Penny stocks are a study in contrasts. They’re equities whose share price stands below $5, and that low price opens up a wide field of possibilities. Chief among these are the ultra-low cost of entry, combined with triple-digit upside potentials. These are stocks that truly can jump sky-high when conditions are right.

But penny investors had better be risk tolerant, because these stocks also offer a range of possible downsides. First, there’s that ultra-low cost of entry; it raises the question, why is the stock priced so low? Usually, that’s a sign of fundamental weakness. There’s also the simple rules of mathematics. Penny stocks can bring huge returns, because at their low initial price even a small gain in absolute terms can turn into a high percentage of the total investment. But the reverse can also happen – so investors need to research their penny stock carefully before jumping in.

Fortunately, Wall Street’s analysts have gotten a leg up on that research. They regularly search the markets for stocks that show signs of taking off, and many of those stocks fall into the low-cost penny category.

Using TipRanks’ database, we locked in on two that have garnered glowing reviews from the Street, enough to earn a “Strong Buy” consensus rating. Not to mention each offers massive upside potential.

Allena Pharmaceuticals (ALNA)

We’ll start with Allena Pharmaceuticals, a clinical-stage biopharma company engaged in the discovery and development of new medications for rare metabolic disorders. The company’s work focuses on hyperoxaluria, a condition in which urinary oxalate levels are markedly elevated, either due to genetic defect or hyper-absorption of oxalate. The condition can cause progressive kidney problems, from stones to organ damage to end-stage renal failure.

Allena has developed reloxaliase, a first-in-class oral enzyme therapeutic to treat hyperoxaluria. The drug candidate has shown efficacy in reducing oxalate levels in three Phase 2 clinical trials, and has advanced to the URIROX-2 Phase 3 pivotal study. This study will enroll 200 patients worldwide, and interim data is targeted for 1Q22.

In addition to reloxaliase, Allena is developing ALLN-346, a new compound under investigation as a treatment for hyperuricemia – high levels of uric acid, whose complications, like hyperoxaluria above, include kidney stones and long-term kidney damage – and gout. ALLN-346 recently completed a Phase 1b study, with 18 patients, of safety and tolerability. The drug candidate is on track for two separate Phase 2a trials this year, and initial data is expected in 4Q21.

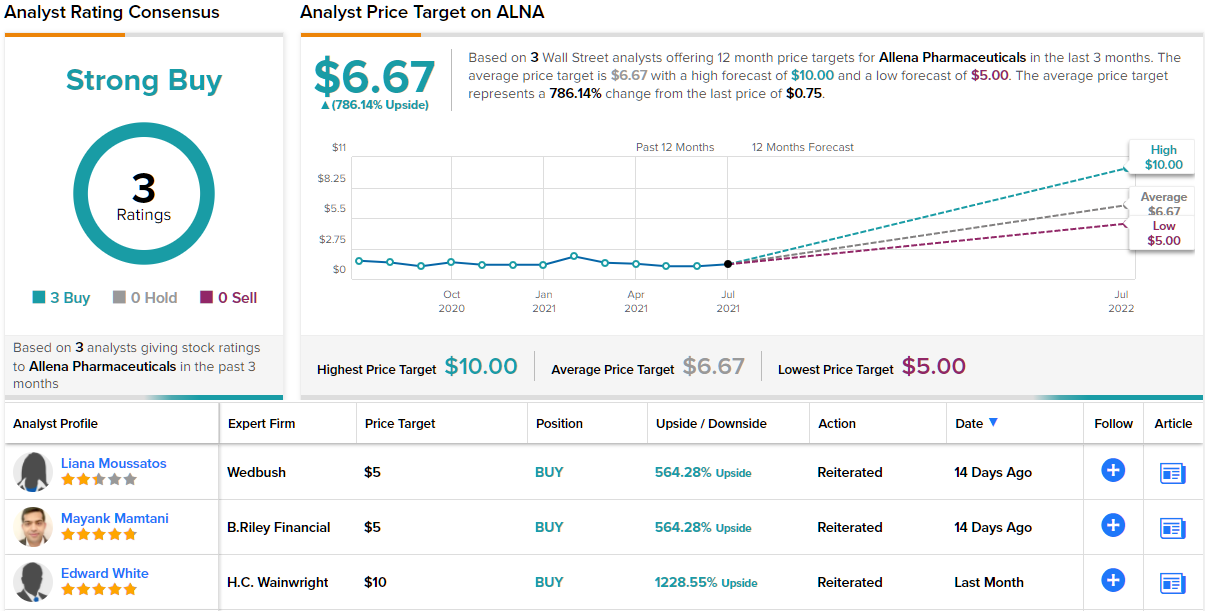

Currently going for $0.75 apiece, several members of the Street believe Allena’s share price presents an attractive entry point.

Among the bulls is Wedbush analyst Liana Moussatos who sees the upcoming Phase 3 study of reloxaliase as a potential catalyst to drive the stock higher.

“URIROX-2 is currently considered by the Company overpowered at 200 patients to demonstrate… significant reductions. Therefore, we view Management’s decision to provide an interim look sooner rather than later as savvy since it may create a value-driving catalyst for ALNA shares in 6-8 months. Positive results may likely stoke partnership interest for a commercial-ready asset as well as shine more light on the value of the enzyme-based platform,” Moussatos opined.

Looking at the ALLN-346 Phase 1b results, Moussatos noted: “ALLN-346 was found to be well-tolerated with no evidence of serious adverse events or systemic absorption confirmed by an enzyme-linked immunosorbent assay (ELISA).”

