Analysts remain bullish on shares of NetEase (HK:9999) (NTES) following the China-based gaming company’s mixed Q2 results. Analysts are optimistic about the company’s gaming business, considering the success of both its popular existing titles and a strong pipeline of upcoming games. Overall, NetEase stock has a Strong Buy rating on TipRanks with a huge upside potential of over 50%.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Year-to-date, NetEase stock has declined 14.4%.

NetEase is a tech company focused on online PC and mobile games, smart devices, e-commerce platforms, and a range of digital services.

NetEase Delivers Strong Gaming Results in Q2

NetEase’s second-quarter results highlighted the strong performance of its online games. The company’s gaming division generated revenue of ¥20.1 billion, marking a 6.7% increase from the previous year.

Notably, online games made up 96.1% of the total Q2 2024 revenue compared to 91.7% in the prior-year quarter. Within its gaming portfolio, Naraka: Bladepoint achieved record-high daily active users (DAUs) on its third anniversary. Also, the mobile version of Naraka: Bladepoint quickly climbed to the top 3 position on the iOS grossing charts shortly after its launch in China.

On the flip side, NetEase’s Q2 net income fell 17% year-over-year to ¥6.8 billion, hit by higher operating expenses.

Analysts Confident About NetEase’s Gaming Revenue

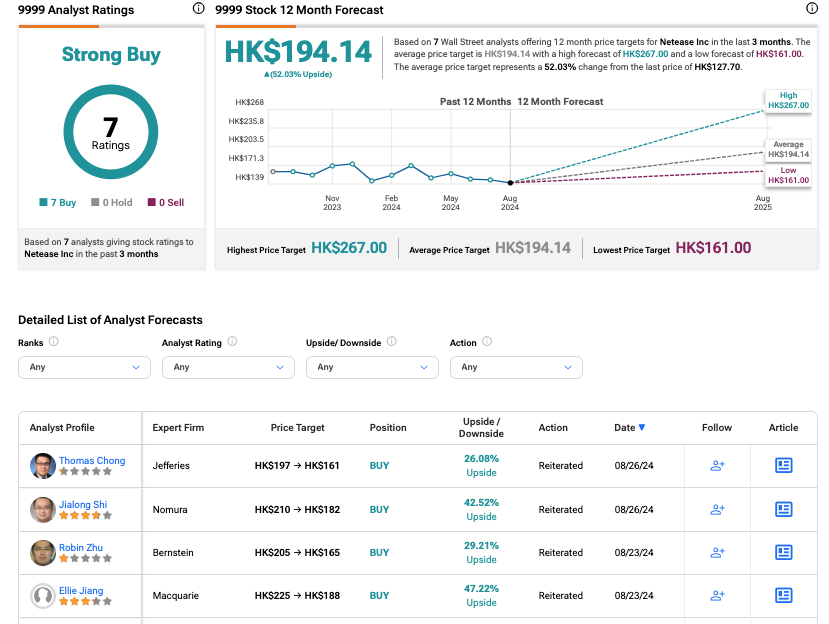

Following the results, NetEase stock received Buy recommendations from four analysts.

Jefferies analyst Thomas Chong predicts an upside of 26% in NetEase stock, even after reducing his price target from HK$197 to HK$167. He expects NetEase’s online gaming revenue to further grow in Q3 compared to the previous quarter. However, the year-over-year comparison might show slower growth due to robust performance last year. On the whole, Jefferies believes that although there are short-term challenges, NetEase’s long-term prospects remain attractive.

Aside from Chong, analysts from Nomura, Bernstein, and Macquarie also maintained Buy ratings on NetEase stock.

Analyst Jialong Shi from Nomura expects the company’s newly launched games, Where Winds Meet on PC and Naraka: Bladepoint, to be major drivers for the gaming business and share price growth.

Is NetEase Stock a Buy?

On TipRanks, 9999 stock has received unanimous Buy ratings from seven analysts. The NetEase share price target is HK$194.14, which implies an upside of 52% from the current level.