Amgen’s (NASDAQ:AMGN) $27.8 billion deal to acquire Horizon Therapeutics (NASDAQ:HZNP) has been blocked by the U.S. Federal Trade Commission (FTC). The regulator has filed a lawsuit in federal court seeking an injunction to prevent the deal from closing.

According to the FTC, the acquisition would enable Amgen to exploit Horizon’s monopoly in thyroid eye disease and chronic refractory gout treatment drugs. Since neither medication has a competitor, Amgen has a strong motive to prevent innovation in the space.

Additionally, the government worries that by giving substantial discounts on the goods, Amgen may lure insurers and drug benefit managers to favor Horizon’s two essential medications. This practice is known as cross-bundling.

The move is one of the few instances in which the FTC has prevented a pharmaceutical merger. Interestingly, the Amgen-Horizon acquisition is the only pharmaceutical deal the FTC has halted since 2009. The agency has recently been closely monitoring whether healthcare providers are raising their costs for customers.

It is worth highlighting that Regeneron CEO Leonard Schleifer has backed the FTC’s action. He asserted that it is promising that the regulator is concentrating on stopping cross-bundling practices.

However, the corporations disagreed with the FTC’s view that the acquisition would pose any competitive challenges. They are still committed to completing the deal by the end of 2023 in order to provide cures for rare diseases everywhere.

What is the Price Target for AMGN Stock?

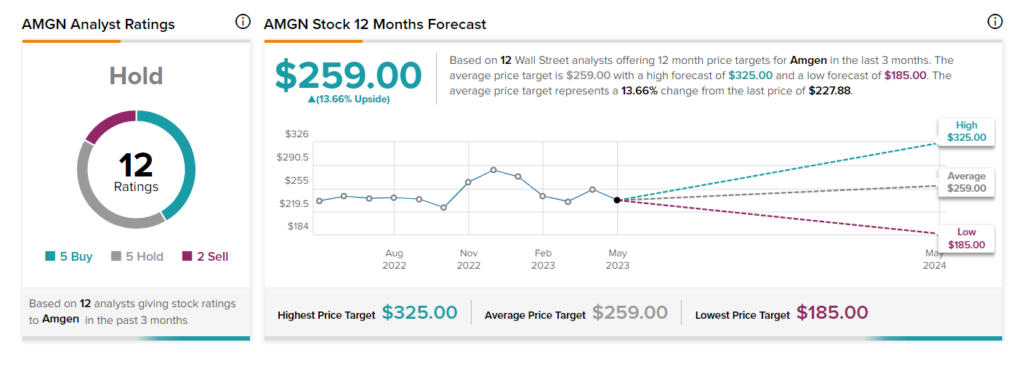

Currently, Wall Street is sidelined on Amgen stock, with a Hold consensus rating based on five Buys, five Holds, and two Sells. The average AMGN stock price target of $259 implies a possible upside of 13.7% from current levels. Shares have declined 12.1% year-to-date.