The long-term upward trend in the markets is marked; the S&P 500 is up 51% over the last 12 months, even taking into account some recent slips. For investors, this makes the present a propitious time to seek out low-cost market segments with high return potential. Or in other words, to take the old time advice and buy low to sell high.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Jefferies equity strategist Steven DeSanctis, in a recent note on small-cap market themes, points out that this segment is attracting investor notice.

“We are seeing interest in the size segment and hearing that institutional investors are really interested in adding assets to the size segment. This makes sense to us, as small caps as a percentage of total US equity market exposure is still running well below its 90- year history as investors clamored for large caps, large growth, and the FAANG names. We estimate over $38B has come into small caps over the last five months, the largest inflow since we started tracking the data back to 2006, representing 4.6% of total assets, close to an all-time high. We also estimate about 45% of all flows go towards passive investing, and this drives the performance,” DeSanctis wrote.

And this brings us to penny stocks, those low-cost equities priced below $5 per share – are a high-stakes opportunity with upsides that frequently approach several hundred percent and a low enough cost of entry to mitigate the attendant risk. These stocks are priced low for a reason, but for those that break out, the rewards are tremendous.

With this in mind, we used TipRanks’ database to zero in on only the penny stocks that have received bullish support from the analyst community. We found two that are backed by enough analysts to earn a “Strong Buy” consensus rating. Not to mention each offers up massive upside potential.

ADMA Biologics (ADMA)

We’ll start with ADMA Biologics, an end-to-end biopharmaceutical company, which develops and commercializes blood plasma-derived products that can be used to treat infectious disease – and more important, to help prevent such diseases in the first place. ADMA, in 2020, saw the expansion of two products for the treatment of primary humoral immunodeficiency (PI). These products, Asceniv and Bivigam, are both derived from human blood plasma and deliver immune globulin to the patient through intravenous injection.

In any business, success is measured in cash. ADMA achieved that, reporting a 44% year-over-year increase in total revenues for 2020, with the top line reaching $42.2 million. This was driven by increased sales of the company’s main intra-venous immune globulin (IVIG) products.

Going forward, ADMA recognizes the underlying fact of its products – that they are derived from human blood products, and so are dependent on voluntary donations. The company currently has 7 plasma collection centers in operation, with COVID safeguards in place, and plans to open two more this year. Longer-term expansion plans include opening 10 additional centers by 2024.

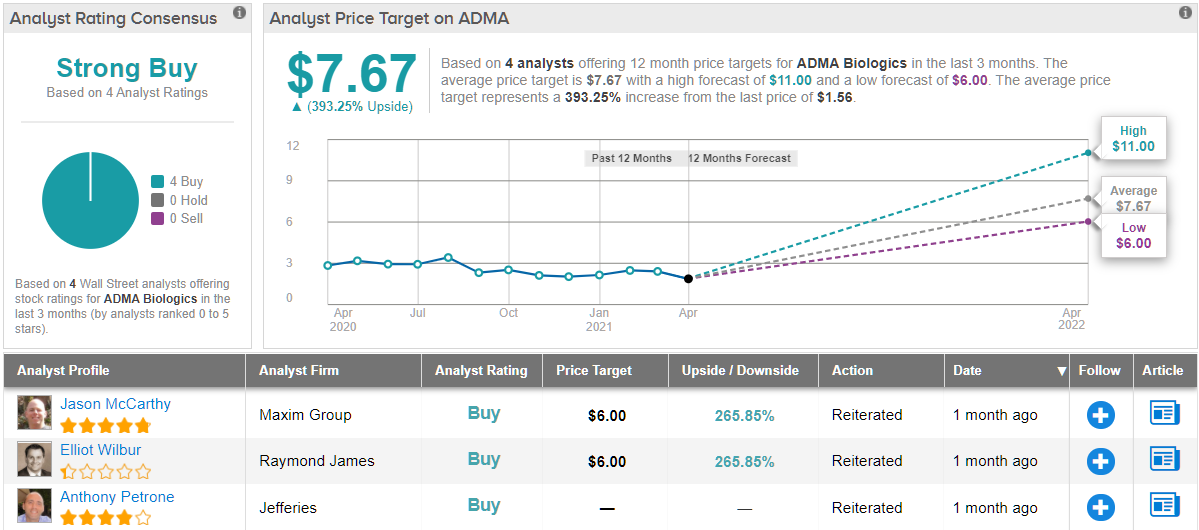

Currently going for $1.55 apiece, the pros on the Street think that ADMA’s share price presents investors with an attractive entry point.

Among the bulls is Maxim’s 5-star analyst, Jason McCarthy, who sees a clear path forward for the company.

“Management is executing on its strategy and off the heels of a positive, but COVID-19 impacted year, ADMA is poised for a breakout in 2021. Multiple initiatives should drive revenue and margin acceleration. In particular, ASCENIV’s new J-code and multiple manufacturing initiatives, including the new fill-finish machine and BIVIGAM’s capacity expansion to ~4,400 L, should drive sales and margin acceleration in 2H21,” McCarthy opined.

