Abercrombie & Fitch Co. (ANF) plunged in trading on Wednesday despite the lifestyle retailer raising its FY24 sales outlook and delivering better-than-expected comparable sales in the second quarter. The retailer’s comparable sales increased by 18% in the second quarter, surpassing the 15% growth that analysts had projected. The rise in comparable sales was primarily driven by the Hollister chain, which saw a 15% increase in comparable sales.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ANF’s Q2 Earnings Exceed Estimates

Furthermore, the company reported record second-quarter sales of $1.1 billion, up 21% year-over-year. However, this was in line with analysts’ expectations. Additionally, Abercrombie & Fitch reported adjusted earnings of $2.50 per share, compared to $1.08 in the same period last year. This surpassed analysts’ estimates of $2.22 per share.

ANF Stock Dragged Down by High Expectations

Expectations were sky-high for the retailer in the second quarter as ANF stock has skyrocketed by more than 100% over the past year, making it the top performer in the S&P Composite 1500 Apparel Retail Index. This surge follows a nearly 300% jump in 2023.

Furthermore, Abercrombie, once famous for its perfumed stores and shirtless models, has reinvented itself to appeal to Gen Z and millennials with popular denim, a wedding shop, and frequent new releases. Despite tighter budgets, sales have continued to climb, outpacing other discretionary retailers.

ANF Raises its FY24 Outlook

Considering the robust Q2 results, the company raised its FY24 outlook and now expects net sales to grow in the range of 12% to 13% year-over-year, up from its initial guidance of a 10% increase. Additionally, ANF has projected its operating margin to be between 14% and 15%, compared to its initial guidance of 14%.

Looking ahead to the Fiscal third quarter, ANF has forecasted net sales to grow in the low double digits, with the operating margin likely to be in the range of 13% to 14%. This projection indicates a deceleration in margin compared to the 15.5% margin in the second quarter.

What Is the Target Price for ANF Stock?

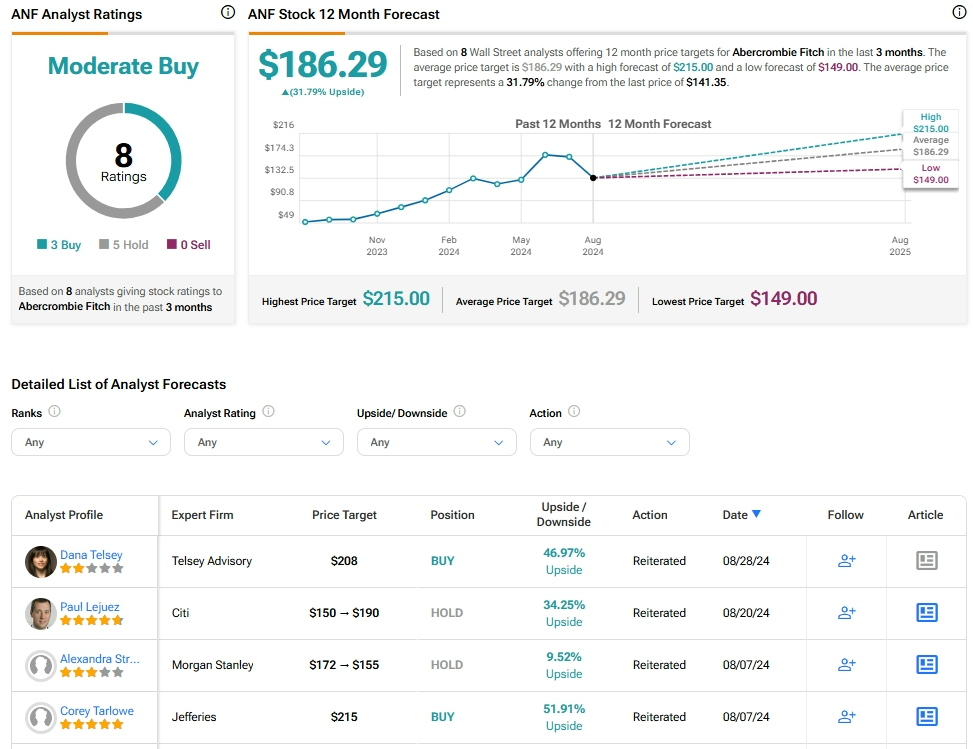

Analysts remain cautiously optimistic about ANF stock, with a Moderate Buy consensus rating based on three Buys and five Holds. The average ANF price target of $186.29 implies an upside potential of 31.8% from current levels. These analyst ratings are likely to change following ANF’s results today.