Apple reported its largest revenues in a single quarter, exceeding the $100 billion milestone for the first time, driven by strong sales in every product category, especially 5G iPhone sales. The iPhone maker’s earnings and revenues also surpassed the Street’s estimates.

Maximize Your Portfolio with Data Driven Insights:

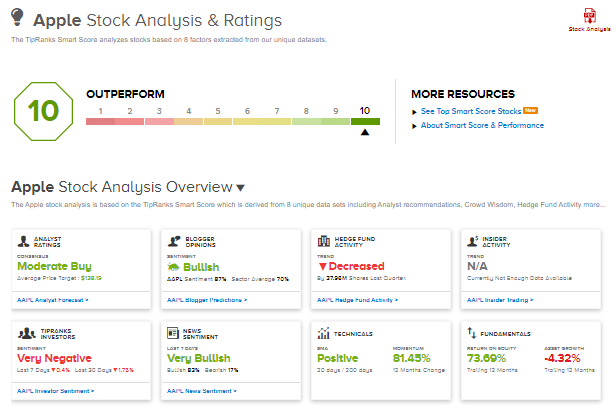

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

However, Apple stock fell about 3.3% in Wednesday’s extended trading session on a lukewarm 2Q outlook.

Apple’s (AAPL) 1Q earnings of $1.68 per share increased 34.4% year-over-year and crushed analysts’ expectations of $1.42 per share. Sales jumped 21.3% to $111.4 billion year-over-year, topping the consensus estimates of $103.2 billion.

Top-line performance was fueled by iPhone sales growth of 17% year-over-year, which generated $65.6 billion and beat analysts’ expectations of $59.8 billion. Apple released 4 new iPhone 12 models with 5G capabilities. The company’s Mac sales grew 21% to $8.68 billion but marginally missed the Street consensus of $8.69 billion. Meanwhile, iPad revenues soared 41% to $8.44 billion year-over-year and exceeded analysts’ estimates of $7.46 billion.

Apple’s services business revenues jumped 24% to $15.76 billion year-over-year, beating consensus estimates of $14.8 billion. Sales from the company’s wearables, home, and accessories category, which includes Apple Watch and headphones such as AirPods and Beats, rose 29% to $12.97 billion year-over-year versus analysts’ expectations of $11.96 billion.

Looking ahead to the March quarter, the company did not provide any formal guidance citing the COVID-19 uncertainty, but the company’s CFO Luca Maestri said that the services business will face a “tougher year-over-year comparison”, as the company witnessed increased demand for digital services amid the pandemic-led lockdowns announced during the March quarter last year. Maestri added that sales growth in airpods and in the wearables, home, and accessories category is expected to decelerate sequentially in 2Q. (See AAPL stock analysis on TipRanks)

Following the strong 1Q results, Wedbush analyst Daniel Ives maintained a Buy rating and a price target of $175 (23.2% upside potential) on the stock. Ives said, “We essentially view this quarter as the kickstart to the 5G supercycle which so far, we are seeing order activity continue to track significantly ahead of expectations as well as its predecessor iPhone 11 signaling a green light into FY21.”

Overall, the Street has a cautiously optimistic outlook with the analyst consensus of a Moderate Buy based on 19 Buys, 6 Holds, and 2 Sells. The average analyst price target of $138.38 implies downside potential of about 2.6% to current levels. That’s after shares already surged 79.5% over the past year.

Furthermore, AAPL scores a perfect 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Microsoft’s Cloud Services Fuel 2Q Sales Beat; Shares Rise

Starbucks’ Profit Outlook Disappoints; Shares Fall

Texas Instruments’ 4Q Sales Top Estimates; Street Says Hold