Technology giant Apple (NASDAQ:AAPL) has added a new chapter in its dispute with Epic Games, the creator of Fortnite. In a social media post of X, Epic Games said Apple has terminated its developer account, implying it will not be able to develop the Epic Games Store for iOS. It added that this is a significant breach of the European Union’s Digital Markets Act (DMA).

The two companies have been in a legal battle since 2020 when Epic Games alleged that Apple’s practice of charging up to 30% commissions on in-app payments on its iOS devices violated U.S. antitrust rules. In January, the U.S. Supreme Court refused to hear the antitrust dispute between Apple and Epic Games, which is seen as a win for Apple.

Speaking to CNBC, Apple’s spokesperson said that the company has the authority to close the account. The company’s representative added that Epic’s history of non-compliance and ongoing legal disputes have led Apple to reject Epic’s application for a developer account.

Apple is Complying with the DMA

It’s worth noting that Apple received criticism for its App Store policies, leading to the implementation of reforms. The company announced substantial alterations to its iOS, Safari, and App Store services in the European Union to adhere to the DMA.

Further, Apple announced its decision to allow developers in the U.S. to integrate alternative payment methods, subject to a fee of 27% for most digital transactions or 12% for subscription-based services.

Is Apple a Buy, Hold, or Sell?

Apple stock is down about 12% year-to-date as the company faces challenges in China. Due to heightened competition from local players, including Huawei, iPhone sales declined in the region.

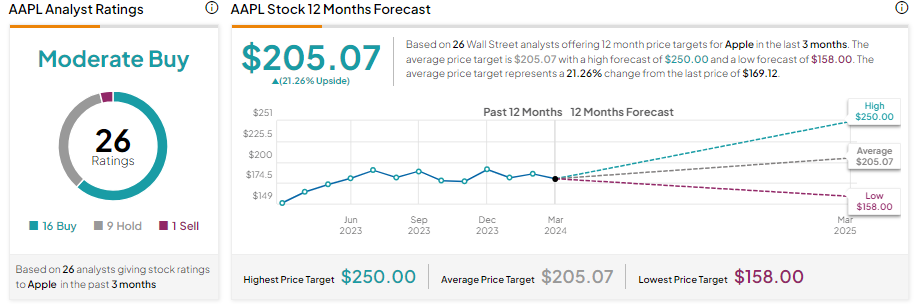

As Apple faces challenges with its hardware sales, analysts maintain a cautiously optimistic outlook. AAPL stock has 16 Buys, nine Holds, and one Sell recommendation for a Moderate Buy consensus rating. Analysts’ average price target of $205.07 implies 21.26% upside potential from current levels.