Apple (NASDAQ:AAPL) has agreed to settle a lawsuit that accused the tech giant of knowingly allowing scammers to use its gift cards to steal money. According to a report from Reuters, Apple is in the process of finalizing settlement terms with the plaintiffs.

It’s worth noting that scammers were tricking people into buying Apple gift cards for fake emergencies, and victims were sharing the card codes. The complaint stated that Apple would deposit 70% of the stolen funds into the scammers’ bank accounts and keep 30% as a “commission.” The victims lost significant money in this scam.

Apple’s decision to settle is a smart move, considering that a persistent legal battle could prove expensive for the company. In a similar strategy, Apple agreed to pay $25 million to end a lawsuit related to its Family-Sharing feature, MacRumors reported. The case was filed in 2019 and alleged that Apple misrepresented the functionality of the Family Sharing feature.

As Apple faces significant legal and regulatory risks, let’s closely examine its risk profile.

Apple’s Risk Analysis

Apple has a history of dealing with various claims, legal disputes, and government investigations. The company sometimes enters into agreements or arrangements to resolve legal disputes. However, there is no assurance that advantageous terms can always be negotiated or that litigation can be completely averted.

As it is subject to several litigations, TipRanks’ Risk Analysis tool shows that Apple’s legal and regulatory risk exposure is higher than the industry average. Notably, legal and regulatory risks account for 21.4% of its total risks, higher than the industry average of 20.3%.

Is Apple a Buy or Sell?

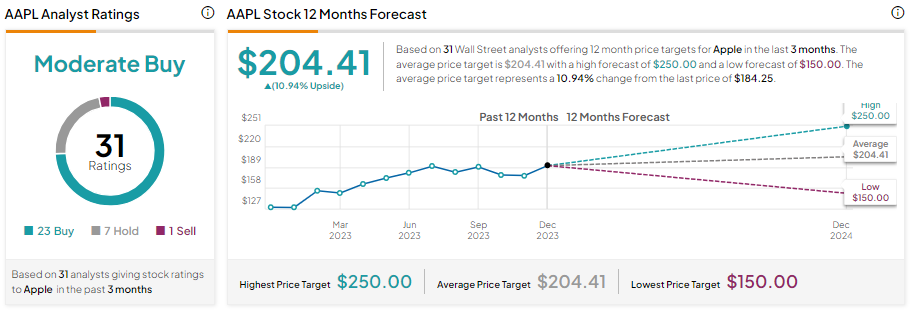

Wall Street is cautiously optimistic about Apple stock amid softness in hardware sales. With 23 Buys, seven Holds, and one Sell recommendation, Apple stock has a Moderate Buy consensus rating. AAPL stock has gained nearly 40% in one year. Further, analysts’ average AAPL price target of $204.41 implies 10.94% upside potential from current levels.