Even after reporting solid numbers in its June quarter results and meeting investor expectations, Apple (AAPL) has faced increased investor skepticism. This is largely due to its iconic shareholder, Warren Buffett, reducing his multi-billion dollar stake in Apple by almost 50%. However, I believe this move does not necessarily reflect the company’s fundamentals, so I maintain my bullish stance on AAPL.

Six months ago, Apple represented around 49% of Berkshire Hathaway’s ($BRK.B) holdings. Even after selling 390 million shares, Apple still accounts for 30% of Berkshire’s portfolio. In my opinion, this seems more like a strategic shift in Buffett’s portfolio, aiming for greater protection and diversification, rather than a bearish signal about Apple’s business.

In this article, I’ll highlight two reasons why investors should focus on Apple for now and not fixate on concerns about Warren Buffett’s reduction in his AAPL stake.

Apple’s Fiscal Q3 Is a Likely Inflection Point

The June quarter earnings season was a bit erratic for tech stocks. Among the Big Tech giants, so far, only Meta Platforms (META) managed to impress the market with its results. This time, though, Apple’s Fiscal Q3 results also came out strong, with the stock seeing slight gains, post-earnings.

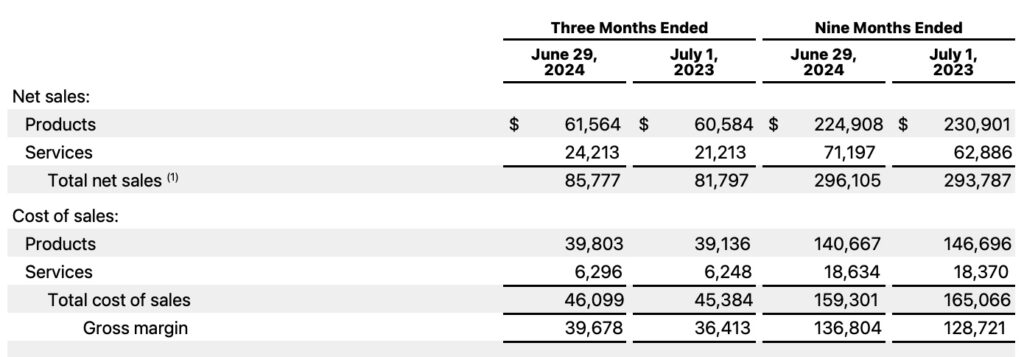

Overall, Apple had a solid quarter, delivering an all-around beat. The Cupertino-based company exceeded the EPS consensus for the sixth consecutive quarter, reporting $1.40 compared to the expected $1.34, marking an 11% year-over-year increase in earnings. Revenues reached $85.8 billion, surpassing Wall Street’s $84.4 billion estimate.

In addition, two key points stood out this quarter: performance in China and, additionally, the CapEx guidance cut.

As expected, Apple faced challenges in China, with sales falling 6.5% year-over-year and 10% from the previous quarter. However, this result was not as dire as it might seem. Over the past three years, the China segment has typically seen a 16% sequential decline. Some analysts believe this could signal a turning point, with the potential for positive growth next year, especially with the anticipated AI-driven super cycle update.

Dan Ives from Wedbush highlighted that there are 225 million iPhones in China, and 70% of these haven’t been upgraded in the last three years. Bernstein’s Toni Sacconaghi added that Chinese consumers are sensitive to iPhone features, and with no major updates over the past year, the upcoming super cycle might reverse the trend.

The second key point was Apple’s approach to capital expenditures (CapEx), which differs from other Big Tech firms. While many of its peers are ramping up CapEx, Apple has reduced its spending by 26% year-to-date.

The iPhone maker plans to spend about $10 billion on capital expenditures this year, compared to $50 to $70 billion for some other tech giants. This conservative approach to spending aligns with Apple’s strategy as an installed-base company (a company that focuses on generating revenue from its existing customer base through services and product upgrades).

For Apple, AI is meant to enhance existing products and services rather than drive massive investments in new data centers or large language models.

In the end, the market seems to value this conservative approach to AI spending for Apple, which should contribute to robust cash flows in the coming quarters as capital expenditures ease.

Apple Services Keeping the Momentum Going

While many market participants focus on Apple’s iPhone and product demand, the Services segment continues to grow strongly. Net sales in this segment reached $24 billion, up 14% year-over-year. Over the last three quarters, Services has accounted for about 24% of Apple’s total revenue compared to 21% a year ago.

The importance of Services is clear when looking at Apple’s gross profit margin. Services achieved a gross margin of 74%, while products had a gross margin of 35.3%. As Apple hits an all-time high in its active installed base thanks to its hardware, these users are driving Services revenue to record levels. This has helped Apple improve its overall gross margin, with $39.7 billion in gross profits in Q3 compared to $36.4 billion in the same period last year.

Furthermore, improving margins often translates into strong cash flow generation, especially coupled with a slowdown in CapEx spending, as noted earlier. By the end of the quarter, Apple generated $29 billion in operating cash flow, a June quarter record, with $153 billion in cash and $101 billion in debt. This strong cash flow has been used for buybacks and dividends. Apple declared a $0.25 dividend and returned over $32 billion to shareholders during the quarter.

Looking ahead, AI enhancements and updates to Apple’s product cycle, combined with a large user base, are driving Services growth. Apple expects Services to continue growing by double digits through the end of the year. This should sustain the virtuous cycle, benefiting shareholders by increasing the value returned to them and ultimately enhancing overall investment returns, thereby supporting a long-term bullish thesis.

Is AAPL Stock a Buy, According to Analysts?

Overall, analysts are quite bullish on AAPL. The consensus rating is a Moderate Buy, with 24 out of 32 analysts recommending a Buy, seven suggesting a Hold, and just one advising a Sell. Recently, most analysts have raised their price targets for Apple. The average AAPL stock price target is $248.96, which suggests a potential upside of 19.3% from the most recent share price.

Key Takeaways

Although investors are concerned about Warren Buffett trimming half of his Apple shares, this move likely represents a portfolio rebalancing rather than a specific bearish signal regarding the company’s fundamentals.

The strong results in Fiscal Q3, especially compared to other Big Tech peers and during a typically slower quarter, ease concerns about AI spending and challenges in China. While the full impact of the AI-fueled iPhone upgrade super cycle is still to come, the rapid growth of Services continues to ensure robust value creation for shareholders.