AppLovin (APP) stock has surged even higher over the last month on the back of strong earnings data, a resurgent technology sector, and some broker upgrades. Over one year, the stock has gained 242%, reflecting incredible returns from its use of artificial intelligence as well as market trends. Despite this rise, personally, I’m still bullish on AppLovin, noting its impressive margins, great forecast for growth, and attractive valuation multiple.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What Is AppLovin?

Many investors may not have heard of this company despite its extraordinary stock market performance over the past two years. So, what is AppLovin? AppLovin is a mobile technology company that provides a suite of solutions to help app developers and owners monetize their mobile apps and websites.

In more detail, AppLovin’s platform offers a range of tools for user acquisition, monetization, and analytics, enabling businesses to grow their mobile app revenue by improving the marketing and take rate of applications. The company’s key products include AppDiscovery for user acquisition, MAX for ad mediation, and ALX for programmatic advertising.

Additionally, AppLovin also makes mobile games such as “Wordscapes,” “Matchington Mansion,” and “Game of War.”

Why Has AppLovin Been So Successful?

So, why has AppLovin been so successful over the past 18 months? Surely something must have changed? Well, AppLovin’s remarkable success over the past 18 months can be attributed to several key factors that strengthen my bullish stance on the stock.

First among these is the company’s strategic focus on its high-margin software platform business, particularly the launch of AXON 2.0. This AI-powered advertising engine has been game-changing and has significantly improved campaign performance, driving higher installs and revenue per install. Interestingly, management didn’t suggest that AXON 2.0 would be game-changing, with CEO Adam Foroughi simply saying “it’s just better”.

However, as AXON 2.0’s enhanced efficiency and better return on ad spend has become well-known, the company has found it easier to attract advertisers and increase spending on AppLovin’s platform. Moreover, AppLovin’s acquisition and integration of MoPub has also played an important role, providing valuable data insights in the post-IDFA (identifier for advertisers) world.

Finally, AppLovin has benefited from a broader shift in marketing as companies increasingly spend less on linear television and more on engaging platforms. With a strong footing in mobile gaming advertising and some success in new verticals, AppLovin has been well-positioned for success.

AppLovin Is Valued Heavily on Growth Prospects

Despite its recent success, AppLovin is currently valued heavily on its growth prospects, and for good reason. The company’s growth is driven by its highly profitable software business and its strategic expansion into new verticals. These growth engines give me confidence in its future potential, which is why I remain optimistic about the stock’s long-term performance.

Furthermore, the shift towards the software business has already been fruitful, with software revenue growing 75% year-over-year (YoY) in Q2 2024, delivering $711 million in revenue. In addition, management is aiming for 20% to 30% long-term growth from its software business.

On top of that, the company is also expanding beyond its gaming roots into new verticals, with e-commerce being a key focus. AppLovin’s pilot program, launched in Q2 2024, gives e-commerce website owners the ability to purchase in-app mobile game video ad inventory, leveraging its billion-plus daily active user base.

AppLovin Has the Hallmarks of a Quality Business

After several years of non-linear growth, AppLovin now shows all the hallmarks of a quality business, particularly through its impressive margin expansion and strategic growth—key factors that solidify my bullish stance on the stock.

Management’s desire to expand teams “in a very lean and targeted manner” has been reflected in its expanding adjusted EBITDA margins. In Q2 2024, the adjusted EBITDA margin expanded 11.2 points YoY to 55.6% as GAAP earnings per share (EPS) grew to $0.89 (up 304.5% YoY).

Unsurprisingly, the software segment has been a keen margin driver, accounting for comprising 65.8% of total sales with rich adjusted EBITDA margins of 73.1%. This has contributed to a TTM Free Cash Flow (FCF) margin of 35.6%, which may push even higher towards the end of the year.

In short, it’s looking like a quality company with great margins, strong FCF, and growth potential.

AppLovin’s High P/E Ratio Is Justified

As noted above, AppLovin is priced heavily on its growth potential. The stock currently trades at 26.3x forward earnings, representing a 10.2% premium to the information technology sector as a whole. However, with earnings expected to grow at an impressive 33.4% over the next three to five years, this leads to a price-to-earnings-to-growth (PEG) ratio of just 0.79, which indicates a significantly undervalued stock with a 57.9% discount to the wider sector. This reinforces my bullish view, as the potential upside makes the premium more than justifiable.

Is AppLovin a Buy, According to Analysts

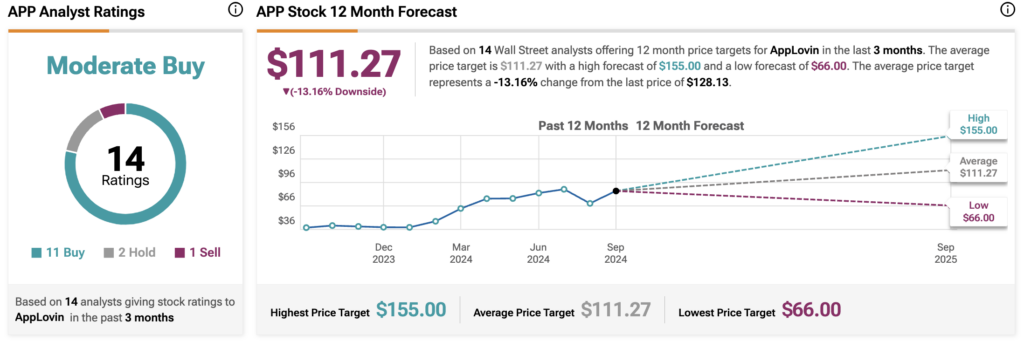

On TipRanks, APP comes in as a Moderate Buy based on 11 Buys, two Holds, and one Sell rating assigned by analysts in the past three months. The average AppLovin stock price target is $111.27, implying a 13.16% downside potential.

The Bottom Line on AppLovin

AppLovin stock has delivered for shareholders over the past 18 months, and it could continue to do so. The company’s software and use of AI have proven incredibly successful, with margins pushing sky-high. Despite overtaking its share price target, the stock still looks like great value with earnings expected to grow by more than 30% per annum and a PEG ratio of 0.79.