The anticipated merger between leading insurance brokers Aon Plc (AON) and Willis Towers Watson Plc (WLTW) has been called off due to ongoing litigation with the U.S. Department of Justice (DOJ). Shares of AON shot up 8.2%, closing at $251.56 following the announcement, while Willis Towers Watson slipped almost 9% to close at $206.07 on July 26. (See Aon stock charts on TipRanks)

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The merger was first announced in March 2020, with the deal valued at $30 billion. Aon and WLTW are global advisory firms providing a broad range of risk, retirement, and health solutions.

In June, the DOJ filed a case against the proposed business combination, stating that the merger of two eminent players would stave off competition and lead to higher prices of products and services for the customers.

Aon CEO Greg Case said, “Despite regulatory momentum around the world, including the recent approval of our combination by the European Commission, we reached an impasse with the U.S. Department of Justice.”

The European Commission had approved the merger on certain conditions, including that both companies sell off parts of their businesses to rival companies to increase competition in the sector. Accordingly, Aon announced the sale of its U.S. retirement business and its Retiree Health Exchange business, and WLTW had agreed to sell Willis Re and a set of the company’s corporate risk and broking and health and benefits services.

Both companies undertook several efforts to appease the regulatory bodies, but the prolonged nature of the court hearings compelled them to call off the merger.

Case added, “We are confident that the combination would have accelerated our shared ability to innovate on behalf of clients, but the inability to secure an expedited resolution of the litigation brought us to this point.”

As part of the agreement, Aon will pay a $1 billion termination fee to Willis Towers Watson.

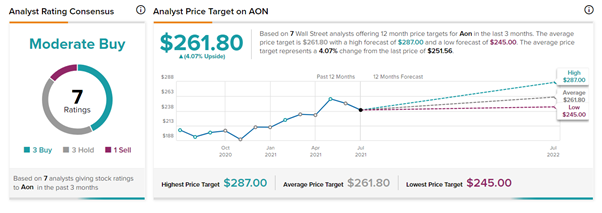

Following the news of the break-up, Wells Fargo analyst Elyse Greenspan reiterated a Buy rating on the AON stock with a price target of $287, implying 14.1% upside potential to current levels.

Greenspan sees Aon’s valuation as unaffected by the break-up and goes on to state that as and when the markets start viewing Aon as an independent player, the valuation gap that persists between its competitors should diminish.

The analyst also states the potential headwinds associated with the stock’s performance including, “tough economic conditions, a slowdown of the P&C rating improvement, foreign exchange risk, pressure on expenses from investments Aon is making, and volatility associated with its pension plan.”

Overall, the stock has a Moderate Buy consensus rating based on 3 Buys, 3 Holds, and 1 Sell. The average Aon price target of $261.80 implies 4.1% upside potential to current levels. Shares have gained 21.5% over the past year.

Related News:

OTIS Hits All-Time High on Strong Q2 Results; Raises Guidance

Facebook’s Kustomer Acquisition Under EU Review – Report

Why Has General Motors Been in the Spotlight Lately?