Apple (NASDAQ:AAPL) is making a significant reduction in the production quantity of its upcoming mixed-reality Vision Pro headset that will be made available next year. As per the Financial Times report, the intricate design of the device is the key reason behind the tech giant’s decision to lower its production target.

In addition, AAPL has dropped its plans to develop a more affordable version of the device. The current price of the headset is $3,499 per unit.

Production Scales Back

The company has asked its Chinese suppliers to provide parts for approximately 130,000 to 150,000 units in the first year of production. This figure represents a significant reduction from Apple’s initial internal sales target of one million units within the first 12 months.

The challenge in the manufacturing process lies in the production of sleek screens for the device. The model features two micro-OLED displays and an outward-facing curved lens.

These headsets are expected to come equipped with their own operating system, called visionOS, accompanied by a dedicated App Store. Initially, the headset will be launched in the United States next year, with plans to gradually expand its availability to other regions in the future.

AAPL’s Valuation Crosses $3 Trillion

The company’s stock has gained about 56% year-to-date. AAPL’s market capitalization crossed over $3 trillion on Friday. The company’s efforts to enhance its generative AI capabilities, new product launches, and strong earnings report supported the impressive rally. However, the news regarding the reduction in production plans for the headset could potentially affect investor optimism surrounding the company.

After the company hit this milestone, analyst Angelo Zino from CFRA raised the price target on AAPL stock to $220 from $190, while maintaining a Buy rating. Zino believes that in the next five to seven years, Apple will be well-poised to benefit from opportunities in “foldable devices, supporting higher average selling prices, greater Services revenue, and mixed reality.”

Further, the analyst believes that the company’s aim to expand its presence in health care and autonomous cars will further drive growth.

What is the Forecast for Apple Stock?

Overall, Wall Street is optimistic about the stock. The Strong Buy consensus rating for Apple is backed by 24 Buys and seven Holds. At $192.93, the average AAPL stock price target currently implies 0.54% downside potential. It is worth mentioning that many analysts have yet to update their price targets following the recent change in the stock’s valuation.

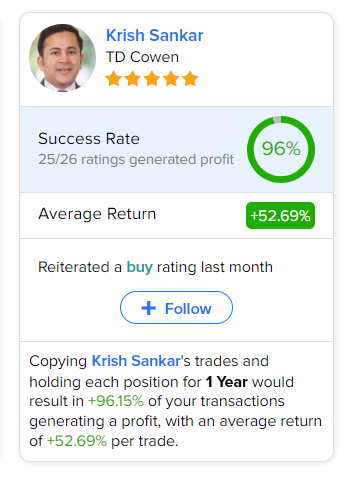

Investors looking for the most accurate and profitable analyst for AAPL could follow TD Cowen analyst Krish Sankar. Copying the analyst’s trades on this stock and holding each position for one year could result in 96% of your transactions generating a profit, with an average return of 52.69% per trade.