Tech giant Apple (NASDAQ:AAPL) stated that it was going to make some major changes in its iOS, Safari, and App Store offerings in the European Union to comply with the Digital Markets Act (DMA) that will come into effect on March 7.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The EU’s Digital Markets Act identifies AAPL as a gatekeeper, that is, a large platform offering core services, such as online search engines, app stores, and messenger services. The DMA stipulates that such gatekeepers must adhere to obligations and prohibitions outlined in the act.

In a first for Apple, the company will allow third-party app stores on the iOS, ending its monopoly as a sole distributor of apps on the iPhone. Moreover, the company will offer customers alternate payment systems and enable them to switch to the default browser more easily. Users will also be able to change the default marketplace for apps.

From March, these changes will be functional on AAPL’s iOS 17.4 for users in 27 EU countries.

Apple’s changes will also hit its commission of 30%, which the company charges developers for distributing their apps on its App Store. Developers in the EU will now pay a commission of 17% on apps distributed through the App Store, with the commission falling to 10% for certain apps after the first year. The company will charge an additional 3% fee for developers opting to use its core payment system.

In addition, AAPL announced a Core Technology Fee for apps with over a million yearly downloads. Moreover, as a part of these changes, the company will open its Near Field Communication (NFC) system, which will allow developers to use NFC technology in their banking and wallet apps. NFC technology enables data sharing between Android devices or devices with NFC tags.

Despite these sweeping changes, the company cautioned that the new iOS payment and app download options could raise the risks of malware, fraud, scams, and privacy threats for users.

Meanwhile, EU industry head Thierry Breton told Reuters that if the solutions offered aren’t good enough, regulators won’t hesitate to take decisive action.

What is the Forecast for Apple Stock?

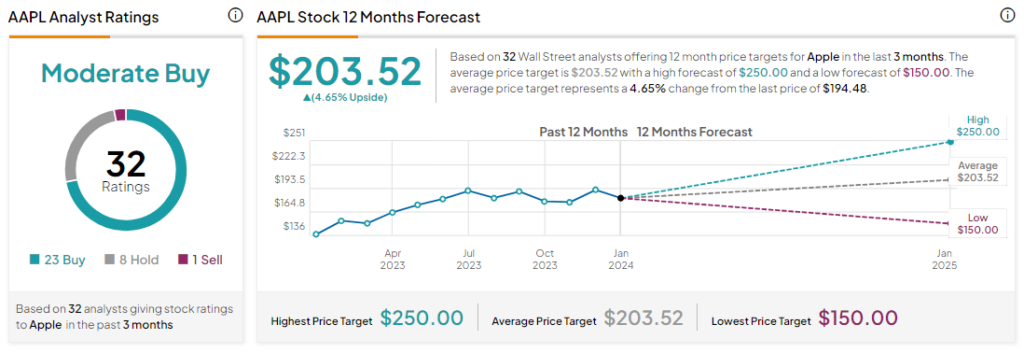

Analysts remain cautiously optimistic about AAPL stock with a Moderate Buy consensus rating based on 23 Buys, eight Holds, and one Sell. Over the past year, AAPL has surged by more than 30%, and the average AAPL price target of $203.52 implies an upside potential of 4.6% at current levels.