Apple (AAPL) and Nvidia (NVDA) have partnered to enable faster LLM (large language models) token generation that ultimately leads to faster and more efficient AI text generation. The efficiency would be achieved by integrating Apple’s Recurrent Drafter (ReDrafter) technique into NVIDIA’s TensorRT-LLM framework.

Here’s How the Two Techniques Work Together

Apple introduced ReDrafter earlier this year as a means of generating text with LLMs. Research showed that the ReDrafter technique could accelerate LLM inference by up to 3.5x tokens per generation step for open-source models. Apple’s technology involves combining beam search with dynamic tree attention to study different text options and make efficient choices.

Meanwhile, Nvidia’s TensorRT-LLM framework has been optimized by adding new functionalities to adapt the ReDrafter technique. The combination leads to notable speed increases in generating tokens. For instance, the ReDrafter achieved a 2.7 times boost in generating tokens per second.

The new integrated tool will benefit developers using Nvidia GPUs to achieve faster token generation, reduce latency, and lower computational costs. Developers would be able to create more sophisticated models with lower costs and easily deploy them using Nvidia’s TensorRT-LLM. The collaboration of the two tech giants showcases how the industry is coming together to enhance AI-driven possibilities and innovations.

Is AAPL Stock a Good Buy?

Wall Street remains divided on Apple stock, given the slowing demand for its iPhones. On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 20 Buys, nine Holds, and two Sell ratings. Also, the average Apple price target of $243.72 implies 1.8% downside potential from current levels. Year-to-date, AAPL shares have gained 29.5%.

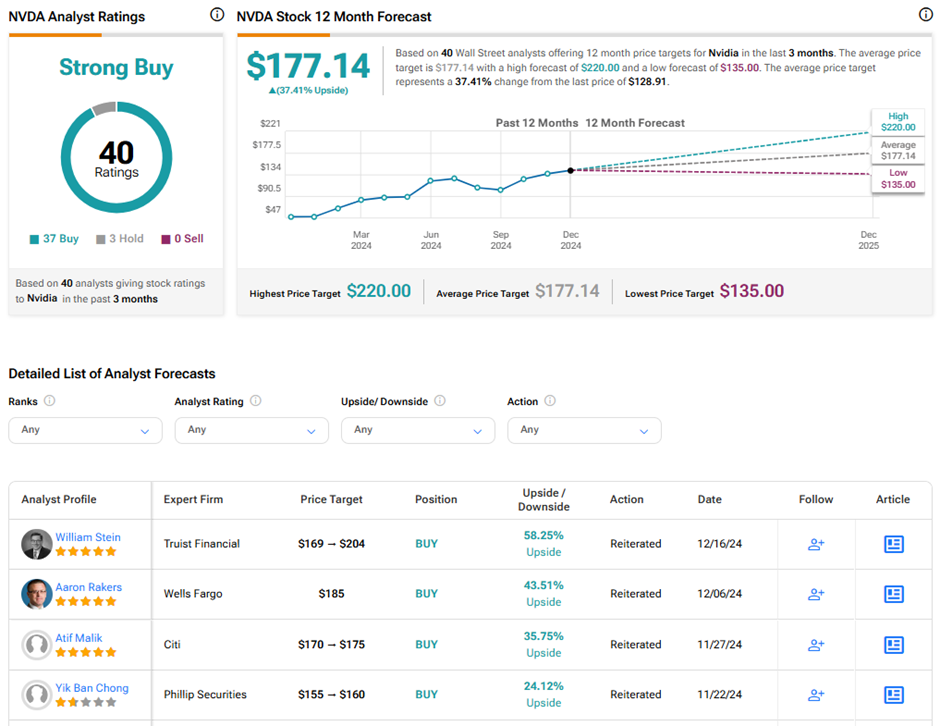

Is NVDA a Good Stock to Buy?

Nvidia, indeed, remains one of Wall Street’s most favored stocks. On TipRanks, NVDA stock commands a Strong Buy consensus rating based on 37 Buys and three Hold ratings. The average Nvidia price target of $177.14 implies 37.4% upside potential from current levels. Year-to-date, NVDA shares have rallied over 160%.