Let’s take a moment to talk about opportunity, share price, and risk/reward considerations. These are some of the factors investors must consider when moving into penny stocks – and we haven’t even touched on the fundamental soundness of the company or its business model.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Penny stocks – as their name suggests, they once traded for just a pennies per share, but these days are considered those equities trading at less than $5 – are a challenging market niche. The penny stock critics make valid points when defending their stance. Sure, the price tag may look like a steal, but the fact that shares are trading at such low levels could reflect overwhelming headwinds or weak fundamentals.

That being said, the fans offer up a solid argument as well. Not only does the low price mean you get more shares for your money, but hefty returns are also on the table. Even seemingly insignificant share price appreciation can result in colossal percentage gains that other more well-known or expensive names aren’t as likely to deliver.

The nature of these investments presents somewhat of a dilemma. How are investors supposed to separate the penny stocks that are ready to take off on an upward trajectory from those set to remain down in the dumps?

To help with the due diligence process, we used TipRanks’ database to zero in on only the penny stocks that have received bullish support from the analyst community. We found two that are backed by enough analysts to earn a “Strong Buy” consensus rating. Not to mention each offers up massive upside potential, as some analysts see them climbing to $10, or more.

Aptinyx, Inc. (APTX)

We’ll start with Aptinyx, a company in the biopharma industry. Aptinyx works on the treatments for brain and nervous system disorders, developing new synthetic small molecule medications for commercialization. The company has a proprietary NMDA receptor modulator discovery platform, which enables a novel approach to the targeted disorders.

Aptinyx’s research pipeline currently has three compounds in the clinical stages, all in Phase 2 trials. NYX-458 is a potential treatment for Parkinson’s disease and Lewy body dementia, two serious central nervous conditions of aging. Preclinical and Phase 1 studies showed robust activity in rodent models and favorable safety tolerance in human patients; the Phase 2 clinical trial will focus on patients with mild levels of cognitive impairment and dementia.

NYX-783, the second compound in the pipeline, is being studied for its efficacy in treating post-traumatic stress disorder. A Phase 2 exploratory study showed positive results in symptom reduction in just 4 weeks of treatment, and the FDA has granted this drug a Fast Track designation.

Finally, NYX-2925, the lead drug candidate in the pipeline, is under study as a treatment for two conditions: fibromyalgia, and diabetic peripheral neuropathy (DPN). These are both chronic, painful, conditions, and NYX-2925 has demonstrated reduced pain levels in patients during earlier stage testing. The DPN study, like NYX-783 above, has FDA Fast Track designation.

Based on the potential of the company’s drug candidates, and its $2.84 share price, several members of the Street believe that now is the time to get in on the action.

Among the bulls is Leerink Analyst Mark Goodman who sees a string of catalysts ahead to boost the stock.

“The stock has been trending lower during the past several months mainly due to the lack of near-term catalysts, but we believe that investors will start to get much more focused on the name moving into 2H21 ahead of the multiple data points in 2022. We continue to have a positive view of Aptinyx’s focus on NMDA receptor modulators and its pipeline opportunities… Aptinyx has a strong drug discovery platform plus a library of >1,000 identified compounds, which should enable continued pipeline expansion and sustain long-term growth,” Goodman explained.

To this end, Goodman rates APTX an Outperform (i.e. Buy) along with a $12 price target. Investors could be pocketing gains of 324%, should Goodman’s thesis play out as expected. (To watch Goodman’s track record, click here)

