Taking a page out of Tesla’s (NASDAQ:TSLA) playbook, Apple (NASDAQ:AAPL) cut the prices of its iPhone models to spur demand in China. According to a Reuters report, Apple launched an aggressive discounting campaign, providing discounts of up to $318 on certain iPhone models, aiming to safeguard its market share against local rivals, particularly Huawei.

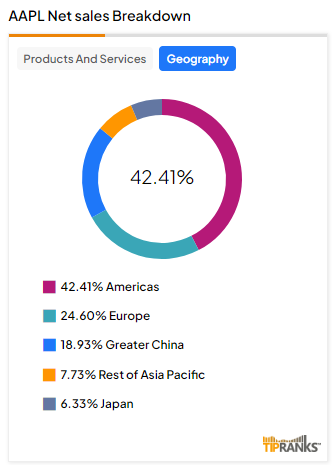

It’s worth noting that Apple’s sales in China are under pressure due to the heightened competitive activity. Apple’s Greater China net sales decreased during the second quarter and the first six months of Fiscal 2024, reflecting lower net sales of iPhone and iPad. China accounts for nearly 19% of Apple’s total sales.

Overall, iPhone sales fell over 10% in Q2 worldwide due to the lower net sales of Pro models.

iPhone Sales Under Pressure

During the Q2 conference call, Apple CEO Tim Cook said that sales in China had witnessed a sequential improvement, with the iPhone being the primary catalyst. Moreover, Cook emphasized that iPhones are the top-selling brand in urban China.

However, Apple’s recent decision to reduce prices indicates that iPhone sales face challenges in the region. Additionally, iPhone sales could continue to remain under pressure in Q3. KeyBanc analyst Brandon Nispel reiterated a Hold recommendation on AAPL stock on May 14, citing continued weakness in iPhone demand. Nispel’s survey suggests that iPhone 15 sell-through in April was either meeting or slightly below store expectations and typical seasonal trends, with some areas experiencing decreased demand.

Whether the company’s move to cut prices will spur demand remains to be seen. Meanwhile, let’s look at the Street’s forecast for AAPL stock.

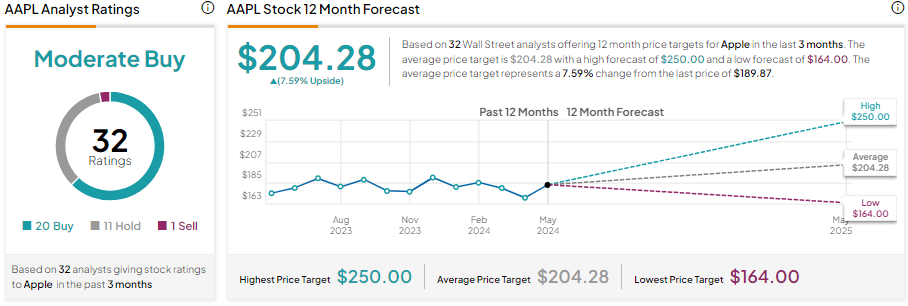

Is Apple a Buy, Hold, or Sell?

Apple stock is down about 1.1% year-to-date, reflecting weakness in product demand and competitive headwinds in China.

Apple stock has a Moderate Buy consensus rating based on 20 Buys, 11 Holds, and one Sell recommendation. The analysts’ average price target for AAPL stock is $204.28, implying a 7.59% upside potential from current levels.