Shares of tech giant Apple (NASDAQ:AAPL) slipped in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at $2.18, which beat analysts’ consensus estimate of $2.10 per share. Sales increased by 2.1% year-over-year, with revenue hitting $119.6 billion. This beat analysts’ expectations by $1.34B.

The iPhone generated $69.7B in sales, while iPad and Services revenues contributed $7.02B and $23.12B, respectively. Additionally, the Wearable, Home, and Accessories segment recorded revenues of $11.95B, while Mac sales hit $7.78B.

Is AAPL Stock a Buy?

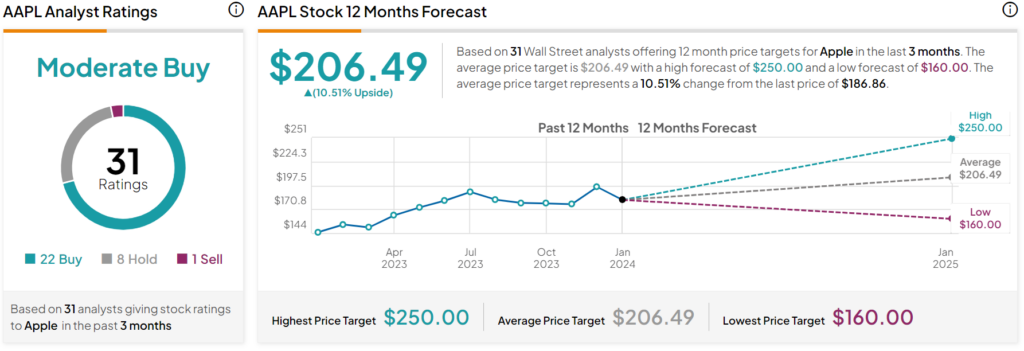

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 22 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 24% rally in its share price over the past year, the average AAPL price target of $206.49 per share implies 10.5% upside potential.