Annaly Capital Management, Inc. (NLY) has reported better-than-expected third-quarter earnings available for distribution (EAD) per share of $0.28 against the consensus estimate of $0.27 per share.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

While net interest income of the real estate investment trust company declined 19% year-over-year to $362.5 million, net interest margin slipped 1 basis point to 2.04%.

See Insiders’ Hot Stocks on TipRanks >>

For the third quarter, the company reported a book value per common share of $8.39, as compared to $8.70 per share in the same quarter last year. Annualized EAD return on average equity stood at 12.81%, down from 13.79% in the prior-year quarter.

As of September 30, 2021, total assets stood at $94.2 billion, with the Agency portfolio representing 92%. Notably, the Agency portfolio was increased by about $3 billion during the quarter through the redeployment of capital from the sale of the commercial real estate business. (See Annaly Capital stock charts on TipRanks)

Additionally, Annaly Mortgage Servicing Rights (MSR) Portfolio held assets worth $575 million, up 41% sequentially, while Annaly Residential Credit Portfolio reflected assets of $4.3 billion, up 3%. Assets in Middle Market Lending Strategy stood at $2.3 billion.

In response to the third-quarter results, the CEO of Annaly Capital, David Finkelstein, said, “In particular, we maintain a favorable outlook for Annaly’s Residential Credit Group, which priced five securitizations since the beginning of the quarter totaling nearly $2 billion. Further, our Middle Market Lending Group achieved a major corporate milestone by closing its inaugural private fund subsequent to quarter end, which will significantly enhance the platform’s long-term growth potential.”

“Ultimately, we are well-poised to take advantage of opportunities that arise as the Federal Reserve shrinks its footprint in the mortgage market given our prudent portfolio construction, historically low leverage and substantial liquidity,” Finkelstein added.

Wall Street’s Take

On October 6, Piper Sandler analyst Kevin Barker downgraded the stock to Hold from Buy and decreased the price target to $8.50 (.23% downside potential) from $9.

Based on expectations of higher interest rate volatility through year-end and in 2022, Barker considers the company’s risk/reward profile as fairly balanced.

Overall, the stock has a Hold consensus rating based on 3 Holds and 1 Buy. The average Annaly Capital price target of $8.77 implies 3.2% upside potential from current levels. Shares have increased 23.2% over the past year.

Risk Analysis

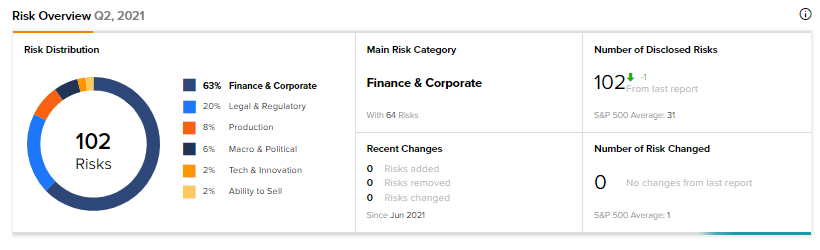

According to the new TipRanks’ Risk Factors tool, the Annaly Capital stock is at risk mainly from two factors: Finance and Corporate, and Legal & Authority, which contribute 63% and 20%, respectively, to the total 102 risks identified for the stock.

Related News:

General Electric Exceeds Q3 Earnings Estimates

Facebook Posts Upbeat Q3 Earnings but Revenues Disappoint

Advanced Micro Devices’ Q3 Results Beat, Q4 Forecasts Top Estimates