Investing in Energy ETFs (Exchange-Traded Funds) is a cost-convenient way to gain exposure to the energy sector. Today, we have leveraged the TipRanks ETF Screener to scan for two energy sector ETFs with more than 15% upside potential: SPDR S&P Oil & Gas Equipment & Services ETF (XES) and First Trust Nasdaq Oil & Gas ETF (FTXN).

Let’s take a closer look at what Wall Street thinks about these two ETFs.

SPDR S&P Oil & Gas Equipment & Services ETF (XES)

The XES ETF seeks to track the performance of the S&P Oil and Gas Equipment and Services Select Industry Index. It provides exposure to oil and gas drilling, and oil & gas equipment and services companies. XES has $303.4 million in assets under management (AUM), with its top 10 holdings contributing 43.22% of the portfolio.

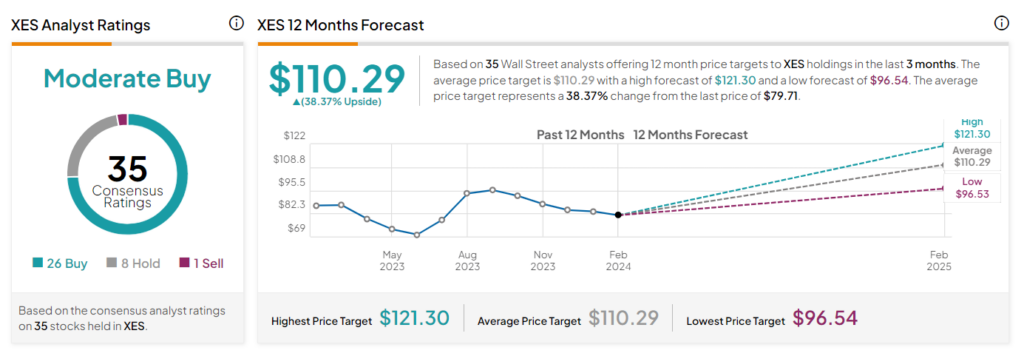

On TipRanks, the XES ETF has a Moderate Buy consensus rating. Of the 35 stocks held, 26 have Buys, eight have a Hold rating, and one has a Sell. The average XES price target of $110.29 implies a 38.4% upside potential from the current levels. The ETF has declined 14.4% in the past six months.

First Trust Nasdaq Oil & Gas ETF (FTXN)

The FTXN ETF seeks to track the performance of the Nasdaq U.S. Smart Oil & Gas Index. The fund generally invests at least 90% of its net assets in the securities that are part of the index. FTXN has $202.8 million in AUM, with the top 10 holdings contributing 58.42% of the portfolio.

On TipRanks, the FTXN ETF has a Moderate Buy consensus rating. Of the 43 stocks held, 36 have Buys and seven have a Hold rating. The average FTXN ETF price forecast of $33.41 implies a 19.1% upside potential from the current levels. The ETF has declined 4.7% in the past six months.

Concluding Thoughts

Energy ETFs can be valuable additions to an investment portfolio, offering diversification and the potential to generate income. Given the solid upside potential expected by analysts, XES and FTXN ETFs might seem worth considering.