iPhone maker Apple’s (AAPL) share in the smartphone market continued to decline in the second quarter of 2024 (year-over-year) even as shipments rose, preliminary data from the IDC (International Data Corporation) showed. Meanwhile, rival Samsung (OTC:SSNLF) remained the top player but also lost market share compared to the second quarter of 2023. Chinese players are making big headways in smartphone market penetration, led by Xiaomi and Vivo, the IDC noted.

In Q2, global smartphone shipments increased by 6.5% year-over-year to 285.4 million. Heavy discounts and integration of generative AI (artificial intelligence) in smartphones is helping to boost the overall demand for smartphones around the globe.

Apple’s iPhones Losing Steam

As per data from the IDC’s Worldwide Tracker team, Apple shipped 45.2 million iPhones in Q2, up 1.5% compared to Q2FY23. Having said that, its market share fell to 15.8% from 16.6% during the same period. While the Q2 figures show an improvement from the first quarter shipments, Apple is facing solid competition from local Chinese manufacturers. Also, the ban on use of foreign devices by Chinese officials could be one of the reasons for the diminishing iPhone sales.

Notably, iPhone sales contribute the major portion of Apple’s total revenue.

Interestingly, Apple still remains in the second position in global smartphone shipments for high-range, premium phones. For reference, Apple lost the number one spot to Samsung in Q1FY24, when its shipments collapsed by 9.6% year-over-year to 50.1 million units. On the brighter side, the IDC’s data on PC (personal computers) shipments showed that Apple’s PC shipments surged by 20.8% year-over-year in Q2.

Samsung, on the other hand, shipped 53.9 million smartphones in the quarter, up 0.7% compared to Q2FY23. In the meantime, its market share declined to 18.9% from 20% during the same period.

Chinese Phone Manufacturers Take Charge

The IDC noted that Chinese companies are gaining market share by focusing on mid and low range smartphones, leveraging the current consumer spending dynamics. Indeed, both Xiaomi and Vivo registered double-digit growth in Q2 shipments. Xiaomi shipped 42.3 million (not too far behind Apple) and Vivo sold 25.9 million smartphones in the quarter. Also, Oppo shipped 25.8 million smartphones in Q2. The market shares for Xiaomi, Vivo, and Oppo increased to 14.8%, 9.1%, and 9.0%, respectively.

The IDC is expecting a greater push for generative AI-driven smartphones in the second half of the year. It remains to be seen if Apple could reignite the demand momentum and regain its top spot in the global smartphone market or whether its iPhones continue to lose steam.

Is Apple a Buy, Sell, or Hold Stock?

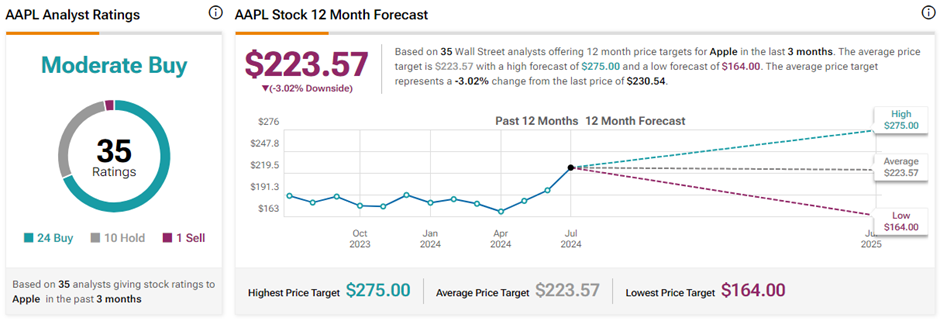

On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 24 Buys, ten Holds, and one Sell rating. The average Apple price target of $223.57 implies 3% downside potential from current levels. Year-to-date, AAPL shares have gained over 20%.