Apple’s (NASDAQ:AAPL) market share in China, the world’s largest smartphone market, dropped to 15.7% in Q1, down from 19.7% a year ago, as reported by technology research firm Counterpoint. During the first quarter, the iPhone maker experienced a 19.1% decline in smartphone sales.

Chinese Tech Giants Charge Forward

In contrast, Chinese telecommunications giant Huawei saw a remarkable 69.7% surge in smartphone sales in Q1. This surge was largely attributed to the launch of Huawei’s Mate 60 smartphone, which supports 5G mobile connectivity. According to Counterpoint, Huawei held the fourth largest market share in Q1 at 15.5%.

Furthermore, Chinese smartphone maker Vivo held the top spot in the Chinese smartphone market in Q1 with a market share of 17.4%. Honor, a brand catering to the mass market and spun out of Huawei, secured second place with a market share of 16.1%.

Overall, smartphone sales in China increased by 1.5% year-on-year in the first quarter. This marked the industry’s second consecutive quarter of positive growth.

Analyst’s View on Apple

Counterpoint analyst Ivan Lam noted that Huawei’s resurgence had affected Apple’s premium market segment, with replacement demand for Apple phones slightly lower than in previous years.

However, Lam anticipates that iPhone sales could rebound in the second quarter as the company could offer new color options and implement aggressive sales strategies.

Is Apple a Buy, Sell, or Hold?

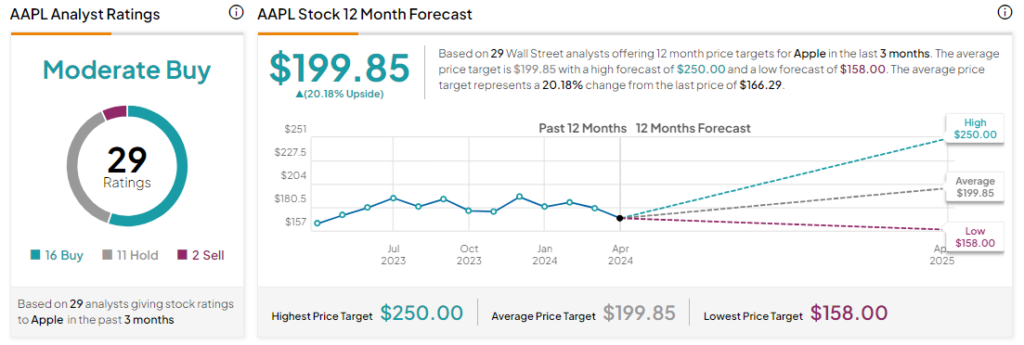

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 16 Buys, 11 Holds, and two Sells. Year-to-date, AAPL has declined by more than 10%, and the average AAPL price target of $199.85 implies an upside potential of 20.2% from current levels.