Argo Group International Holdings, Ltd. has inked a deal to divest its Italian operations, ArgoGlobal Assicurazioni S.p.A (AGA), to Swiss company Perfuturo Capital AG. Shares closed 1.3% higher on Wednesday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Argo did not disclose the financial terms of the deal. The underwriter of specialty insurance products expects the transaction to close in early 2021, pending regulatory approval.

Matt Harris, Argo’s (ARGO) head of international operations said that the sale deal is in-line with the company’s strategy to streamline and simplify its business. Notably, last month, the company closed the Ariel Re sale to Pelican Ventures and J.C. Flowers & Co. for $30 million.

Harris further said, “We are confident that Perfuturo’s expertise and knowledge of the European market will allow AGA to thrive.” He added, “Argo Group will continue to focus on specialty insurance lines of business that we expect will result in profitable growth and improved shareholder value.” (See ARGO stock analysis on TipRanks)

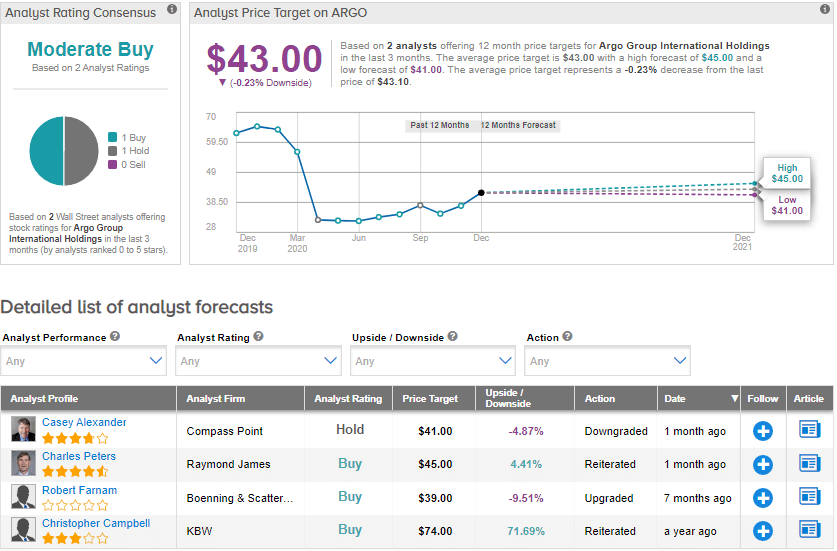

On Nov. 11, Compass Point analyst Casey Alexander downgraded the stock to Hold from Buy and maintained a price target of $41 (4.9% downside potential). The analyst said that the Covid-19 vaccine progress and positive sentiment in equity markets fueled a “rapid rally” in Argo shares. However, he added that if a vaccine “is not a game-changer on the loss side of the book,” then there could be increased submissions on the premium side.

Meanwhile, the Street has a cautiously optimistic outlook on the stock with a Moderate Buy analyst consensus. The average price target stands at $43 and implies that the shares are almost fully priced at current levels. Shares have dropped 34.5% year-to-date.

Related News:

HeidelbergCement Looks to Divest California Operations – Report

IAC Soars 14% On Vimeo Spin-Off Plan; Oppenheimer Lifts PT

Honeywell To Buy Sparta Systems For $1.3B; Stock Up 17% YTD