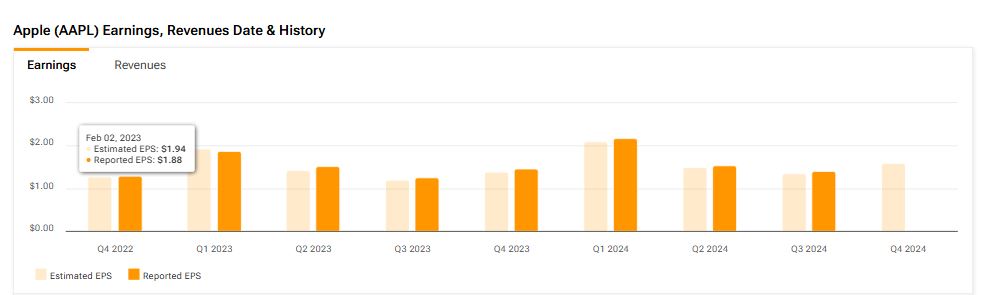

iPhone maker Apple (AAPL) will release its fiscal Q4 financials on October 31. Wall Street analysts expect the company to report earnings per share of $1.60, a 10% year-over-year increase. Also, revenue is expected to reach $94.51 billion, representing a 6% year-over-year increase, according to data from the TipRanks Forecast page.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Interestingly, AAPL has an encouraging earnings surprise history. The company missed earnings estimates just once out of the previous eight quarters.

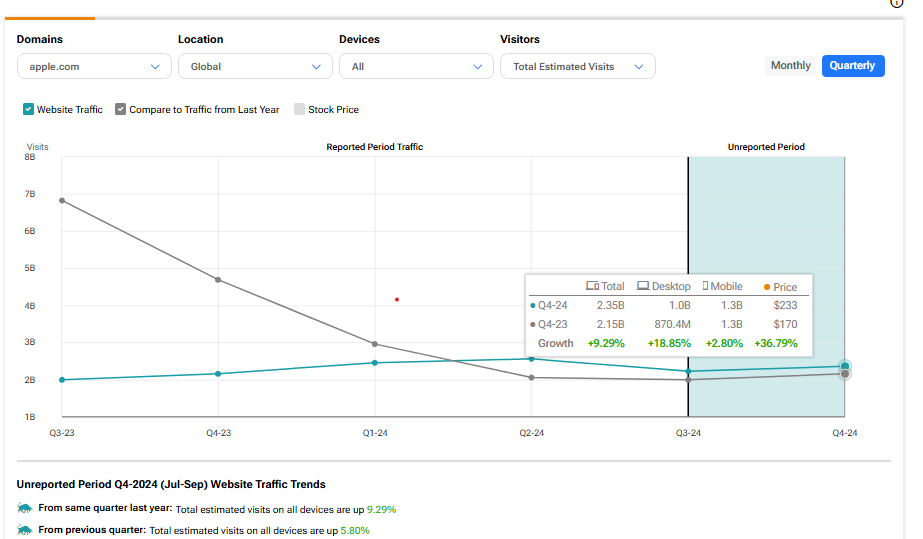

Encouraging Website Traffic Trend

Along with encouraging analysts’ estimates, Apple’s website traffic data also suggests strong results for the company in the upcoming Q4 quarter. It should be noted that investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

For AAPL, TipRanks’ website traffic screener reveals that the traffic increased sequentially as well as year-over-year in Q4. According to the tool, the number of visits to apple.com increased 9.29% from the year-ago quarter and 5.8% sequentially. This rise in visits indicates growing demand for Apple’s products.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool, bulls emphasize Apple’s solid iPhone demand, reflecting strong consumer interest. Service revenue is also expected to grow 14% year-over-year in Q4, bolstered by a diverse service portfolio. Conversely, bears argue that regulatory risks could be challenging, as new App Store and payment policies for European compliance might impact revenue.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 3.63% move in either direction.

What Is the Price Target for Apple?

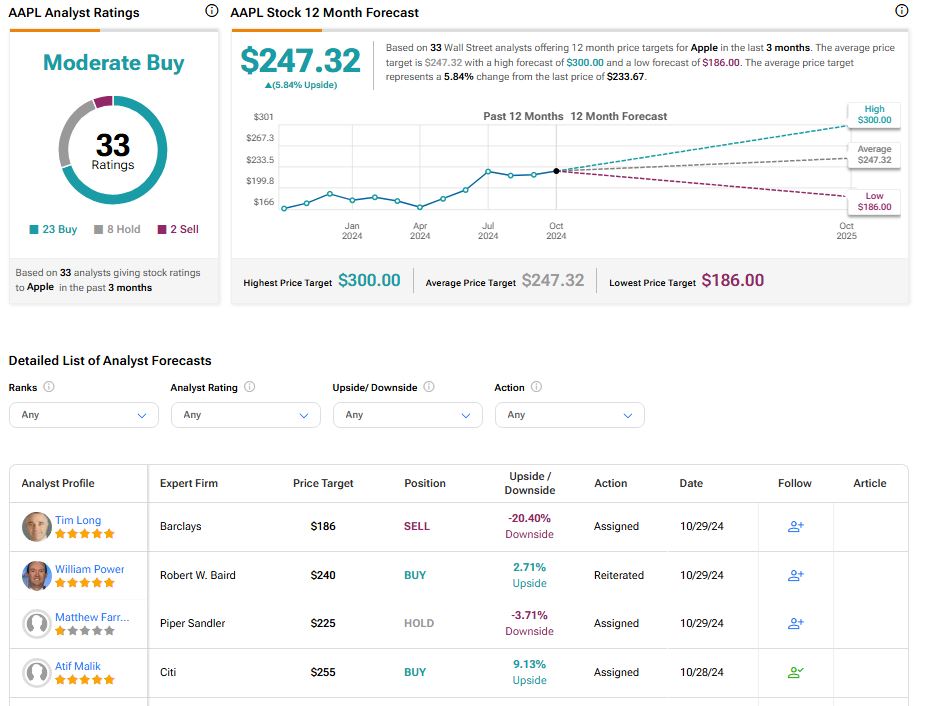

Turning to Wall Street, analysts have a Moderate Buy consensus rating on APPL stock based on 23 Buys, eight Holds, and two Sells assigned in the past three months, as indicated by the graphic below. The average AAPL stock price target is $247.32, implying upside potential of 5.84%.