In a challenging turn of events, Apple’s (AAPL) iPhone shipments in China fell by 3.1% during the recent quarter, according to the International Data Corporation (IDC), a leading global market research firm. This drop contrasts sharply with an 11% rise in shipments for Android-powered phones, resulting in Apple losing market share and falling out of the top five handset makers in China for the first time in four years.

The IDC reports that increased shipments from local Chinese smartphone brands, such as Huawei, Vivo, and Xiaomi Corp., have moved Apple to sixth place in the Chinese market. Notably, Huawei experienced a significant boost, with its shipments growing by 50% during the June quarter.

Reasons Behind Apple’s iPhone Sales Decline

Despite initial signs of recovery, iPhone sales in China have struggled due to a combination of macroeconomic challenges and fierce competition from local brands. The country’s sluggish economy has dampened consumer spending, making high-end purchases like the iPhone less appealing.

Earlier in the year, iPhone shipments had started to rebound, driven partly by aggressive price cuts from Apple and its Chinese resellers. These discounts, which extended into the Chinese shopping festival on June 18, aimed to attract buyers in a tough economic climate.

However, IDC explains that these efforts were insufficient to counteract the broader economic slowdown and the growing dominance of local competitors. The drop in shipments during the June quarter is also attributed to profitability concerns among Apple’s local partners, who became more cautious about spending on marketing and promotions, affecting overall sales.

What’s Next for Apple

Despite these setbacks, Apple is planning a comeback with its new iPhone 16 series. The company aims to ship 90 million units in the second half of the year and hopes for a 10% increase in shipments compared to earlier models. IDC analyst Nabila Popal remarked, “The company is in much better position today in China than it was back in 2020.” Apple will release its full earnings report on August 1, which will provide more details on its performance.

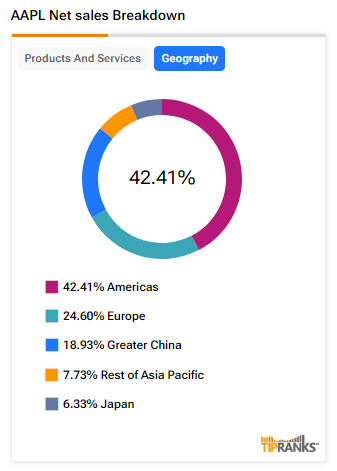

In addition, the company derives a significant portion of its revenue from iPhones, with $51.33 billion in iPhone sales during the March quarter, accounting for over 50% of its total revenues of $94.84 billion.

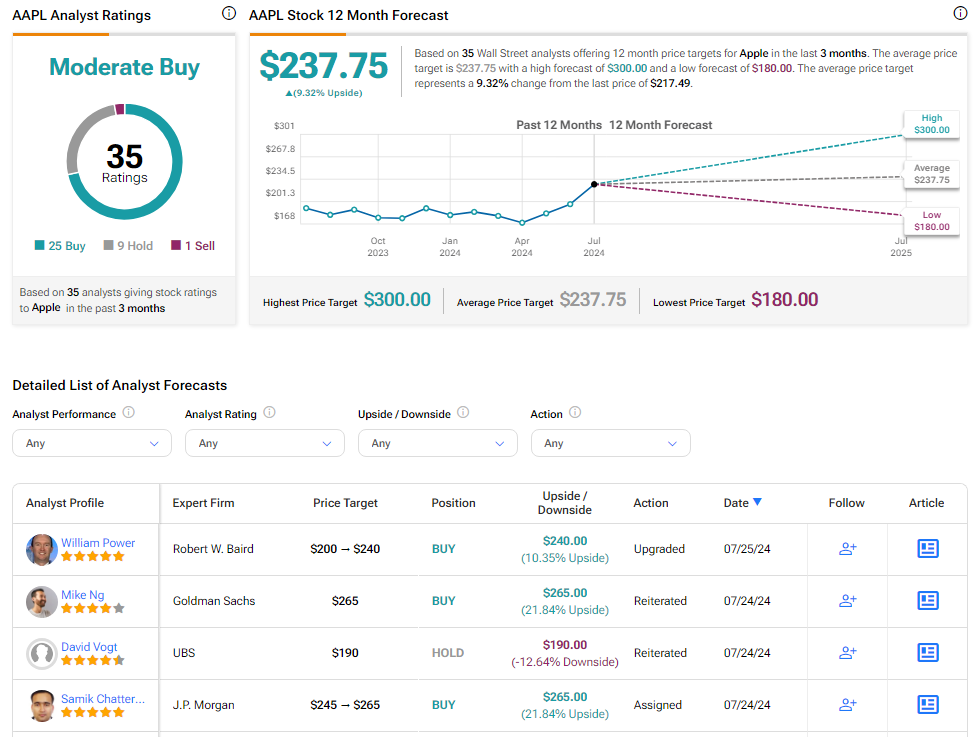

Is Apple a Buy, Sell, or Hold Stock?

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 25 Buys, nine Holds, and one Sell. Over the past year, AAPL has increased by more than 10%, and the average AAPL price target of $237.75 implies an upside potential of 9.32% from current levels.