Apple Inc. has asked suppliers to build at least 75 million 5G iPhones for later this year, indicating that demand for the company’s most important product is holding up in the midst of the global pandemic and economic downturn, according to a Bloomberg report.

Shares are advancing 2.6% in Tuesday’s pre-market trading. Apple (AAPL) expects shipments of these next-generation iPhones may reach as high as 80 million units in 2020, according to the report. The California-based technology giant plans to launch four new models in October with fifth-generation wireless speeds, a different design and a wider choice of screen sizes. Apple suppliers include Taiwan Semiconductor Manufacturing Co. and LG Display.

Among a comprehensive product refresh in the fall, Apple is also preparing a new iPad Air with an edge-to-edge iPad Pro-like screen, two new Apple Watch versions and its first over-ear headphones outside the Beats brand. A smaller HomePod speaker is in the works, too.

Apple plans to ship the lower-end phones sooner than the Pro devices, according to the report. Apple said recently that the new iPhones would ship a “few weeks” later than last year’s models, which started shipping Sept. 20. This year’s rollout is on course to be the latest since the release of the iPhone X in November 2017.

The new Apple Watch lineup will include a successor to the Apple Watch Series 5 and a replacement for the Series 3 that will compete with lower-cost fitness devices such as those from Fitbit, according to the report.

While other tech companies’ operations and supply chains have been disrupted by the Covid-19 outbreak, Apple is experiencing strong demand for iPhones, iPads and Mac computers as consumers continue to work and study remotely. iPhones still generate almost half of Apple’s sales.

Apple shares have jumped 75% this year, making it the first US company to surpass $2 trillion in market value, as the pandemic has created opportunities for companies like Apple who are weathering the crisis relatively well and are looking to increase their reach and boost market share. (See Apple stock analysis on TipRanks)

Wedbush analyst Daniel Ives on Monday adjusted the stock’s price target to $150 and bull case to $175 after Apple’s 4:1 stock split took effect.

“With Apple’s stock split it speaks to Cook & Co. in a major position of strength with clear tailwinds heading into its iPhone 12 supercycle kicking off in early October,” Ives wrote in a note to investors. “With 350 million of 950 million iPhones worldwide in a window of an upgrade opportunity based on our analysis, we view this as a “once in a decade” golden opportunity for Cupertino looking ahead which speaks to the Street bullishness over the past few months.”

The analyst kept a Buy rating on the stock marking it as his favorite 5G play over the coming year.

“A key part of the re-rating in the stock (despite the skeptics) remains the services business which we assign a valuation of between $900 billion to $950 billion and has been the Rock of Gibraltar for Apple during this stormy COVID backdrop,” he added.

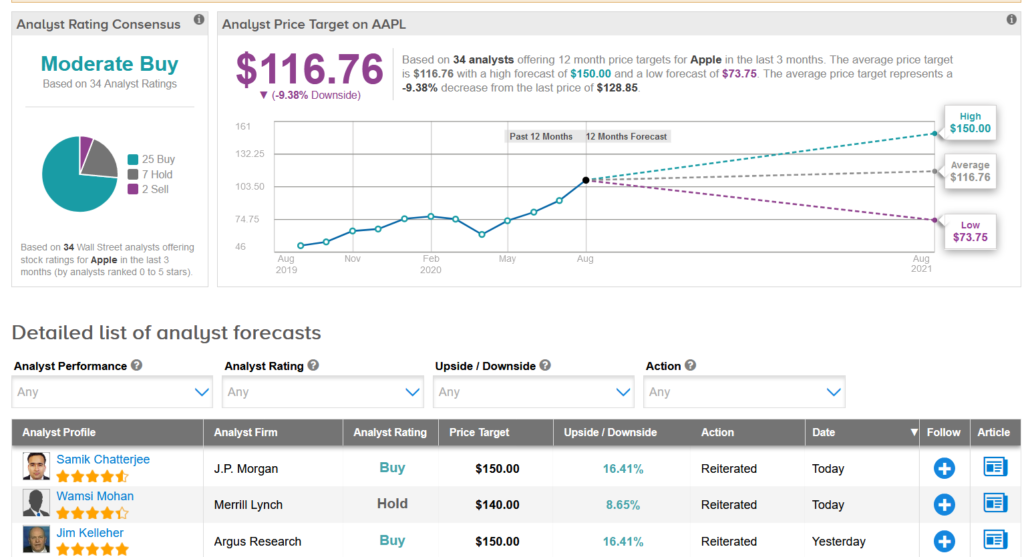

Overall, the rest of the Street is cautiously optimistic on the stock with a Moderate Buy analyst consensus. In light of this year’s sharp rally, the $116.76 average price target implies 9.4% downside potential to current levels.

Related News:

Zoom Video Pops 23% On Blowout Quarter With Sales Soaring 355%

Facebook Will Scrap News Sharing In Australia If New Law Passed