Shares of Apple (AAPL) slipped in pre-market trading on Tuesday after early pre-order data from Bank of America suggested that global shipping times for the iPhone 16 were shorter than last year’s iPhone 15 Pro, indicating weaker-than-expected demand for iPhone 16 Pro. This data came in three days after the tech giant started taking orders for the iPhone 16.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

According to the BofA data cited by Reuters, average shipping time for the iPhone 16 Pro currently stood at 14 days, down from 24 days for the iPhone 15 Pro last year, while the iPhone 16 Pro Max has a 19-day wait compared to 32 days previously.

Does AAPL’s iPhone 16 Face Weaker-Than-Expected Demand

Many Wall Street analysts believe that many potential customers could be undecided about upgrading to the new iPhone 16 Pro due to the delay in the availability of Apple Intelligence on its new iPhone. The beta version of Apple’s AI software, Apple Intelligence, is expected to be launched next month in the U.S., but global releases may be delayed until next year.

As a result, an analyst at research house Jefferies commented to Reuters, “The U.S. is much weaker than last year, unless Apple massively increased supply allocation.” However, other Wall Street analysts believe improved supply may have led to shorter shipping times.

In fact, D.A. Davidson analyst Gil Luria was not worried if the pre-orders for the iPhone 16 did not show “meaningful growth.” Moreover, the analyst noted that the AI features will roll out gradually and expects that the AAPL upgrade cycle will likely develop over the next 12-18 months. Gil Luria has given AAPL a Buy rating with a price target of $260, implying an upside potential of 20.2% from current levels.

Is Apple a Buy or Sell Now?

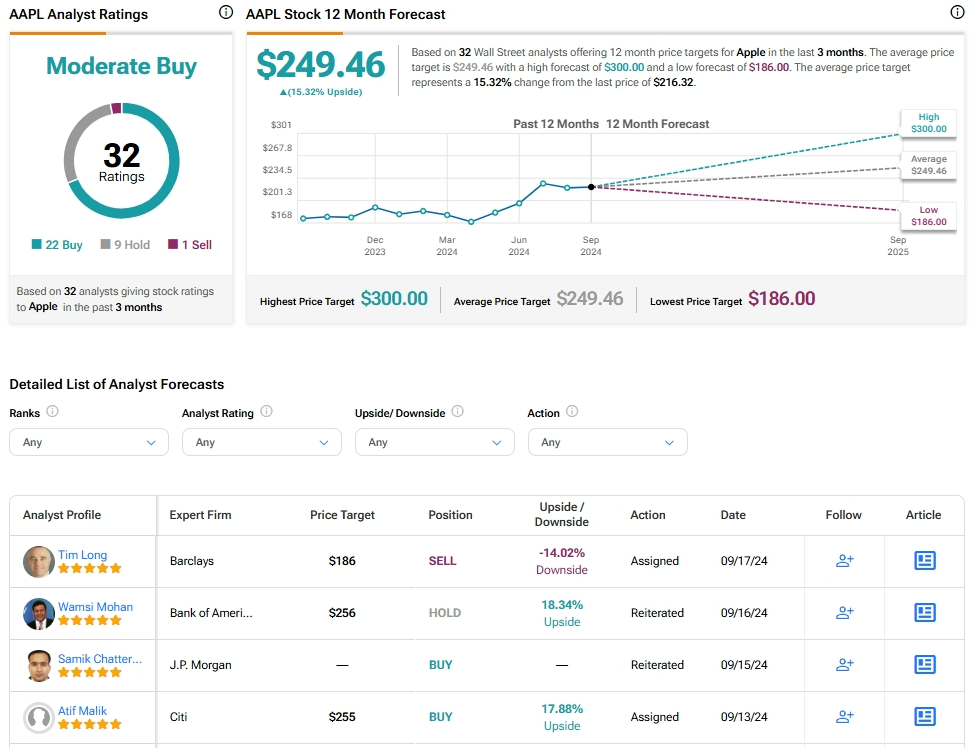

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 22 Buys, nine Holds, and one Sell. Over the past year, AAPL has increased by more than 20%, and the average AAPL price target of $249.46 implies an upside potential of 15.3% from current levels.