Applied Materials surprised the Street with its better-than-expected earnings results and an upbeat sales outlook, sending its shares up 3% in Friday’s pre-market trading.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

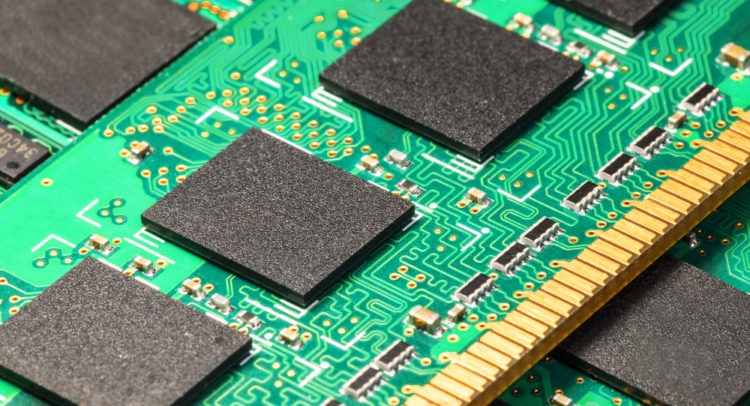

Applied Materials’ (AMAT) revenue during the fiscal fourth quarter jumped 25% to $4.69 billion year-on-year, and surpassed analysts’ estimates of $4.6 billion. Semiconductor systems net sales, which include flash memory and DRAM chips, increased 33% from the year-ago quarter.

The world’s largest flat panel display chip maker earned $1.23 a share in the three months ended Oct. 25, up from the $0.75 a share in the year-ago period. Analysts had been looking for earnings of $1.17 a share.

Adding to the good news, Applied Materials said it now expects to generate net sales of about $4.95 billion (plus or minus $200 million) in the first quarter of fiscal 2021. Non-GAAP adjusted diluted EPS is forecasted to be in the range of $1.20 to $1.32. Analysts had projected earnings of $1.11 a share on revenue of $4.51 billion for the quarter.

“Applied Materials closed fiscal 2020 with record quarterly performance as demand for our semiconductor systems and services remains very strong,” said Applied Materials CEO Gary Dickerson. “Our future opportunities have never looked better and, as powerful technology trends take shape, we are uniquely positioned to accelerate our customers’ roadmaps and outperform our markets.”

In fiscal 2020, the semiconductor company generated a record $3.80 billion in cash from operations, paid dividends of $787 million and used $649 million to repurchase 12 million shares of common stock.

AMAT shares have already outperformed the S&P 500 Index, surging more than 14% so far this year with analysts cautiously optimistic about the stock. The Moderate Buy analyst consensus boasts 11 Buys versus 4 Holds. That’s with an average price target of $76.50, indicating that 10% upside potential lies ahead in the coming 12 months.

In reaction to the earnings release, Mizuho Securities analyst Vijay Rakesh raised the stock’s price target to $82 from $77 and reiterated a Buy rating, saying that AMAT “drives a strong strategic value proposition with share gains.”

“We believe AMAT’s DRAM market share gains, combined with stronger 2021 DRAM WFE [wafer fabrication equipment] growth, could position AMAT better,” Rakesh commented in a note to investors. (See Applied Materials stock analysis on TipRanks)

Related News:

Alibaba-Backed XPeng Sales Balloon 343%; Shares Pop 34%

Fiat Chrysler, Engie Join Forces For E-Mobility Joint Venture

Comcast In Talks With Walmart To Develop Smart TVs – Report