The analyst added, “There is valuation disconnect between the company’s plasma collection facilities + sales potential vs. the market cap, in our opinion. Grifols recently acquired 25 US-based plasma centers for ~$370M, valuing each center at ~$15M. ADMA has 7 centers in various stages of development/ approval, and is planning to expand to 10 fully operational by 2024. The company is already on a ~$55M run-rate, with accelerating sales and on pace for potentially ~$250M by 2024. Management is executing, and we believe the intrinsic value of the plasma facilities and approved products already should exceed the company’s market cap.”

In line with these expectations, McCarthy rates ADMA a Buy, and his $6 price target indicates confidence in a robust 266% growth potential for the coming year. (To watch McCarthy’s track record, click here)

It’s clear from the analyst consensus that McCarthy is no outlier on this stock. ADMA has 4 recent reviews on record, and all are to Buy, making the consensus rating a unanimous Strong Buy. The $7.67 average price target is even more bullish than McCarthy’s, and suggests a one-year upside of 393%. (See ADMA stock analysis on TipRanks)

Catalyst Biosciences (CBIO)

The next stock we’ll look at, Catalyst Biosciences, works in the biopharmaceutical industry, where it researches unmet needs in rare disorders of the complement and coagulation systems. The company has a protease engineering platform, and its hemostasis development program includes two late-stage clinical tracks. The complement pipeline is still in preclinical development, and includes four separate drug candidates.

Catalyst has seen a major milestone back in December last year, when the FDA granted Fast Track Designation for the the company’s most advanced pipeline product, marzeptacog alfa (activated), or MarzAA. The fast track designation will allow Catalyst more opportunities to work hand in hand with the FDA in MarzAA’s development and could involve a priority review if it meets its endpoints in studies. MarzAA is a next-gen engineered coagulation Factor VIIa for the treatment of episodic bleeding in hemophilia patients. It is currently entering a Phase 3 trial with plans to enroll 60 subjects. The company anticipates sending its final report to the Data and Safety Monitoring Board in mid-2022.

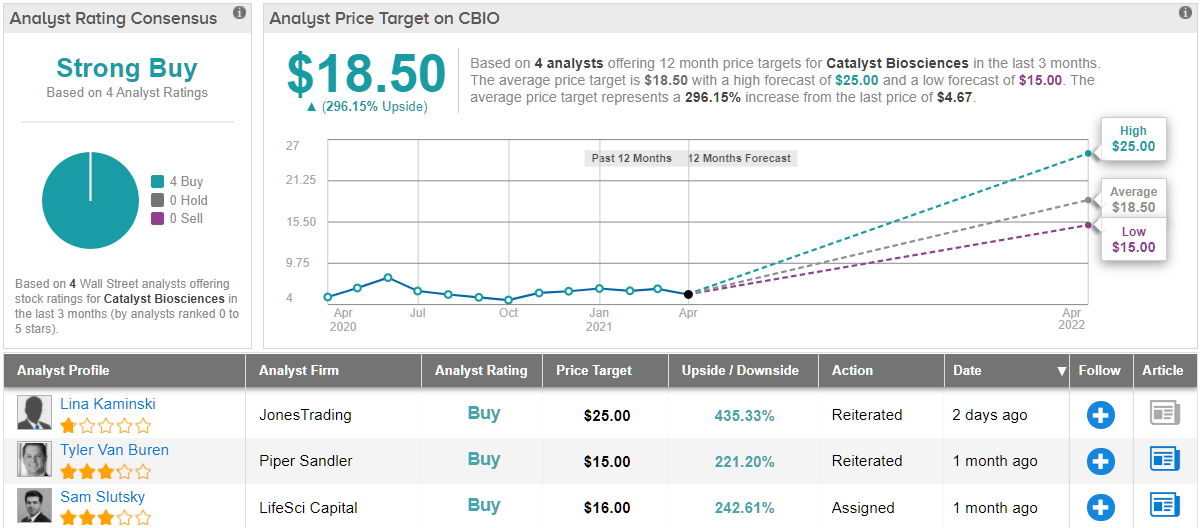

CBIO’s strong pipeline has scored it substantial praise from Piper Sandler analyst Tyler Van Buren.

“In our view, the catalytic power of the company’s protease platform continues to be underappreciated due to lack of familiarity. First up in 2021, we look forward to data from the MarzAA Phase III trial, which could support a 2023 approval. The Phase I/II trial in Glanzmann thrombasthenia (1,600+ patients) and other indications will also get underway. For Catalyst’s complement-targeting proteases, we expect an observational trial to begin shortly in CFI deficiency, which should provide a bolus of patients to enroll in a Phase I for CB 4332 next year. There is also significant upside potential from expansion of CB 4332 into other indications, and from the rest of the complement franchise which includes CB2782-PEG, a novel anti-C3 protease for dry AMD, and other C4b degraders,” Van Buren wrote.

With the active development program in mind, the analyst summed up, “Bottom line, we… recommend that investors accumulate shares ahead of the upcoming study initiations and clinical readouts throughout the year.”

Those bullish comments back the analyst’s Overweight (i.e., Buy) rating on the stock. His price target, of $15, implies an upside of 229% for the next 12 months. (To watch Van Buren’s track record, click here)

What does the rest of the Street think about CBIO’s prospects? It turns out that other analysts agree with Van Buren. The stock received 4 Buys in the last three months compared to no Holds or Sells, making the consensus rating a Strong Buy. CBIO shares are currently trading at $4.69, and the $18.50 average price target brings the upside potential to 296%. (See CBIO stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.