Amgen (AMGN) and AstraZeneca (AZN) have announced positive topline results from the Phase 3 Navigator trial for tezepelumab, which demonstrated a statistically significant reduction in exacerbations compared to placebo in patients with severe asthma.

Asthma affects an estimated 339 million people worldwide, and approximately 10% of asthma patients have severe asthma.

Specifically, the trial met the primary endpoint with tezepelumab added to standard of care (SoC) demonstrating a statistically significant and clinically meaningful reduction compared to placebo plus SoC in the annualized asthma exacerbation rate (AAER) over 52 weeks in the overall patient population.

In this case the SoC was medium- or high-dose inhaled corticosteroids (ICS) plus at least one additional controller medication with or without oral corticosteroids (OCS).

According to the companies, tezepelumab was very well tolerated in patients with severe asthma. Preliminary analyses showed no clinically meaningful differences in safety results between the tezepelumab and placebo groups.

Tezepelumab is a potential first-in-class medicine that blocks the action of thymic stromal lymphopoietin (TSLP), an epithelial cytokine that plays a key role across the spectrum of asthma inflammation. This is the first Phase 3 trial to show benefit in severe asthma by targeting TSLP.

“We are absolutely thrilled with the topline results of the NAVIGATOR study in this broad population of patients with severe asthma, regardless of eosinophil count,” cheered Amgen’s David M. Reese, M.D.

“Tezepelumab represents a potential new class of biologics that could enable us to treat severe asthma at the top of the inflammatory cascade, addressing a high unmet need among the millions of patients living with severe asthma throughout the world. Tezepelumab has the potential to revolutionize care with efficacy demonstrated even in patients with a low eosinophil count” he added.

Earlier in 2020, Amgen and AstraZeneca updated the 2012 collaboration agreement for tezepelumab. Both companies will continue to share costs and profits equally after payment by AstraZeneca of a mid-single-digit royalty to Amgen. AstraZeneca continues to lead development and Amgen continues to lead manufacturing.

Amgen will record sales in the U.S. and AstraZeneca will record sales in Canada. Outside the U.S., Amgen will record sales as collaboration revenue.

AZN shares are up 7% over the past 5 days bringing the stock’s year-to-date advance to 8.4%. (See AstraZeneca stock analysis on TipRanks)

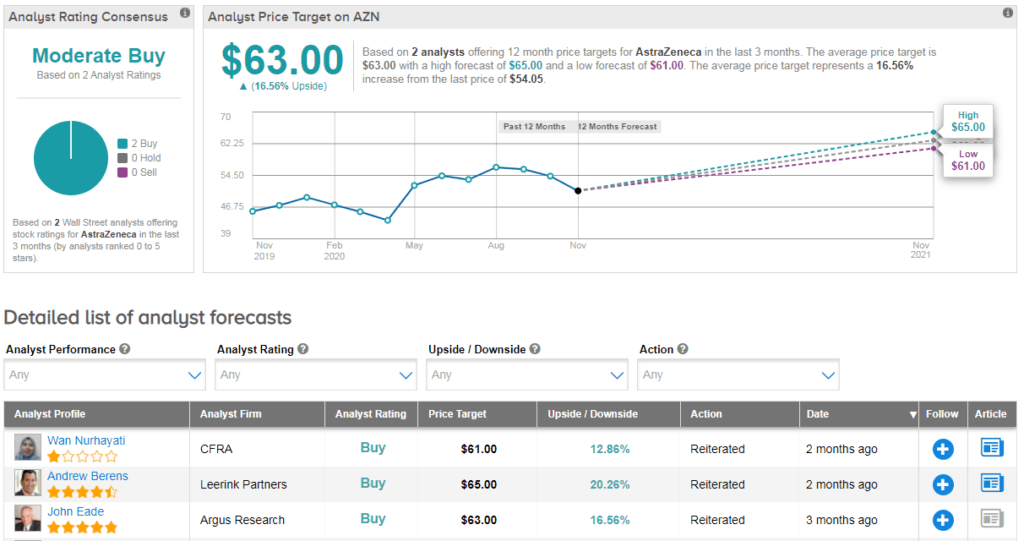

CFRA analyst Wan Nurhayati recently reiterated a Buy rating on the stock with a $61 price target (13% upside potential) as she believes that the company’s new medicines will help grow revenue in the high single-digit percentage range in 2020.

Nurhayati doesn’t expect AstraZeneca’s Covid-19 vaccine candidate to be a major profit driver, as the drugmaker is prioritizing affordable distribution.

Overall, AZN scores a Moderate Buy analyst consensus with 2 unanimous Buy ratings. Meanwhile, the $63 average analyst price target puts the upside potential at about 17% in the coming 12 months.

Related News:

Pfizer, BioNTech Announce COVID-19 Vaccine is 90% Effective

Ocular Therapeutix Rises 7% On Stellar Results Backed By Dextenza

Canada’s Canopy Growth Pops 12% On Blowout Quarter, Cost Cuts