After market close today, semiconductor equipment company Applied Materials (AMAT) reported its Fiscal Q3-2022 earnings results. Both earnings per share (EPS) and revenue came in higher than analysts were expecting. In addition, the company provided its Fiscal Q4 outlook, which also came in higher than analysts’ expectations. As a result, the stock is trending slightly higher in the after-hours trading session.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In Fiscal Q3, AMAT’s revenue increased about 5.2% year-over-year to $6.52 billion. Analysts were anticipating revenue of $6.27 billion. Non-GAAP EPS came in at $1.94 compared to $1.90 last year. Meanwhile, analysts were expecting non-GAAP EPS to come in at $1.78.

However, AMAT’s adjusted gross margin dropped by 180 basis points year-over-year, reaching 46.2%. Similarly, its adjusted operating income margin dropped by 270 basis points to reach 30%.

Lastly, the company’s Semiconductor Systems and Applied Global Services segments’ revenues grew 6.3% and 10.4%, respectively, the Display and Adjacent Markets segment shrunk 22.7% year-over-year.

Applied Materials Expects Modest Growth in Fiscal Q4

Regarding its Fiscal Q4 outlook, Applied Materials expects revenue to land between $6.25 billion and $7.05 billion, or $6.65 billion at the midpoint. Non-GAAP EPS is projected to range from $1.82 to $2.18, or $2.00 at the midpoint. The company beat expectations because analysts were expecting revenue and EPS guidance to be $6.55 billion and $1.94, respectively.

In Fiscal Q4 2021, AMAT generated $6.12 billion in revenue and $1.94 in EPS, meaning that the company will likely see modest year-over-year growth in the current quarter.

Is AMAT Stock a Buy or Sell?

Turning to Wall Street, AMAT earns a Strong Buy consensus rating based on 18 Buys and five Holds assigned in the past three months. The average AMAT price target of $51.47 implies 25.6% upside potential.

Additionally, AMAT sports an “outperform” Smart Score rating of 9 out of 10, indicating that it has solid potential to outperform the market, going forward.

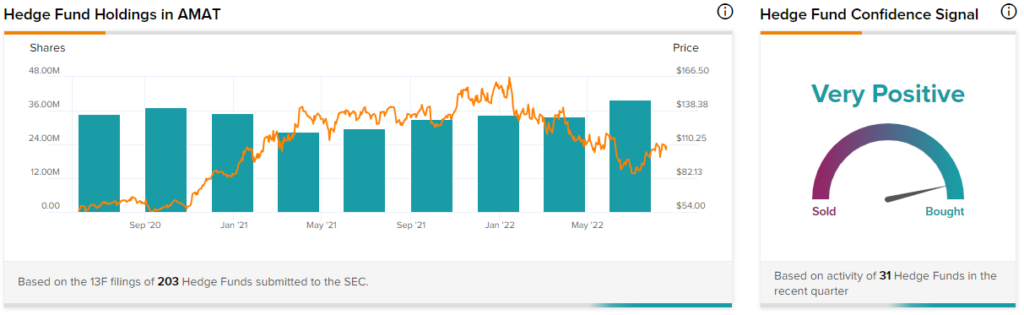

Hedge Funds are Bullish on AMAT Stock

Interestingly, while the stock was falling in Q2, hedge funds increased their positions by 6.1 million shares, going from 33.8 million shares owned to 39.9 million. This includes Buys from five-star hedge fund managers such as David Blood and Gavin M. Abrams, rated #4 and #5, respectively, out of 424 hedge fund managers tracked by TipRanks.

Conclusion: AMAT’s Solid Earnings Results Satisfy Investors

Applied Materials had solid results in Fiscal Q3 that beat analysts’ expectations, and the company expects modest growth in its Fiscal Q4. However, contracting profit margins could become concerning if they continue downward in the coming quarters. Nonetheless, analysts and hedge funds are bullish, and investors seem to like the earnings report, as the stock is up in after-hours trading.