Arcos Dorados (ARCO), the master franchisee for McDonald’s in much of Latin America and the Caribbean, has grappled with macroeconomic challenges resulting in a pullback in its shares, with the stock down over 26% year-to-date. However, the company has significantly outperformed McDonald’s over the past three years and is projected to grow by 50.65% based on average analyst price targets. The potential for resurgent growth makes the stock an intriguing opportunity for investors interested in emerging markets.

Archos Expands McDonald’s Footprint South of the Border

Arcos Dorados (“golden arches”) is the world’s largest independent McDonald’s franchisee, maintaining the biggest quick-service restaurant chain in Latin America and the Caribbean. The company retains the exclusive right to operate and grant McDonald’s restaurant franchises across 20 Latin American and Caribbean countries and territories. With over 2,350 restaurants company-managed or operated by sub-franchisees, Arcos employs over 100,000 people.

Consistent with McDonald’s Experience of the Future (EOTF) technology-based strategy of shifting restaurant service to its global mobile app, self-order kiosks, and digital menu boards, Archos reported the opening of 37 tech-enabled restaurants in the first half of the year, inclusive of 34 freestanding locations. A notable contribution to this growth was from Brazil, the company’s largest market, where it added 21 EOTF restaurants during the first half, including 20 new standalone units.

Analysis of Archos’ Recent Financial Results

The company recently reported its second-quarter results for 2024. Total revenue for the company was $1.11 billion, beating analysts’ expectations of $1.06 billion, marking a 6.8% increase over the same period last year. The increase was driven by a rise in systemwide comparable sales and guest volume as the McDonald’s brand gained more market share in the region. Off-premise sales rose 11% and represented 45% of the systemwide sales for this quarter, while on-premise sales stood for 55% of systemwide sales with a 4% year-over-year growth.

Digital channel sales also grew by 24% compared to last year, contributing significantly to the top-line performance. Arcos’s customer relationship management platform had about 90 million unique registered users, and the mobile app surpassed 130 million cumulative downloads with 21 million monthly active users across the quarter.

Adjusted EBITDA reached $118.8 million, marking an increase of 7.9% in U.S. dollars compared to the prior year. The adjusted EBITDA margin for the quarter of 10.7% stayed relatively flat compared to Q2 2023. The company’s earnings per share stood at $0.13, which aligns with analysts’ expectations.

What Is the Price Target for ARCO Stock?

While the stock has been lackluster recently, it has been on an upward trajectory over a more extended period, climbing over 71% in the past three years. It trades at the lower end of its 52-week price range of $8.59 – $13.20 while demonstrating negative price momentum by trading below its 20-day (9.41) and 50-day (9.56) moving averages. It trades at a relative discount to industry peers based on a P/E ratio of 11.33x compared to the Restaurant industry average of 25.98x.

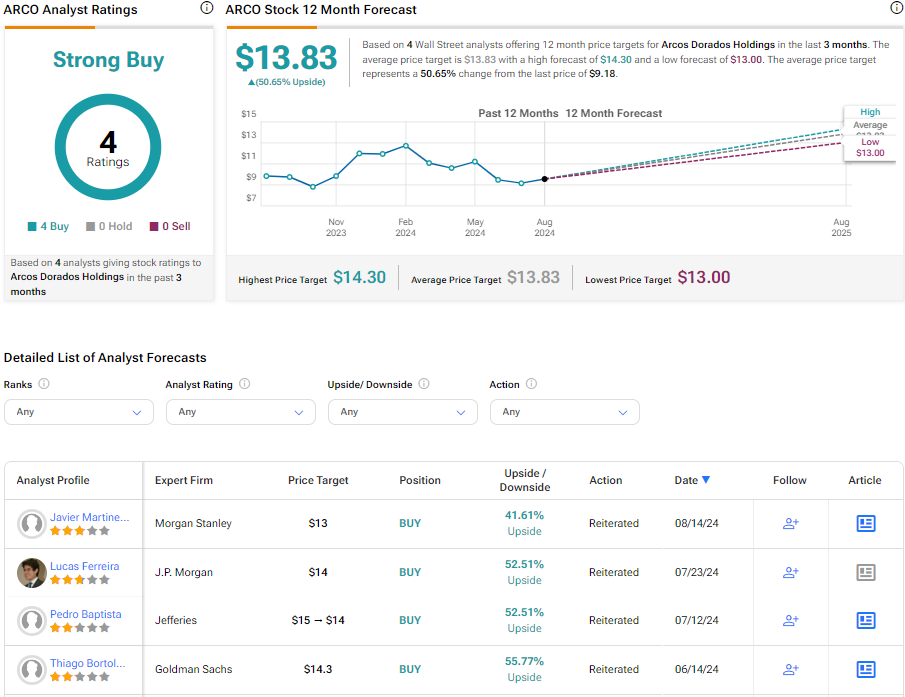

Analysts following the company have been bullish on the stock. For instance, Morgan Stanley analyst Javier Martinez Olcoz Cerdan recently reiterated a Buy rating with a price target of $13.00 on the shares, noting the company’s strong performance and growth prospects, particularly in Brazil and the Northern Latin American Division, creating a favorably skewed risk-reward profile.

Overall, ARCO stock is rated a Strong Buy based on four analysts’ recommendations and price targets. The average price target for ARCO stock is $13.83, representing a potential 50.65% upside from current levels.

Final Analysis on Arcos Dorados

Despite the recent downturn, Arcos Dorados is well-positioned for a rebound, with recent financial results surpassing analysts’ expectations. Further, the company is capitalizing on the McDonald’s Experience of the Future (EOTF) strategy, opening multiple tech-enabled restaurants in the first half of the year, primarily in its largest market, Brazil. With the shares trading at a discount, the upside opportunity paints a positive picture for potential investors.