The oldest advice in the financial markets is to buy low and sell high. The trick to winning, however, is to find the right stocks to buy, and to remember that ‘buy low’ doesn’t always mean these stocks can’t go lower.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Sometimes the best bargains really do come in at the lowest prices. There are plenty of stocks under $10 that won’t break your bank and still offer substantial upside potential. How substantial? Well, one analyst at investment banking giant Morgan Stanley has been tapping two winners among these low-cost stocks, and she sees the upside beginning at 100% or better.

We can dig deeper into the Morgan Stanley picks using the TipRanks database, to find why these lost-cost stocks are getting the thumbs up.

Rocket Lab USA (RKLB)

First up is a California-based company that works in a futuristic niche – space flight. Rocket Lab is a non-governmental space launch company, offering customers access to the Electron small orbital launch vehicle, which it boasts is the second-most frequently launched US rocket. The Electron, which boosts payloads up to 300kg into low Earth orbit, is on the only reusable small launch vehicle in service. Rocket Lab has completed 25 Electron launches to date, successfully deploying 112 satellites into orbit.

In a major announcement for the company, Rocket Lab released news that it will attempt a mid-air helicopter recovery of the Electron vehicle’s first stage in the next scheduled launch, later this month.

Currently, the company complements the Electron rocket with the Photon customizable orbital spacecraft. Looking forward, Rocket Lab is developing the Neutron rocket, a large-scale reusable launch system, which will be able to deploy a 13,000kg payload into low Earth orbit, or a 1,500kg payload into an orbital trajectory to Mars or Venus. During 2021, Rocket Lab was awarded a contract from the US Space Force, worth $24 million, to complete development of the Neutron’s upper stage.

Building on its launch program, and to raise capital for its development program, Rocket Lab entered the public markets in August of last year. The stock’s entry to the NASDAQ came through a business combination with a SPAC firm, Vector Acquisition Corporation, and brought the space launch company as much as $777 million in gross proceeds.

Since going public, Rocket Lab has reported fiscal results for three quarters, starting with 2Q21 last September. The company saw zero revenue in that quarter – but reported $5.3 million in 3Q21, which more than quintupled to $27.5 million in 4Q21. Full-year revenue for 2021 came in at $62.2 million, up 77% year-over-year.

Kristine Liwag, Morgan Stanley’s resident expert on the Aerospace & Defense sector, sees the upcoming helicopter retrieval attempt as the key catalyst for Rocket Lab, writing: “We view RKLB’s upcoming mid-air booster retrieval attempt as a potential near-term catalyst as a successful operation would reflect a key milestone as the company executes on its strategy to increase rocket reusability (and thus lower cost).”

Going on, Liwag points out how this retrieval capability will set Rocket Lab apart from its peers: “We view the company’s ongoing and planned innovations in rocket reusability enabling Rocket Lab to potentially further widen the moat between itself and competitors… These innovations could enable recovery of ~70-80% of each rocket’s economic value, allowing Rocket Lab to potentially further drive down vehicle costs and insulate itself from potential pricing pressures engendered by rival small launch offerings and rideshare services.”

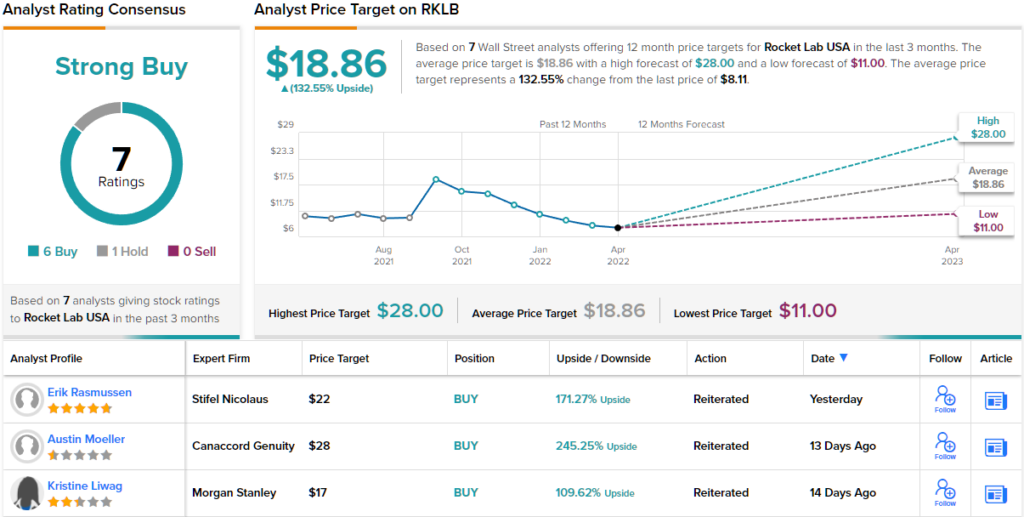

In line with her comments, Liwag rates Rocket Lab shares an Overweight (i.e. Buy), with a $17 price target to imply a robust 109% upside for the stock. (To watch Liwag’s track record, click here)

