Amgen (AMGN) has reported robust third-quarter 2021 results, which surpassed both earnings and revenue estimates. Shares of the biotechnology company, however, slipped 1.5% in the extended trading session on Tuesday after it provided a mixed outlook for 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Amgen registered adjusted earnings of $4.67 per share, topping the consensus estimate of $4.26 per share. Also, the company recorded 11% year-over-year growth in earnings, fueled by top-line growth.

Total revenues generated in the quarter amounted to $6.71 billion against the consensus estimate of $6.69 billion. Additionally, revenues increased 4% year-over-year and reflected higher unit demand but were partially mitigated by lower net selling prices.

During the quarter, while total product sales rose 4% year-over-year, unit volumes grew 8%. However, the net selling prices fell 7%.

In response to the third-quarter results, the company said, “We continue to see gradual recovery from the impact of the COVID-19 pandemic. As we progressed through the third quarter, we saw improvement in patient visits and diagnoses…Overall, the gap in diagnosis visits over the course of the pandemic has suppressed the number of new patients starting treatment, which we expect will continue to impact our business for the remainder of the year.” (See Amgen stock charts on TipRanks)

Guidance

For 2021, the company projects total revenues between $25.8 billion and $26.2 billion against the consensus estimate of $26 billion. Meanwhile, its non-GAAP earnings guidance range of $16.50 per share to $17.10 per share stands ahead of the street’s expectations of $16.43 per share.

Capital Deployment

During the third quarter, the company repurchased 4.6 million shares of common stock at a total cost of $1.1 billion. In October 2021, the Board of Directors raised the stock repurchase authorization by $4.5 billion.

Amgen’s third-quarter 2021 dividend of $1.76 per share was announced on July 30, 2021, and paid on September 8, 2021, to all stockholders as of August 17, 2021. The dividend represented a 10% increase from the prior year.

Analysts Recommendation

Following the third-quarter results, Mizuho Securities analyst Salim Syed maintained a Hold rating and a price target of $222 (3.61% upside potential) on the stock.

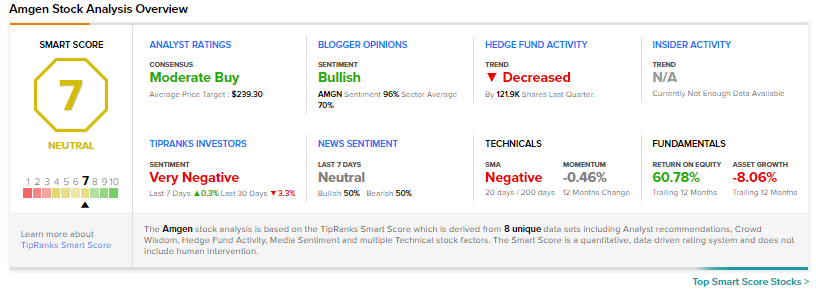

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 4 Buys, 6 Holds and 1 Sell. The average Amgen price target of $239.30 implies 11.69% upside potential to current levels. Shares have lost 2.6% over the past year.

Smart Score

According to TipRanks’ Smart Score system, Amgen gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages. (See Top Smart Score Stocks on TipRanks)

Related News:

Chegg Drops 29% as Q4 Guidance Disappoints, Q3 Revenues Miss Estimates

Diamondback Books Better-than-Expected Q3 Profit, Boosts Dividend

AbbVie’s 2021 Earnings Outlook Exceeds Estimates; Shares Up 4.6%