 12% year-over-year; gross profit grew 20%, from $5 million to $6 million. These gains showed an acceleration through the year; for the first three quarters of 2021, revenues were up 9% to $33.5 million and gross profit was up 16% to $20.8 million. The company’s net loss of, of 3 cents per share, was in line with the last six quarters, which have seen the net EPS loss range from 2 cents to 6 cents. On a negative note, Marrone’s 3Q top line missed expectations; Wall Street had been expecting to see approximately $11 million in revenue.

Since the Q3 report, Marrone has made an important move that will make the company more competitive in the $27 billion herbicide market. The company in December announced that it had acquired exclusive rights to a strain of Streptomyces acidiscabies, a microorganism targeted for use in second-gen bioherbicides. These compounds will address a problem currently costing corn and soybean growers in the US and Canada more than $43 billion annually.

Bioherbicides are a growth niche, and in the view of H.C. Wainwright’s 5-star analyst Amit Dayal, Marrone has a leg up in the field.

“We believe, Marrone Bio’s BioUnite offerings that allows traditional solutions along side the company’s biologicals have the potential to generate incremental revenue from growers looking for cost-effective solutions… We continue to anticipate solid gross margins that should range between high-50% and low-60% levels. We believe Marrone Bio’s new product launches remain on track and should be supportive to EBITDA improvements. We believe the company remains ahead of the competition with respect to commercializing organic pest management and yield improvement solutions for the agricultural industry, with the market continuing to move in its direction,” Dayal opined.

These comments support Dayal’s Buy rating on the stock, while his $4 price target implies a whopping 470% upside for the coming year. (To watch Dayal’s track record, click here)

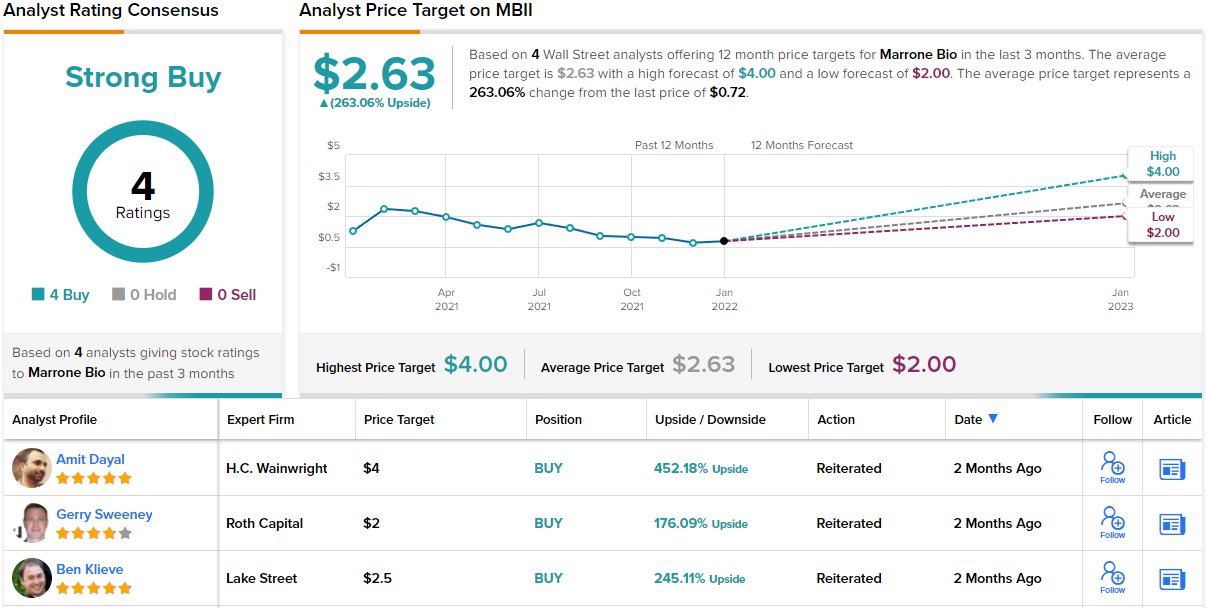

Currently going for $0.72 apiece, several other members of the Street believe that MBII’s share price reflects an attractive entry point. MBII’s Strong Buy consensus rating breaks down into 4 Buys and no Holds or Sells. In addition, the $2.63 average price target brings the upside potential to ~255%. (See MBII stock forecast on TipRanks)

Eledon Pharmaceuticals (ELDN)

The second stock we’ll look at is Eledon Pharma, a clinical stage biotech company working on the development of new treatments for a variety of conditions, including autoimmune and neurodegenerative diseases and organ and cell transplantation. Eledon’s approach targets the CD40L pathway, involved in pro-inflammatory responses, to create new drug candidates that will suppress the response for therapeutic benefit. The company’s chief drug candidate, AT-1501, is currently undergoing several human clinical trials, for the treatment of the kidney disease IgA Nephropathy (IgAN), as well as Amyotrophic Lateral Sclerosis (ALS) and as an anti-rejection drug in kidney and cell transplant procedures.

