Analysts have drawn caution on AI (artificial intelligence) player Super Micro Computer (SMCI) stock after the surprise exit of its auditor, Ernst & Young LLP, yesterday. Ernst & Young (E&Y) stated that it could no longer rely on the financials submitted by the management and Audit Committee and was unwilling to be associated with the firm. Following the news, SMCI stock plunged 32.7% on October 30.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

SMCI’s troubles began soon after short seller Hindenburg called for attention to SMCI’s financial statements. This was followed by the Nasdaq sending a 60-day notice to SMCI for non-compliance with the filing of the annual report (10-K). It was E&Y’s first annual audit since it was hired by SMCI in March 2023.

Two five-star analysts have been quick to share their initial views on the E&Y resignation and the impact on SMCI stock. Here’s a closer look at their views.

Needham Suspends Rating on E&Y Exit

Needham analyst Quinn Bolton withdrew his rating on SMCI stock owing to reputational and financial restatement risks, given E&Y’s exit. Bolton had a Buy rating and a $60 price target on SMCI stock before the resignation of Ernst & Young. Bolton noted that the lead auditor’s exit “raises considerable questions” on the authenticity of SMCI’s current and past financial statements. Bolton warned investors not to depend on their previous financial models for any research.

Also, SMCI’s corporate governance and management integrity are now under scrutiny, further supporting the Justice Department’s investigation into the company. Furthermore, Bolton sees higher chances of a default risk on SMCI’s Term Loan Agreement with Bank of America (BAC). SMCI may have to restate its prior financials under a new auditor, Bolton added.

Mizuho Reiterates Hold Rating on SMCI

Interestingly, Mizuho Securities analyst Vijay Rakesh reiterated a Hold rating and $45 price target (36.1% upside potential) on SMCI, following E&Y’s resignation. Rakesh noted that SMCI now faces increased delisting risks as Nasdaq has already issued a non-compliance warning to the AI hardware maker.

SMCI has until November 16 to present a plan for filing a 10-K report and to secure a new, credible auditor. If SMCI fails to comply with Nasdaq’s requirements, it could mean the delisting of SMCI stock from the stock exchange. On the other hand, if Nasdaq approves SMCI’s revised plan, SMCI would have until around February 25, 2025 (180 days from the 10-K due date) to file its 10-K and return to compliance.

Is SMCI a Good Stock to Buy Right Now?

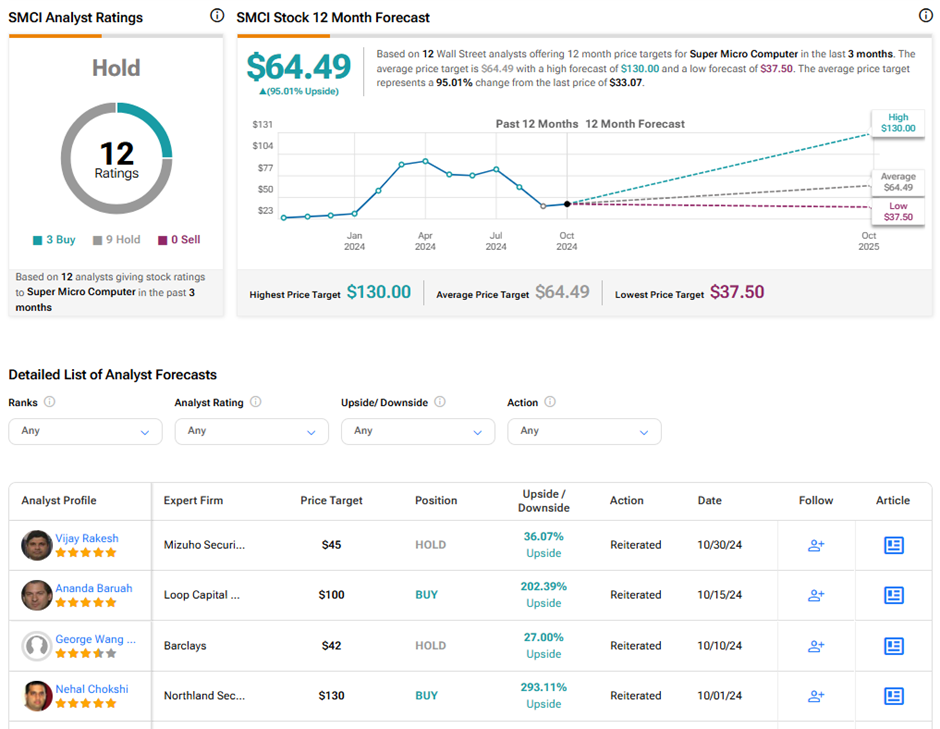

Owing to the ongoing challenges and increased delisting risk from E&Y’s exit, analysts prefer to remain on the sidelines on Super Micro Computer. On TipRanks, SMCI stock has a Hold consensus rating based on three Buys versus nine Hold ratings. The average Super Micro Computer price target of $64.49 implies 95% upside potential from current levels. Year-to-date, SMCI shares have gained 16.3%.