The analyst summed up, “We consider ALNA to be an attractive investment for 2021 with likely upside from ALLN-346 PoC readout in Q4:21, increased confidence in the URIROX-2 clinical timeline and lack of near-term financing overhang… We estimate net sales of ~$605 million for the Company in 2027 following a U.S. launch of reloxaliase/EH in 2023 (~$507MM) and ALLN-346/Gout with CKD (~$98MM) in 2025.”

In line with her bullish stance, Moussatos rates ALNA a Buy, and her $5 price target implies room for a stunning ~564% upside potential in the next 12 months. (To watch Moussatos’ track record, click here)

Turning now to the rest of the Street, other analysts echo Moussatos’ sentiment. As only Buy recommendations have been published in the last three months, ALNA earns a Strong Buy analyst consensus. With the average price target clocking in at $6.67, shares could soar ~786% from current levels. (See ALNA stock analysis on TipRanks)

Read more: 2 Top Picks From a Top Analyst on Wall Street

Selecta Biosciences (SELB)

Biologics are a powerful class of drugs that have proven effective in the treatment of metabolic and autoimmune disorders. Selecta Biosciences, a clinical-stage biotech research company, is working on biologics as a class, using its immune tolerance platform, ImmTOR, to overcome immunogenicity, an warranted immune response provoked in otherwise normal tissues. Immunogenicity is frequently an exacerbating factor in metabolic and autoimmune disease.

Selecta is using its ImmTOR platform to develop a more effective biologic drug therapy. The company’s lead candidate is SEL-212, a treatment for chronic refractory gout. SEL-212 shows potential to treat the underlying disease, as well as manage symptoms such as flare-ups and gouty arthritis. This drug candidate is the flagship of the ImmTOR platform – the first compound developed on it, and the most advanced in the clinical research pipeline. SEL-212 has shown positive results in safety and tolerability studies, and is currently enrolling patients the Phase 3 DISSOLVE trial. Topline data from that trial is expected in 2H22.

With SEL-212 showing that the proprietary ImmTOR platform can work, Selecta is expanding its research program. The company has another 7 drug candidates in the pipeline, all in preclinical stages, and no fewer than four Investigation New Drug applications are in preparation for submission to the FDA by the end of this year and in the first half of next year.

Analyst Yun Zhong, of BTIG, describes Selecta’s platform as underappreciated, and writes: “We see significant potential in Selecta’s ImmTOR technology platform beyond the chronic refractory gout program (SEL-212). We believe SEL-212’s clinical data to date have demonstrated strong efficacy and safety to support an FDA approval. Our surveyed physicians hold a positive view on SEL-212, which we believe bodes well for market uptake upon commercial launch. With the strong proof-of-concept for the induction of antigen-specific immune tolerance, we believe the true value driver for Selecta is the application of ImmTOR in additional indications and treatment modalities, including gene therapy and autoimmune diseases.”

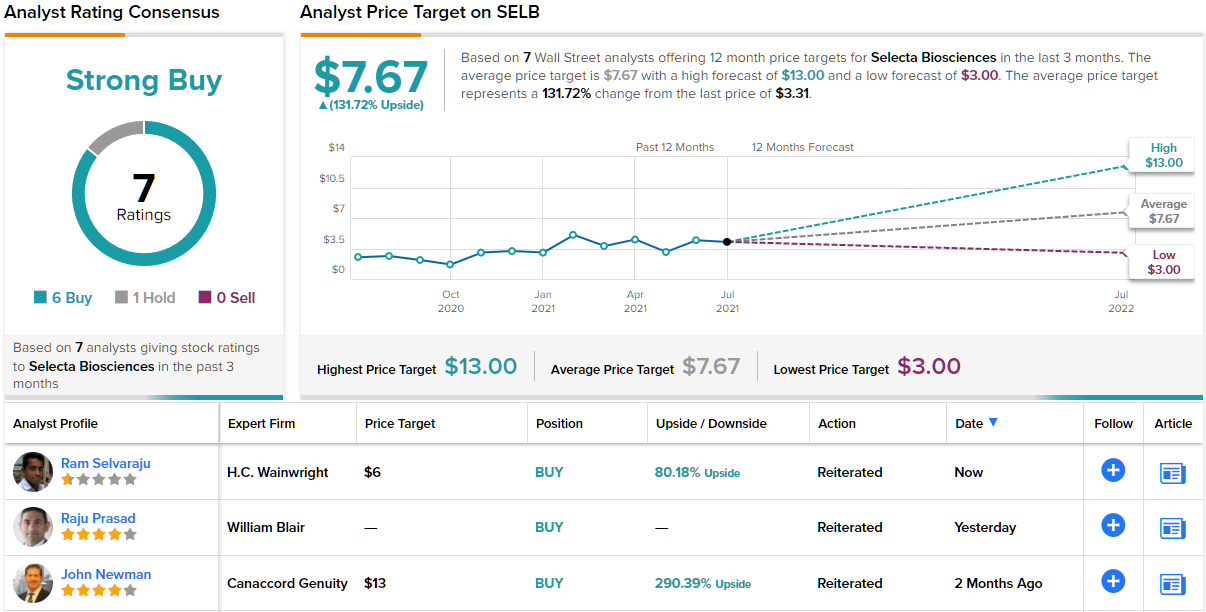

To this end, Zhong rates SELB a Buy along with a $10 price target. Should this target be met in the year ahead, investors could be pocketing a gain of ~202%. (To watch Zhong’s track record, click here)

What does the rest of the Street have to say? 6 Buys and 1 Hold add up to a Strong Buy consensus rating. Given the $7.67 average price target, shares could soar ~132% in the year ahead. (See SELB stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.