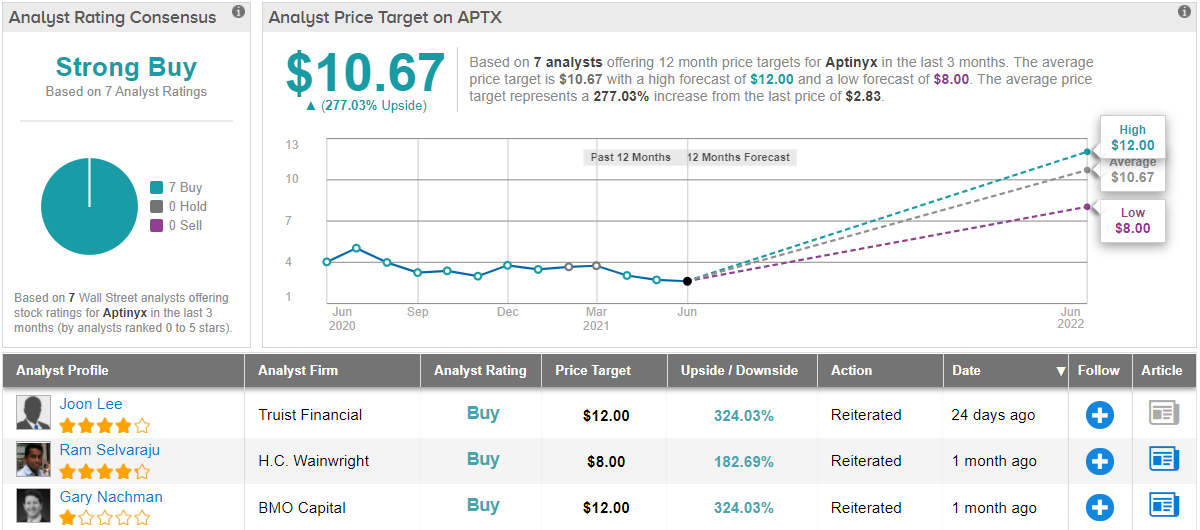

It’s not often that the analysts all agree on a stock, so when it does happen, take note. APTX’s Strong Buy consensus rating is based on a unanimous 7 Buys. On top of this, the average price target is $10.67, suggesting robust growth of ~277% from current levels. (See APTX stock analysis on TipRanks)

Axcella Health (AXLA)

The next penny stock we’re looking at, Axcella, is another biotech company. Axcella is using endogenous metabolic modulators (EMMs) as a jump-off to approach new treatments for complex diseases, including non-alcoholic steatohepatitis (NASH, or fatty liver disease), along with overt hepatic encephalopathy (OHE). These are both serious liver conditions, and can have cascading consequences on the whole body.

For both tracks, Axcella has completed early clinical studies and is beginning Phase 2 trials. AXA1125, the drug candidate under development to treat NASH, started the EMMPACt Phase 2b clinical trial in May of this year. The study will enroll a total of 270 patients, and will stratify them by the presence or absence of type 2 diabetes, and important complicating factor.

Also in May, Axcella announced positive clinical data on AXA1665, the drug being studied as a treatment for OHE. The data showed that two different drug doses proved safe and well-tolerated, and showed positive results when compared to placebo. Both AXA1665 and AXA1125 have had their IND application cleared by the FDA.

AXLA’s strong pipeline has scored it substantial praise from Chardan analyst Keay Nakae.

“We view Axcella’s leading asset, AXA1665, as likely to exceed the benefits provided by the current standard of care therapies lactulose and rifaximin in HE, due to its clean safety/tolerability profile and ability to target more aspects of HE than simply blocking ammonia absorption in the gut. Beyond AXA1665, we also anticipate success for AXA1125 in NASH; the NASH market is crowded with potential therapeutics but is also a very large commercial opportunity that we anticipate will allow for the success of multiple market entrants. We expect AXA1125 to thrive as a base-level therapy due to its impressive safety/tolerability profile as a result of its mechanisms of action, with potential to move forward in pediatric NASH sooner than competitors due to this safety profile,” the 5-star analyst noted.

In line with his optimistic approach, Nakae gives AXLA shares a Buy rating and his $10 price target suggests ~186% potential upside for the coming year. (To watch Nakae’s track record, click here.)

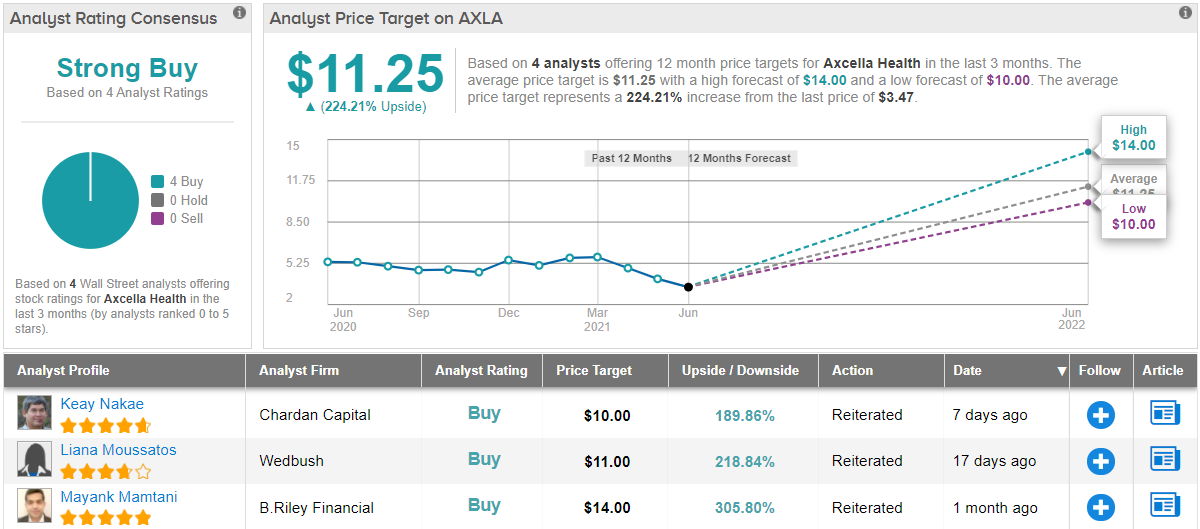

Other analysts are on the same page. With 3 additional Buy ratings, the word on the Street is that AXLA is a Strong Buy. The shares are priced at $3.50, and the $11.25 average price target suggests it has ~222% upside ahead of it. (See AXLA stock analysis at TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.