The most advanced of these research tracks is the Phase 2 study in the treatment of ALS. The trial is nearing full enrollment, and topline data is expected in the second quarter of this year. The FDA has already granted AT-1501 an orphan drug designation for this indication. The drug candidate is being evaluated in another Phase 2 clinical trial for the treatment of IgAN. This trial was commenced at the end of last year, and initial data is expected in 2H22.

On the organ transplant front, AT-1501 is being tested for its efficacy at preventing rejection. A Phase 1b trial is underway in regard to kidney transplantation, with the first data release scheduled in the second half of this year. Also coming up this year should be data from an ongoing Phase 2 trial on the drug candidate’s use in islet cell transplant procedures.

Looking at the company’s forward path, SVB Leerink analyst Thomas Smith noted, “We see different risk/reward trade-offs across these indications, with ALS representing a high risk/high reward opportunity whereas renal transplant comprises a lower risk/lower-reward scenario due to differences in their respective competitive landscapes and established proof-of-concept in humans… In our view, IgAN represents a comparatively high reward scenario, as the condition has a significant unmet medical need and no approved therapeutics, and also represents an avenue to further expand development more broadly into other autoimmune nephritis diseases.”

“We see broad interest in CD40:CD40L field, with multiple companies developing their own internal programs, and recent M&A activity showcasing the perceived opportunity for companies looking to break into the autoimmune disease field. ELDN remains the only CD40:CD40L pure play amongst these competitors,” Smith summed up.

In line with his bullish stance, Smith rates ELDN an Outperform (i.e. Buy), and sets a $33 price target – indicating his belief in a robust 652% one-year upside. (To watch Smith’s track record, click here)

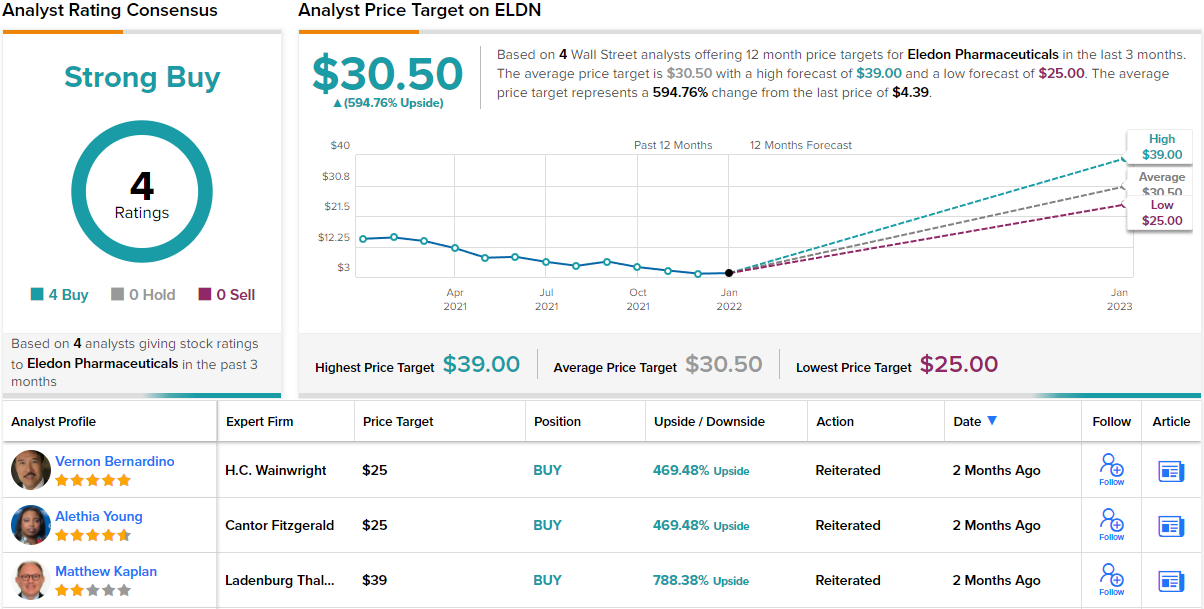

Like Marrone above, Eledon has 4 recent positive reviews, for a unanimous Strong Buy consensus rating on the stock. The shares are selling for $4.39 and their $30.50 average price target implies an upside of ~595% by the end of 2022. (See ELDN stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.