The healthcare sector is expected to continue growing, driven by technological advancements and an aging population. This makes investing in health mutual funds worth considering for those seeking both returns and exposure to a resilient industry. Today, we have focused on two healthcare mutual funds –PRHSX and VGHCX – with over 10% upside potential projected by analysts in the next twelve months.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s delve deeper.

Vanguard Specialized Portfolios Health Care Fund (VGHCX)

The VGHCX fund seeks long-term capital appreciation. Also, it invests at least 80% of its assets in companies engaged in the development and production of products and services related to the healthcare industry.

On TipRanks, the VGHCX fund has a Smart Score of eight, meaning it has the potential to outperform market expectations. As of today’s date, VGHCX has 97 holdings with total assets of $42.91 billion. Over the past three months, the VGHCX fund has gained 10.4%.

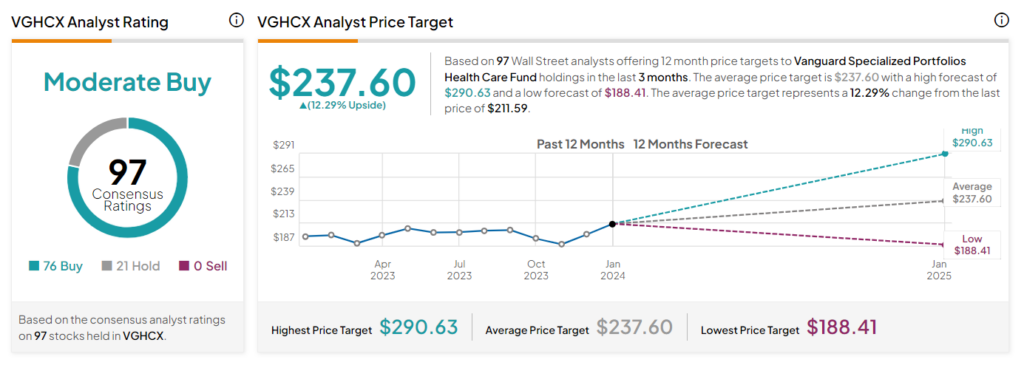

It has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 97 stocks held, 76 have Buys and 21 have a Hold rating. The average VGHCX fund price target of $237.60 implies 12.3% upside potential from the current levels.

T. Rowe Price Health Sciences Fund Inc. (PRHSX)

The PRHSX fund aims to provide long-term capital growth and offers investors a diversified portfolio of healthcare companies with the potential for significant returns. As of today’s date, PRHSX has 149 holdings with total assets of $14.44 billion. Moreover, the fund has returned about 6% over the past three months.

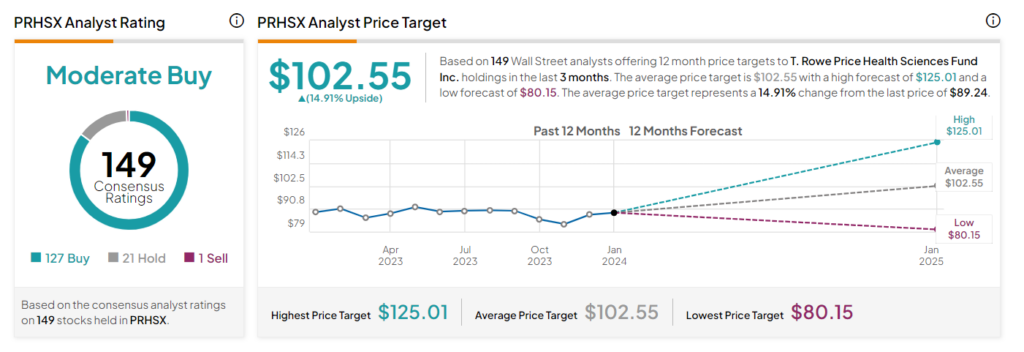

On TipRanks, PRHSX has a Moderate Buy consensus rating. This is based on 127 stocks with a Buy rating, 21 stocks with a Hold rating, and just one Sell. The average PRHSX mutual fund price target of $102.55 implies 14.9% upside potential from the current levels.

Ending Note

Mutual funds offer a perfect balance between diversification, a low minimum investment requirement, and higher liquidity in comparison to individual stocks. However, a prudent approach necessitates in-depth research before investing.