Anglo Pacific Group announced its full year results on April 14 for the year ended December 31, 2020. Royalty income for 2020 dropped to £34 million from £55.7 million, affected by lower production from Kestrel, its largest coal investment.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Anglo Pacific (APY) reduced the value of its investment in Kestrel by £44.2 million, which together with impairments of £3.4 million, resulted in a loss after tax for the year of £18.6 million compared to an after tax profit of £29.0 million in 2019.

Anglo Pacific CEO Julian Treger said, “Anglo Pacific is a very different business to what I reported on this time twelve months ago. We have, with the Voisey’s Bay cobalt stream acquisition, fundamentally repositioned our portfolio towards materials vital in providing cleaner energy for the future whilst ensuring that the Group replaces its Kestrel revenue ahead of time. This is immediately evident on our balance sheet where these materials now account for over 60% of our royalty and streaming assets.”

“Although we are delighted with the quality, size and sustainability profile of the Voisey’s Bay acquisition, the job is not done. We are determined to build on the momentum of this transaction to increase our base and battery metals exposure further over the course of 2021 and are working on a number of opportunities,” Treger added.

The outlook for base metals and batteries looks favorable for the coming year. (See Anglo Pacific stock analysis on TipRanks)

Berenberg Bank analyst Richard Hatch reiterated a Buy rating on the stock today with a C$2.55 price target (6.7% upside potential).

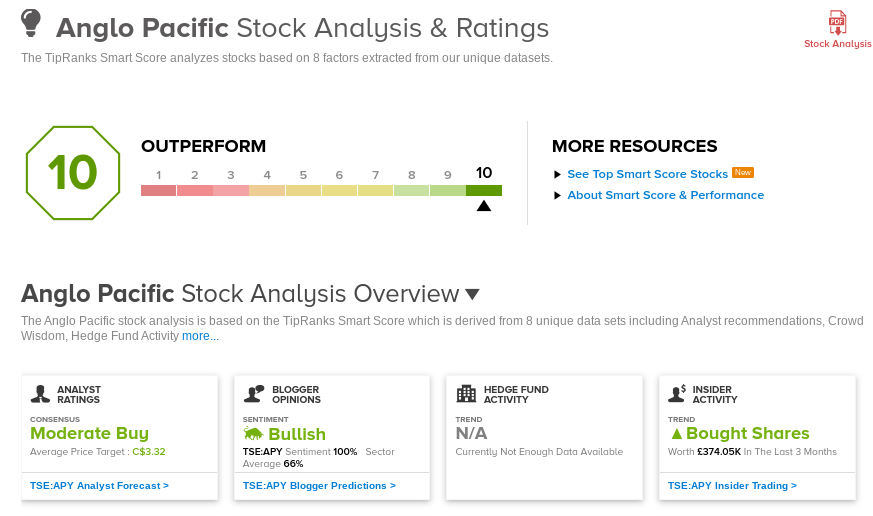

Overall, Anglo Pacific stock scores a Moderate Buy consensus rating by Wall Street analysts based on 2 Buys. The average analyst price target of C$3.32 implies upside potential of about 38.7% to current levels.

Anglo Pacific scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Galiano Gold Reports Preliminary Results for 1Q

Cogeco Communications Reports Higher Revenue And Lower Profit In 2Q

OpSens Posts Record FFR And dPR Sales In 2Q