Microchip equipment maker Applied Materials (AMAT) says it is holding its financial outlook steady despite U.S. government restrictions placed on semiconductor exports to China.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company decided to uphold its outlook after assessing the potential impact of new U.S. regulations that curtail the export of certain microchips and processors to rival China. The current administration of U.S. President Joe Biden recently announced new rules that further tighten regulations on chip equipment makers such as Applied Materials and curb exports to 140 Chinese companies.

The new regulations are the Biden administration’s last attempt to limit China’s ability to access and produce microchips that can help advance artificial intelligence technologies for military applications or threaten America’s national security.

Limited Impacts

Applied Materials said its does not anticipate a significant hit to its finances because of the new rules pertaining to China exports. Similarly, Dutch computer chip equipment maker ASML Holding (ASML) said that it too does not expect the new U.S. restrictions to impact its current financial guidance.

Applied Materials supplies chipmaking tools to companies such as Taiwan Semiconductor Manufacturing Co. (TSM) and Intel (INTC). Management said that they continue to expect revenue of $7.15 billion, plus or minus $400 million, for the current quarter. Earnings per share (EPS) are expected to be $2.29.

AMAT stock has risen 13% so far in 2024.

Is AMAT Stock a Buy?

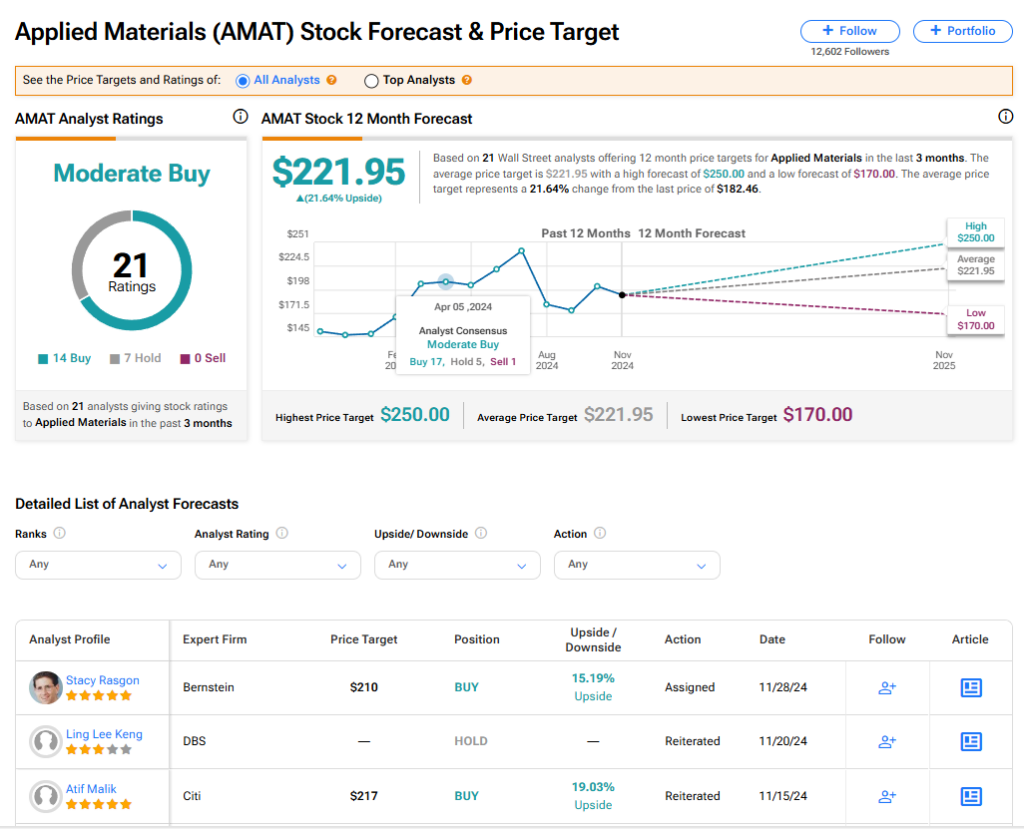

Applied Materials has a consensus Moderate Buy rating among 21 Wall Street analysts. That rating is based on 14 Buy and seven Hold recommendations issued in the last three months. The average AMAT price target of $221.95 implies 21.75% upside from current levels.