Product Manager, Itamar Korem, the brains behind TipRanks website traffic features sets out to explore what Coinbase’s website traffic told us before they reported Q3 earnings.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

One of the metrics that institutional investors use in their research is website traffic. The reason is simple. Tracking visits to publicly traded companies’ websites and platforms can indicate growth.

TipRanks levels the playing field for retail investors by simplifying institutional-grade data. Most recently we added two new features to our platform based on estimated website traffic. We wanted to explore whether we could find a correlation between website traffic to Coinbase and their earnings report.

Coinbase Q3 Earnings

Coinbase stock reported earnings on Nov 9, 2021. Prior to their report, we analyzed Coinbase’s website traffic data, alongside other metrics that might affect the company’s financial results.

We looked at these three key business metrics. You can see their definitions according to Coinbase:

– Verified Users – all retail users, institutions, and ecosystem partners that have registered an account on our platform.

– Monthly Transacting Users (MTU) – a retail user who actively or passively transacts in one or more products on our platform at least once during the rolling 28-day period ending on the date of measurement.

– Trading Volume – the total U.S. dollar equivalent value of matched trades transacted between a buyer and seller through our platform during the period of measurement.

In the three quarters prior to Coinbase’s November report the company posted growth on both MTUs and Verified Users. Would looking at the website traffic from the unreported period suggest growth or decline and would this be reflected in the November report?

Coinbase Website Traffic Analysis

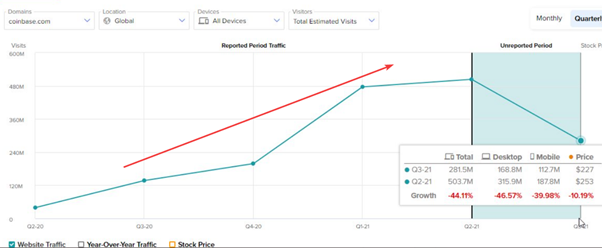

Using the TipRanks Website Traffic tab, we discovered that traffic to the coinbase.com domain, the company’s platform for buying and selling cryptocurrencies, declined from the previous quarter by around 44%. Based on this data, it would be fair to assume that the number of Verified Users decreased in the quarter. The screenshot below is from November 9, before the company reported earnings.

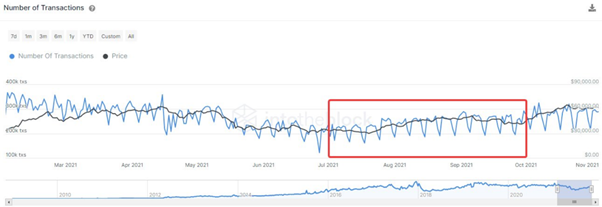

With regards to Trading Volume and MTU, we considered other factors, in particular the price of Bitcoin, which likely affects transactions on Coinbase.

Bitcoin’s price during the third quarter was less volatile than usual and only picked up pace towards the end of the quarter. Looking at the number of transactions in the unreported quarter, it seems relatively low compared to previous quarters, based on data from the IntoTheBlock crypto analytics platform (see chart below).

So again, it seems fair to assume that the numbers for Trading Volume and MTU would not beat or even meet Q2 numbers.

Based on all this data, it would seem reasonable to anticipate that the numbers in the upcoming earnings report wouldn’t be strong. As it was, the stock fell by 7.15% the day following their report.

Coinbase Earnings Data

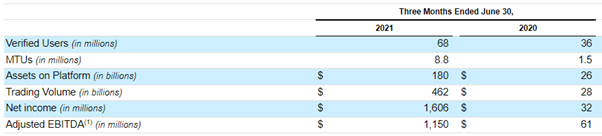

In their Q3 earnings report Coinbase stated:

“This backdrop led to global crypto spot trading volumes declining 37% in Q3 as compared to Q2, however, Coinbase outperformed the market with total trading volumes of $327 billion, a 29% decline in the same period. We have consistently indicated that volatility is a key factor influencing our transaction revenue”.

You can see this illustrated in the Coinbase Key Metrics for Q3, 2021.

With regards to Trading Volume the report says:

“Swings in market conditions are expected in these early days of the cryptoeconomy. However, the cryptoeconomy is growing and innovating throughout, and Coinbase is positioned to thrive. In Q3, Verified Users grew to 73 million and retail Monthly Transacting Users (MTUs) were 7.4 million”.

For greater context, compare these figures to the Q2 report.

What Did the Report Tell Us?

Between Q2 and Q3 Coinbase reported that:

– Verified Users only grew by 7%

– MTUs decreased by 16%

– Trading volume decreased by 45%

By using the Tipranks Website Traffic tool ahead of earnings, we would have seen a decline in traffic. Based on this information, we could have predicted both a decline in trading volume and Monthly Transacting Users.

There are many factors that affect a stock’s price after earnings. At times a stock’s price reacts in a way that contradicts the data in the report. At TipRanks, our goal is to provide you with the data you need in your decision-making, including ahead of earnings.

Disclaimer: The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue