Apogee Enterprises, Inc. (APOG) reported stronger-than-expected fiscal Q1 results, topping both earnings and revenue estimates. Earnings growth was driven by robust performance across all four segments, aided by the post-pandemic recovery.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Shares of Apogee, which designs and develops glass and metal products and services, gained 12.2% to close at $43.30 on June 25.

The company reported adjusted earnings of $0.42 per share, beating the analysts’ expectations of $0.36 per share. Revenues of $326 million also exceeded the consensus estimate of $288.6 billion.

Meanwhile, earnings per share almost quadrupled from $0.11 reported in the prior-year period, while net sales grew 13% on a year-over-year basis. (See Apogee stock chart on TipRanks)

“During the quarter, we made good progress on our key initiatives. We continued to take steps to improve our cost structure and strengthen operational execution across the business,” said Apogee’s CEO, Ty R. Silberhorn.

He further added, “We launched several foundational projects to enable our enterprise transformation. We also made substantial progress on our enterprise strategy project to better position the company for long-term profitable growth.”

Based on strong Q1 results, the company raised its guidance for fiscal 2022. The company now forecasts adjusted earnings in the range of $2.20 to $2.40 per share, while the consensus estimate is pegged at $2.20 per share. Earlier, the company had guided to full-year adjusted earnings of $2.10 to $2.35 per share.

Following the robust Q1 results, Craig-Hallum analyst Eric Stine increased the price target on APOG from $43 to $48 (10.9% upside potential) and reiterated a Buy rating on the stock.

Consensus among analysts is a Moderate Buy based on 1 Buy and 1 Hold. The average analyst Apogee Enterprises price target of $40.50 implies 6.5% downside potential from current levels. Shares of APOG have jumped 84% over the past year.

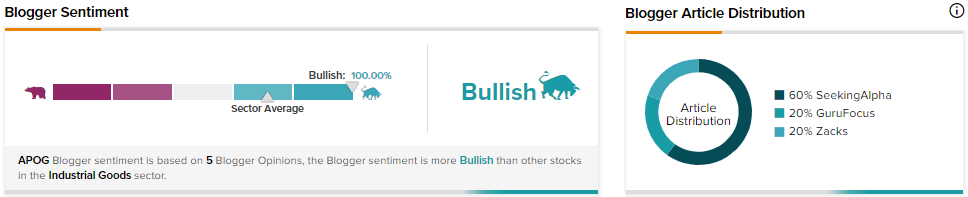

TipRanks data shows that financial blogger opinions are 100% Bullish on APOG, compared to a sector average of 71%.

Related News:

CalAmp Posts Mixed Results; Shares Open 6% Lower

Upland Software Snaps up Panviva; Raises Guidance

Synopsis Announces $175M Share Repurchase Program, Collaboration with Samsung