Shares of Apple (NASDAQ:AAPL) dipped at the time of writing as investors worry about China’s restrictions on iPhones. However, analyst Dan Ives from Wedbush Securities thinks the market is overreacting. He mentioned that, even in the worst case, this would only affect a small fraction of the iPhones expected to be sold in China in the coming year. Ives is quite positive about Apple’s future, especially with the new iPhone 15 coming soon. He believes the new features and technology in the upcoming model justify a slight price increase for the more advanced versions.

At the same time, Citi analysts pointed out that this news also affected the stocks of companies that supply parts to Apple. They think that the market’s reaction might be too extreme, similar to what happened with Tesla’s suppliers last year after certain negative reports. Apple has been doing quite well in China, holding a strong position in the smartphone market, partly because its main competitor, Huawei, is facing challenges due to restrictions imposed by the U.S. government.

Nevertheless, some analysts feel that the recent restrictions in China could slow down Apple’s growth there, adding to the difficulties the company has been facing in the Chinese market. This situation also highlights the increasing trend of both the U.S. and China preferring to use tech products made within their own countries due to growing security concerns.

What is the Apple Stock Price Forecast?

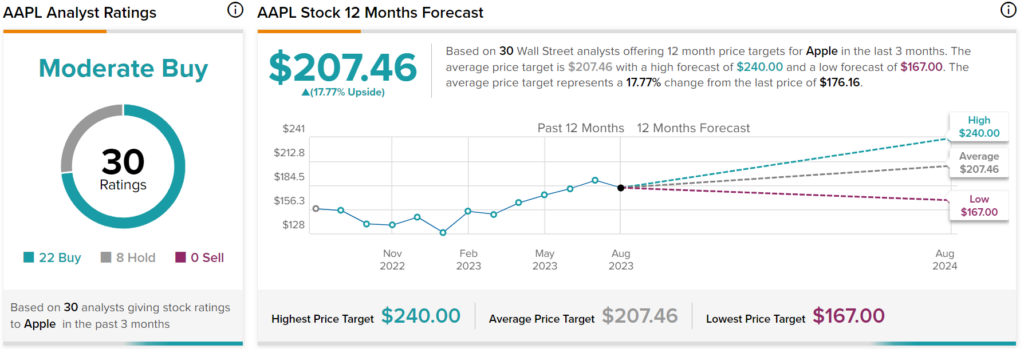

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 22 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $207.46 per share implies 17.77% upside potential.