Starbucks Corporation (NASDAQ: SBUX) has reported encouraging earnings results for the fiscal third quarter (ended July 3, 2022) amid rising costs. Following the results, shares of the company rose 1.8% in Tuesday’s extended trading session.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

SBUX’s Results in Detail

The coffee giant’s adjusted earnings declined to 84 cents per share in the third quarter from 99 cents per share a year ago. However, the metric surpassed the analysts’ estimate of 77 cents per share.

Revenues for the reported quarter came in at $8.15 billion, up 8.7% year-over-year, in line with analysts’ expectations. The metric also includes an adverse foreign currency translation impact of 2%. The upside in the company’s revenues was driven by continued strength in customer demand despite high inflation levels.

Segment-wise, the company’s net revenues for the North America segment rose 13% over the prior year to $6.1 billion in the reported quarter. The upside was majorly led by a 9% year-over-year rise in company-operated comparable store sales, an 8% jump in average tickets from the prior year, and a 1% year-over-year rise in transactions. The U.S. region witnessed net new store growth of 2% over the prior year and strength in its licensed store sales.

Revenues of the International segment declined 6% year-over-year to $1.6 billion in the third quarter. The downside was majorly due to COVID-19 restrictions in China and adverse currency movements.

The Channel Development segment saw a 16% year-over-year rise in net revenues to $479.7 million. The upside was led by strength in the Global Coffee Alliance and ready-to-drink business.

The company’s operating margin contracted 400 basis points to 15.9%, largely due to inflationary pressures, higher spending on labor, and COVID-19 restrictions in China. However, favorable pricing in North America and leverage across markets outside of China partially lowered the burden on its margins.

Key Business Highlights

Starbucks opened 318 net new stores globally in the fiscal third quarter, with the total rising to 34,948 stores. Starbucks had 51% company-operated and 49% licensed stores as of the end of the third quarter. Global store growth came in at 4.9% on a year-over-year basis.

The company’s stores are mostly concentrated in the U.S. and China regions and account for 61% of Starbucks’ global portfolio.

Starbucks’ global comparable-store sales jumped 3% year over year. The upside was witnessed on the back of a 6% rise in average tickets, partially offset by a 3% dip in comparable transactions.

The company’s Active Starbucks Rewards loyalty program widened to 27.4 million active members in the United States, up 13% on a year-over-year basis.

Due to the macroeconomic challenges and COVID-19 uncertainties, the company has suspended its financial guidance for the rest of the fiscal year.

Moving on, Starbucks is expected to pay a cash dividend of 49 cents per share on August 26, 2022, to shareholders of record as of August 12, 2022.

Rising Costs, Union Concerns Burden Starbucks

Starbucks is struggling with increased employee wages, supply costs, and other inflationary pressures, which are putting pressure on its financials. These factors have dented the store-level profit in the reported quarter.

According to a report by The Wall Street Journal, the Starbucks Workers United union, which is responsible for organizing baristas, was not happy with the coffee giant increasing wages for just the employees of nonunion stores. In response to this, the union is now ready to give away their bargaining right over the new wages and has requested the company to raise the wages of baristas under the unionized stores.

On TipRanks, SBUX Stock Has a Moderate Buy Rating

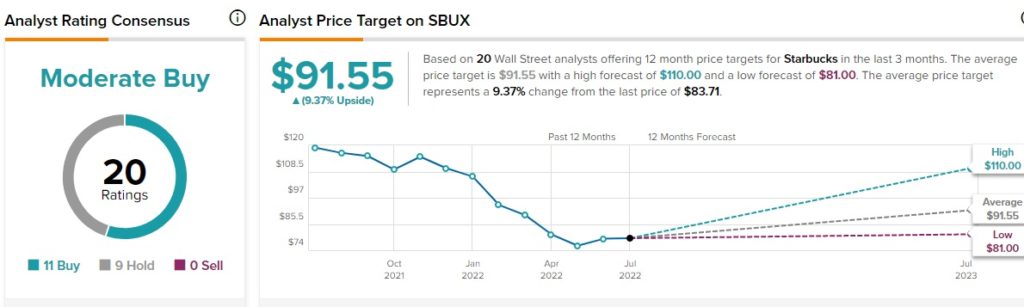

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys and nine Holds. Starbucks’ average price target of $91.55 signals that the stock may surge nearly 9.4% from current levels. Shares of the company have lost 27.4% so far this year.

Bloggers Are Bullish, but Hedge Funds Are Selling SBUX Stock

According to TipRanks, financial bloggers are 78% Bullish on SBUX, compared to the sector average of 66%.

However, TipRanks data shows that hedge funds are Very Negative about the company, as they sold 6.8 million shares of SBUX stock in the last quarter.

Concluding Thoughts

Even though the coffee giant is recovering from the pandemic blows, rising wage and supply expenses remain a concern for the company. Considering the ongoing COVID-19 uncertainties and a tough macroeconomic environment, the company may continue to face operational challenges for the rest of the year.

Read full Disclosure.