Investors looking to generate passive income can consider investing in dividend stocks. The TipRanks Stock Screener tool can now be used to shortlist stocks that offer a dividend yield higher than 5% and have received Strong Buy recommendations from Wall Street analysts.

Let’s take a look at two such stocks with impressive dividend histories: Western Midstream Partners (NYSE:WES) and Outfront Media (NYSE:OUT).

Western Midstream Partners LP

The company owns, operates, acquires, and develops midstream energy assets. WES stock has a rock-solid dividend yield of 7.4%. Western Midstream distributed a $0.5 per share dividend in February this year. Furthermore, the company has been gradually raising the dividend amount for the past two years.

Mizuho Securities analyst Gabe Moreen reiterated a Buy rating on WES stock with a price target of $35. The analyst believes the stock is a buy based on its free cash flow yield and buyback capacity.

Is Western Midstream a Good Buy?

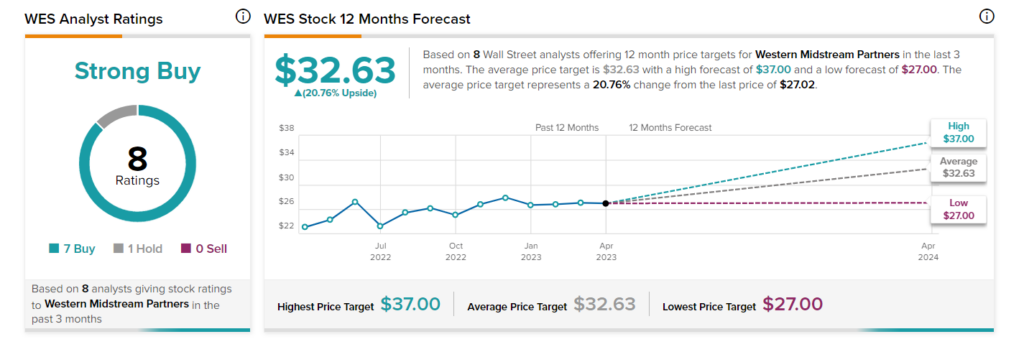

Wall Street is bullish about WES stock. It has received seven Buy and one Hold recommendations for a Strong Buy consensus rating. The analysts’ average price target of $32.63 implies 20.76% upside potential. The stock has gained 7.4% in the past six months.

Outfront Media, Inc.

Outfront provides advertising space on out-of-home advertising structures and sites on lease. The company enjoys a strong market position. Outdoor advertisements have been the most common type of advertisement due to their high effectiveness. Another interesting point for income investors is that the stock offers an attractive dividend yield of 7.4%.

Citigroup analyst Jason Bazinet maintained a Buy rating on the stock but lowered the price target to $25 from $27. The analyst sees 54.9% upside potential in OUT’s share price from its current level.

Is Outfront Media a Buy?

Wall Street is optimistic about Outfront, giving it a Strong Buy consensus rating based on four Buys and one Hold. The average OUT stock price target of $24.20 implies upside potential of 49.9% from here. Shares are up 4.7% over the past six months.

Concluding Thoughts

These stocks are appealing because they have dividend yields above 7%, promising growth prospects, and a consensus Buy rating. It’s interesting to note that Wall Street analysts anticipate these stocks to post decent gains in the next 12 months. Investors who want to generate consistent passive income may want to consider including these stocks in their portfolios.