Shares of tech giant Apple have advanced 34% year-to-date, outperforming the nearly 27% rise in the S&P 500 Index (SPX). In fact, AAPL stock hit an all-time high of $255.81 on December 24. Despite concerns over sluggish sales of Apple’s key product, iPhone, and the impact of competition in key markets like China, several analysts remain about the road ahead as they expect artificial intelligence (AI) enhancements to boost the company’s top line.

Apple stock has risen more than 12% over the past month. The stock boasts of a market capitalization of $3.9 trillion and is expected to touch the $4 trillion mark in 2025, thanks to investors’ enthusiasm about the company’s much-awaited AI enhancements that are expected to revive iPhone sales.

Analysts Are Optimistic About Apple’s Prospects

Recently, Morgan Stanley analyst Erik Woodring reiterated a Buy rating on AAPL stock with a price target of $273. Woodring expects near-term demand to be mixed for Apple, with Services growth outperforming his expectations, but iPhone and Product growth projected to be comparatively muted, as the AI-powered Apple Intelligence is not yet widely available in international markets.

Consequently, Woodring expects FY25 to be a “bit of a calm before the storm,” with fundamentals expected to accelerate in FY26. The analyst gave several reasons to support his bullish stance, including his optimism about Apple Intelligence accelerating the iPhone replacement cycle in FY26, continued double-digit growth in Services revenue, and the possibility of the continued rise in iPhone gross margin.

Likewise, JPMorgan analyst Samik Chatterjee reiterated a Buy rating on Apple stock with a price target of $265. The analyst explained why he remains optimistic about the iPhone maker, with or without a volume upcycle driven by AI features. He contends that even without a major adoption of AI features, iPhone shipments might not experience a significant decline, since the replacement rate as a percentage of the installed base has hit an all-time low. This limits the downside to iPhone volumes.

Moreover, Chatterjee expects the potential for an upside in iPhone volumes if consumer spending in China improves. He added that even without an AI-driven volume cycle, Apple’s gross margin could rise due to its higher-margin Services business and continued expansion in Product gross margin due to favorable product mix trends, supply chain management, and increased vertical integration.

Is AAPL Stock a Buy, Sell, or Hold?

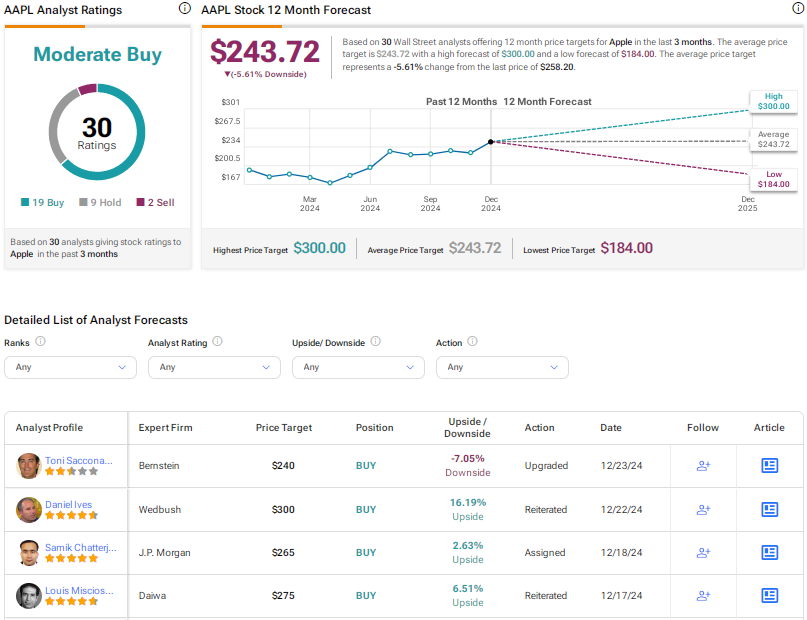

With 19 Buys, nine Holds, and two Sells, Apple scores a Moderate Buy consensus rating on TipRanks. The average AAPL stock price target of $243.72 implies a downside risk of 5.6% following the solid year-to-date rally.

Conclusion

Apple stock has rallied strongly over the past month but Wall Street’s average price target indicates that the elevated valuation could present a downside risk in the stock. Nonetheless, several analysts remain upbeat about the company’s prospects, supported by optimism about its AI features and the robust Services business.