Archer-Daniels-Midland (NYSE:ADM) has revised its full-year 2023 adjusted earnings guidance to $6.90 per share, down from $7. Also, it withdrew the outlook for its Nutrition unit. The move comes in response to an ongoing investigation into accounting practices within ADM’s Nutrition segment, including some intersegment transactions.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

ADM provides food processing and commodities trading services.

Furthermore, the company has postponed its fourth-quarter earnings release and full-year 2023 financial results, which were earlier expected on January 23, 2024.

ADM also revealed that it has placed CFO Vikram Luthar on administrative leave and named Ismael Roig as the interim CFO. In addition, the company clarified that Luthar’s leave is contingent upon an ongoing investigation led by external counsel and the Board’s Audit Committee.

Is ADM a Good Stock to Buy?

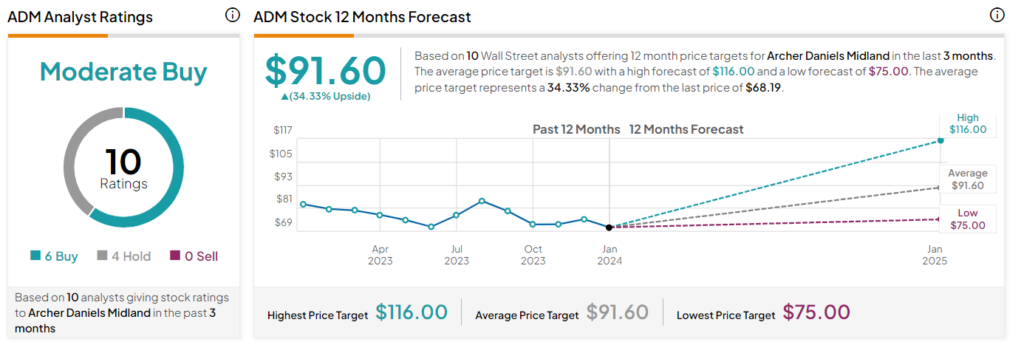

Analysts are cautiously optimistic about ADM stock, with a Moderate Buy consensus rating based on six Buys and four Holds. The average ADM stock price target of $91.60 implies an upside potential of 34.33% at current levels. Shares of the company have declined by about 17% over the past six months.