Shares of Analog Devices, Inc. (ADI) gained 4% to close at $168.34 on February 16, after the company announced huge earnings and modest revenue beat.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

ADI is an American semiconductor company that manufactures analog, mixed-signal, and digital signal processing integrated circuits used in electronic equipment. ADI stock has gained 8.5% over the past year.

The company’s Board of Directors even increased the company’s quarterly cash common dividends by 10% to $0.76 per share, translating to a $3.04 per share annual dividend. The increased dividend is payable on March 8, to shareholders on record as of February 25.

Solid Results

ADI’s Q1 revenue advanced 72% year-over-year to $2.68 billion and marginally surpassed Street estimates of $2.6 billion.

Moreover, Analog’s adjusted earnings leaped 35% year-to-year to $1.94 per share, and came in 17 cents higher than analyst estimates of $1.77 per share.

CEO Comments

Happy with the fourth straight quarter of record revenue, ADI President and CEO, Vincent Roche, said, “Through years of strategic investment, both organic and inorganic, we’ve built an unparalleled performance-leading portfolio equipped to capitalize on the increasing demand surrounding secular megatrends such as automation, electrification, and advanced connectivity… With higher bookings and backlog as well as additional capacity investments, I am confident we will sustain this level of performance throughout 2022.”

Q2FY22 Outlook

Based on the ongoing business momentum, ADI guided for second-quarter revenue to fall in the range of $2.7 billion to $2.9 billion.

Meanwhile, Q2-adjusted earnings are expected to fall between $1.97 per share and $2.17 per share, significantly higher than the consensus of $1.84 per share.

Analysts’ View

Responding to Analog’s solid results, Robert W. Baird analyst Tristan Gerra reiterated a Buy rating on the stock with a price target of $220, implying 30.7% upside potential to current levels.

Gerra is optimistic about the stock’s performance as he believes that, “Analog Devices has traditionally been a premium defensive name notably in downturns, while the acquisitions of Linear Tech and Hittite have further improved company’s fundamentals, barriers of entry and breadth of product mix.”

Moreover, the analyst believes that the stock trades at an attractive multiple of <16x of his above consensus FY23 earnings per share estimates, making it a good investment.

Overall, the ADI stock commands a Strong Buy consensus rating based on 14 Buys and 3 Holds. The average Analog Devices price target of $208.41 implies 23.8% upside potential to current levels.

News Sentiment

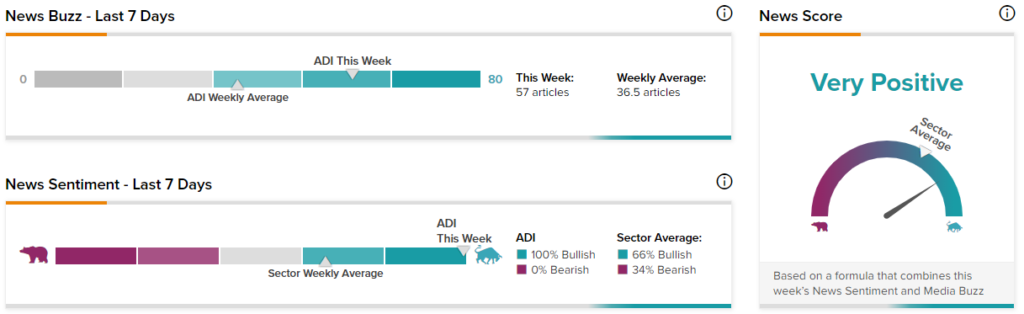

According to TipRanks data, the News Score for Analog Devices is currently Very Positive based on 57 articles over the past seven days, at the time of writing. 100% of the articles have a Bullish Sentiment compared to a sector average of 66%, while 0% of the articles have a Bearish Sentiment compared to a sector average of 34%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

U.S. Regulators Probe Wall Street Firms for Block Trades – Report

Upstart Gains 23% on Phenomenal Q4 Results and Beat

ZoomInfo Drops 12% Despite Beating Q4 Expectations