Price hikes are an increasing inevitability just about anywhere, and streaming is no exception. For entertainment giant Paramount Global’s (PARA) Paramount+ streaming platform, another price hike is poised to hit in Europe.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Another price hike for Paramount+ will occur in the United Kingdom and Ireland starting today (November 20). While there will be two new plans to choose from, there will also be higher rates charged. These changes were first reported earlier in November, when word first came out about an ad-supported tier, which would see Paramount+ follow in the footsteps of other major streaming platforms.

While Paramount+ is regarded as a top-notch service thanks to its breadth of content, there are not a lot of exclusives available, especially as far as movies go. This is especially true in the United Kingdom, where a range of licensing agreement issues keep some content off the platform altogether.

Yellowstone Boost

We have been hearing quite a bit about Yellowstone these days, as it is one of Paramount’s biggest hit shows. But reports say that delayed viewing was a huge help. For the delayed-viewing release of the Season 5 Part 2 premiere, its ratings went up 29%. Regardless, this episode represented the biggest premiere in the history of Paramount+.

Lastly, Shari Redstone reportedly put a lot of Paramount’s debt to bed before leaving the company, although she did it with a lot of Larry Ellison’s cash. Shari Redstone paid off Paramount lenders to the tune of $186 million, and most of that came from the $2.4 billion that Skydance Media and its various partners put up for National Amusements, the company which owns the bulk of Paramount.

Is Paramount Stock a Good Buy?

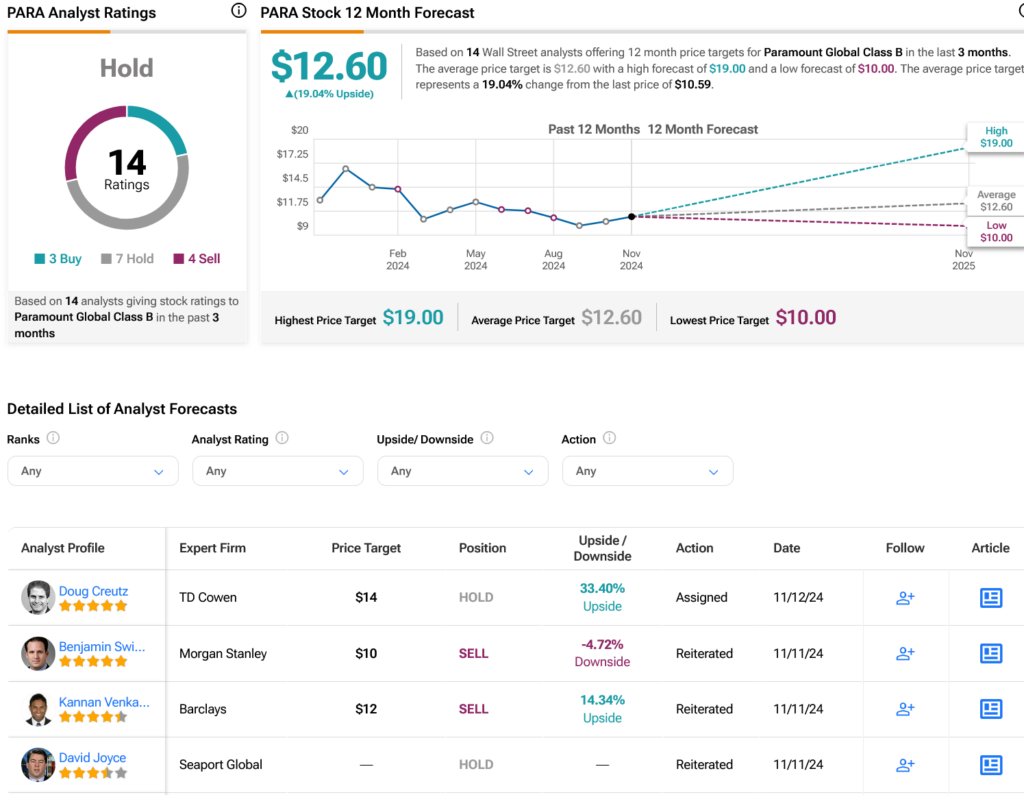

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on three Buys, seven Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 24.06% loss in its share price over the past year, the average PARA price target of $12.60 per share implies 19.04% upside potential.