Analog Devices reported better-than-expected fiscal first-quarter results driven by double-digit year-over-year growth across all business-to-business (B2B) markets.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The chipmaker’s 1Q adjusted earnings surged 40% to $1.44 per share on a year-over-year basis and beat the Street estimates of $1.32. Revenues increased 20% to $1.6 billion and surpassed the consensus mark of $1.51 billion.

Analog Devices’ (ADI) adjusted gross margin in the quarter was 70%, up 150 basis points (bps) year-over-year. The adjusted operating margin came in at 40.7%, up from 36.9% recorded in the prior-year quarter.

Analog CEO Vincent Roche commented, “ADI delivered strong first quarter results at the high end of our outlook, reflecting the diversity of our business and our alignment to the most important secular growth trends.”

“While the economic backdrop remains uncertain, we are confident that a broad-based recovery is underway given continued momentum in ADI’s bookings and lean inventories across the industry,” he added.

For the second quarter of fiscal 2021, the company projects adjusted EPS to be in a range of $1.36 to $1.52 per share, versus analysts’ expectations of $1.39. Revenue is expected to generate between $1.55 billion and $1.65 billion, versus the consensus estimate of $1.55 billion. The adjusted operating margin is forecasted to range between 40.3% and 41.7%. (See Analog stock analysis on TipRanks)

Earlier this week, Analog announced an 11% hike in its quarterly dividend to $0.69 per share. The new quarterly dividend will be paid on March 9 to shareholders of record as of Feb. 26. Its annual dividend of $2.76 per share now reflects a dividend yield of 1.73%.

Following the 1Q results, Oppenheimer analyst Rick Schafer maintained a Buy rating and a price target of $175 (9.5% upside potential) on the stock. The analyst believes, “ADI operates a hybrid model” which “positions ADI better than most.”

Schafer foresees, “ADI as an emerging growth story led by 5G RAN content/share gains with expanding auto content led by BMS.”

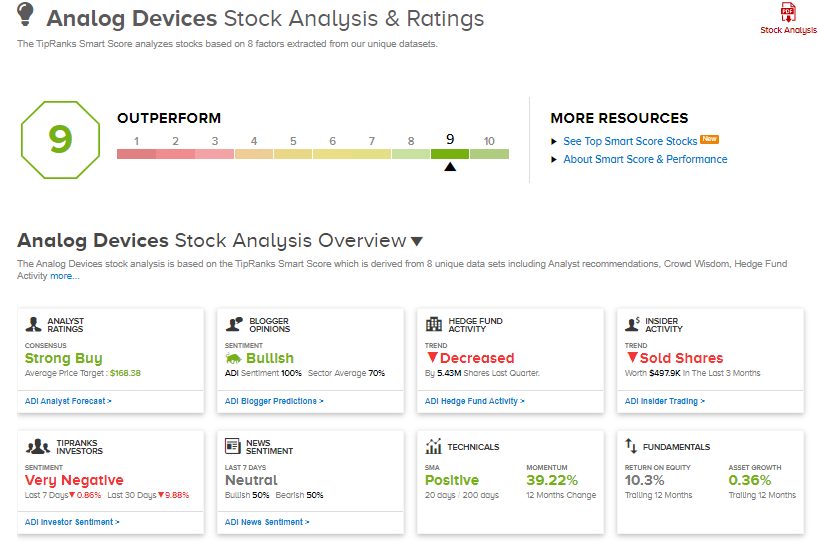

The consensus rating among analysts is a Strong Buy based on 16 Buys and 2 Holds. The average analyst price target stands at $168.38 and implies upside potential of 5.4% to current levels. Shares have jumped about 38% over the past six months.

Additionally, Analog scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

CAE’s Quarterly Profit Lags Estimates Amid Air Travel Slump

Moody’s Posts Better-Than-Expected 4Q Revenue But Profit Disappoints

Lincoln Electric Posts Better-Than-Expected Quarterly Profit; Street Sees 5% Upside