Analog Devices Inc. (ADI) is reportedly in talks to buy rival semiconductor Maxim Integrated Products Inc. (MXIM) for an estimated $20 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Analog and Maxim are discussing an all-stock deal that could be finalized as soon as Monday, though it isn’t guaranteed and discussions could still fall apart, the Wall Street Journal reported over the weekend. The deal would be the largest U.S. merger so far this year, according to data from Dealogic.

According to the discussed talks, Maxim shareholders would own about 30% of the combined company, which would be valued at just under $70 billion including debt, should the deal go through.

California-based Maxim, which was founded in 1983 and has a market capitalization of $17 billion, produces semiconductors used in a variety of sectors including industrial, automotive and health care. Both Maxim and Analog are major players in analog semiconductors, used in areas such as power management for automotive batteries.

A combination of the two chipmakers would create a competitor to Texas Instruments Inc. (TXN), the leader in analog semiconductors with a $119 billion market value. Analog would also gain access to Maxim’s hardware engineers.

Any deal between Analog and Maxim would likely require approval from regulators in the U.S., China and the European Union.

Maxim shares are now up 4.2% year-to-date after dropping to a low in March and are trading at $64.10 as of Friday’s close. Similarly, Analog Devices’ stock also recovered from this year’s March plunge and has gained 4.8% in 2020.

Five-star analyst Rick Schafer at Oppenheimer recently reiterated a Buy rating on Analog’s stock with a $140 price target (12% upside potential), saying that he applauds management’s proactive cost control efforts, and structural growth opportunities in 5G RAN.

“We see near-term COVID-19 pressures, particularly in auto/industrial, impacting ADI and peers this year,” Schafer wrote in a note to investors. “The medical, defense, and 5G RAN offer a hedge against potential downside risk in GDP-sensitive auto and broad industrial segments.”

Schafer added that looking ahead to CY21 and beyond, he likes ADI’s 5G-led structural growth/margin profile.

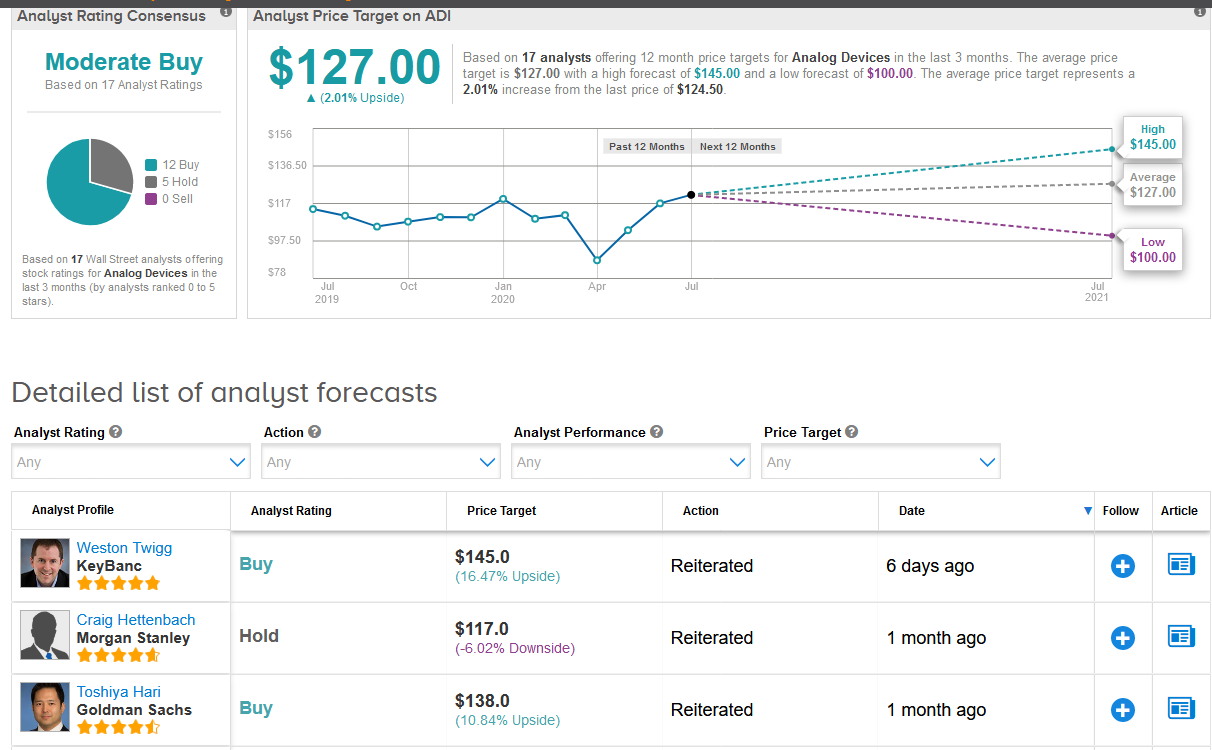

The rest of the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus breaks down into 12 Buy ratings versus 5 Hold ratings. In light of the stock’s recent gains, the $127 average price target implies a mere 2% upside potential in the shares in the coming 12 months. (See ADI stock analysis on TipRanks)

Related News:

Amazon Delays Prime Day- This Time Until October

Has Apple Surged Too Far, Too Fast? Analyst Weighs In

Lookout Walmart, Amazon Is Coming for Your Grocery Customers, Says Analyst