After market close today, Aritzia (TSE:ATZ) (OTC:ATZAF) reported its Fiscal Q1-2024 financial results for the period ended May 28, 2023. Both revenue and earnings beat analysts’ estimates. Aritzia’s revenue reached C$462.7 million compared to the consensus estimate of about C$460.2 million, growing by 13.4% year-over-year. Also, its adjusted earnings per share (EPS) came in at C$0.10 compared to the consensus estimate of C$0.09. However, last year’s EPS figure was a much higher $0.35.

Additionally, adjusted EBITDA reached C$31.6 million, falling by 54.6%, and the company also saw a lower gross profit margin compared to last year, falling from 44.3% to 38.9%. Nonetheless, Aritzia’s U.S. expansion is still going strong, with U.S. revenue growing by 21.8% year-over-year.

Aritzia’s Fiscal 2024 Financial Outlook Got Revised Lower

For Fiscal 2024, Aritzia expects the following:

- Net revenue between C$2.25 billion and C$2.35 billion, marking a 2% to 7% sales increase year-over-year. The previous estimate was C$2.42 billion to C$2.5 billion.

- A 300 basis point (bps) drop in its gross profit margin

- A 300 bps rise in SG&A as a percentage of net revenue

- Capital cash expenditures of around C$220 million.

Is Aritzia Stock a Buy, According to Analysts?

According to analysts, Aritzia earns a Moderate Buy consensus rating based on three Buys, three Hold, and one Sell assigned in the past three months. The average Aritzia stock price target of C$49.76 implies 48% upside potential.

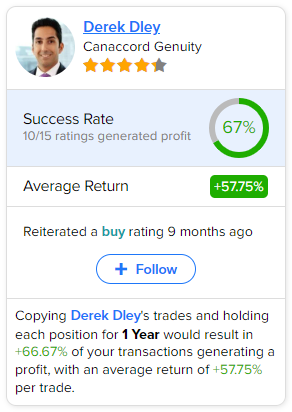

If you’re wondering which analyst you should follow if you want to buy and sell ATZ stock, the most accurate analyst covering the stock (on a one-year timeframe) is Derek Dley of Canaccord Genuity, with an average return of 57.75% per rating and a 67% success rate. Click the image below to learn more.