Overall, with 6 recent Buy ratings overpowering a single Hold, Rocket Lab gets a Strong Buy from the analyst consensus. The shares are priced at $8.11, and their $18.86 average target suggests ~133% upside from that level. (See RKLB stock forecast on TipRanks)

Joby Aviation (JOBY)

Sticking with the Aerospace realm, we’ll look over at Joby Aviation. This is a mid-cap firm, working on development of a new urban commuter aircraft. Joby’s proposed aircraft is an electrically powered vertical takeoff and landing (eVTOL) model, designed for the urban air taxi niche. Joby has demonstrated the concept through small-scale remotely controlled drones, and is currently testing a full-sized prototype. The company is aiming for FAA type certification next year.

Joby’s prototype commuter aircraft uses six electric motors, in a tilt-rotor configuration. The engines are aligned at the leading edges of the wing and tail surfaces, in a layout that optimizes motor and rotor efficiency. Joby’s concept plane has 5 seats – a pilot and four passengers – plus room for passenger luggage, and is designed to fly up to 150 miles on a full battery charge, with a top speed at 200 mph.

Last year, in August, Joby completed a SPAC combination with Reinvent Technology Partners, and entered the NYSE on August 11. The company’s realized proceeds, plus cash on hand, brought the balance sheet to $1.6 billion after the business combination.

The company is highly speculative, but last year, while the SPAC combo was in planning and in progress, Joby achieved several milestones. The pre-production prototype aircraft flew a total of 5,300 miles in test flights. That total included a flight on 154.6 miles on a single battery charge – the longest single flight, and an important proof-of-concept for the prototype’s proposed performance. Joby has also completed construction of its second pre-production prototype, and the first FAA production conformity inspection.

Once again, we’ll check in with Morgan Stanley’s Kristine Liwag, who lays out this aircraft maker’s strengths: “Joby continues to progress on their path to aircraft certification with meaningful steps forward in the certification and manufacturing process, along with strides in pushing the flight envelope of the aircraft. The company made meaningful progress in the certification process as it began manufacturing conformity testing and completed their first Systems and Compliance Reviews with the FAA.”

“Strides were made on the manufacturing front as the company began the manufacturing of their first production-intent aircraft. The design of the aircraft is yet to be frozen, but the idea is to have more conforming production with each passing aircraft across the line,” Liwag added.

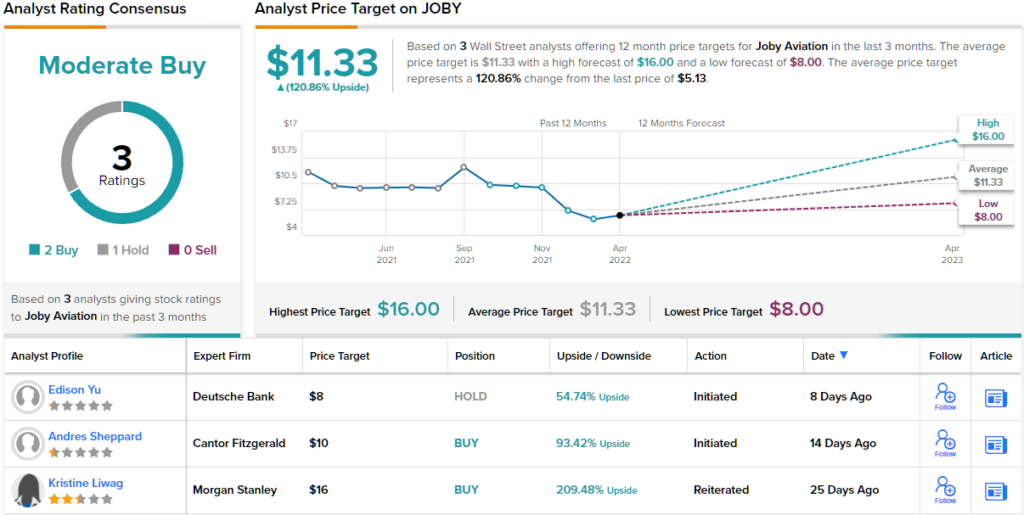

Overall, Liwag believes this is a stock worth holding on to. The analyst rates JOBY shares an Overweight (i.e. Buy), and her $16 price target indicates room for 209% one-year upside potential. (To watch Liwag’s track record, click here)

With 2 Buy ratings and 1 Hold assigned in the last three months, the word on the Street is that JOBY is a Moderate Buy. Not to mention the $11.33 average price target brings the upside potential to ~121% from the current trading price of $5.14. (See JOBY stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.